It has become a common and accepted notion that a positive sign in front of GDP denotes a recovery. The historical basis for that, and the potential disruption of the correlations between recovery occasions and GDP, has been covered before. It is also connected to the reduction in standards by which we judge economic performance, as reduced levels of pretty much every economic account are being contrived into recovery narratives.

On a more fundamental level, I think the mainstream has lost the very idea of a recovery, or even real growth, since it has been more than a half a decade since we experienced it (and far more than a full decade since it was not so artificial). For one thing, real growth is totally unambiguous – there is no doubting its occurrence.

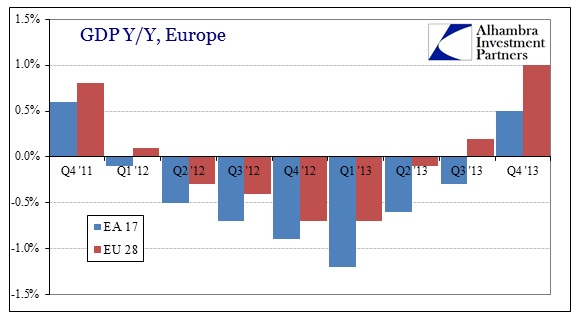

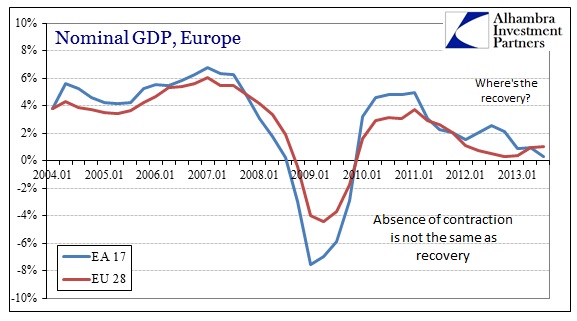

That makes the current indications across not only the US but also Japan and Europe more than suspect. In Europe, for example, there is GDP that seems to indicate a recovery:

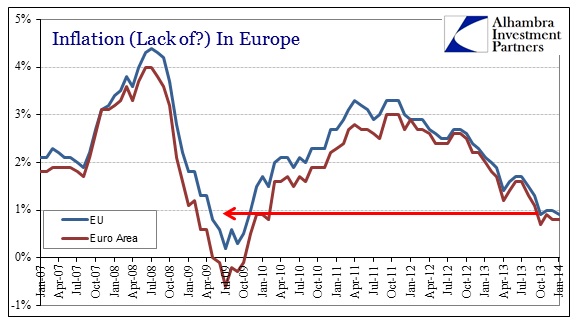

But that is not confirmed, particularly by indications such as inflation:

This is especially troubling for the orthodoxy, since growing economies are believed to generate inflationary pressures. That those pressures would be so conspicuously absent now, as they were at the worst levels of 2008 and 2009, is particularly indicative of broad monetary policy failure.

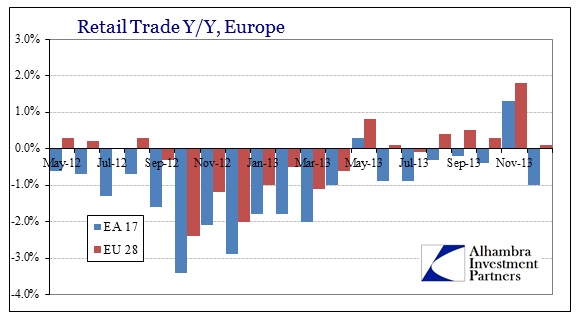

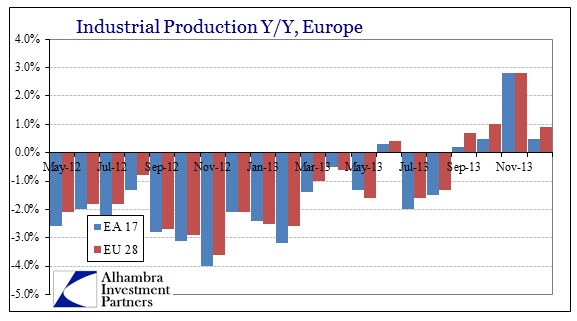

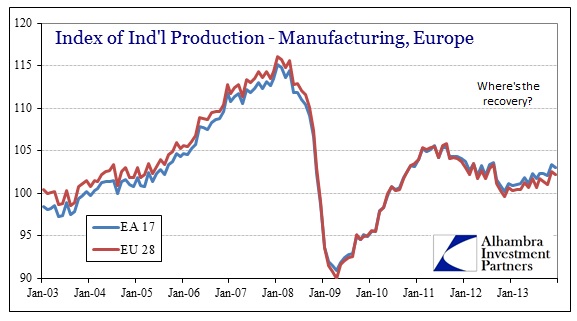

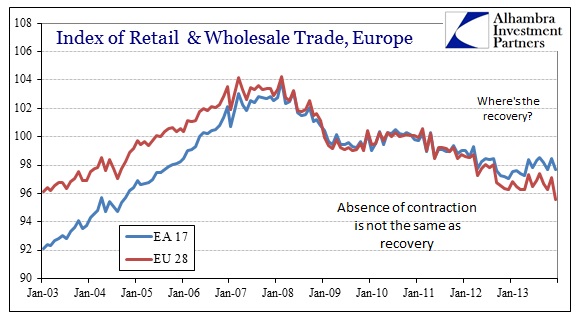

If we extend our analysis, there does seem to be at least some positive momentum in Europe, perhaps belying the inflation indications.

Without wider context, however, you really cannot derive much beyond simple relative estimation. And that is where I believe the narrative falls apart. Certainly results in these vital economic indicators are now mostly showing positive signs, but that does not necessarily mean conditions are truly improving. It may only indicate that the current economic situation is not getting worse (at this moment). There is a world of difference between recovery and absence of further contraction.

Nominal GDP is still decelerating, for example. Since the official inflation rate is decelerating as well, at a quicker second derivative no less, then real GDP calculations actually become positive. There is no more activity, really, in the European economy, only a relative change in certain ratios. Because inflation is decelerating faster than nominal GDP, we should interpret that as a sustainable renaissance?

That extends into those other economic indications as well. Retail trade may be growing at a positive rate in the more recent months, but that is only a relative measure showing absence of further contraction. In absolute terms, the European economy is not producing anywhere close enough trade volume to close the gap to previous “cycle” peaks. That means the economy is really not recovering, particularly when the word recovery itself is semantically appropriate in the context of cycles.

Recovery means to re-obtain previous levels of activity, not simply to stop moving in the “wrong” direction. None of the indications here show that. It is possible that this is the first step in building such an absolute action, but it is equally possible, if not moreso given the state of the financial and credit systems (as we know from both credit destruction and inflation), that this is just a pause before resuming the downward spiral.

If retail trade collapses by 10% one year, and is up 1% the next, that is not a recovery in any meaningful sense. Some of this gets back to the plucking model and the historical nature of cycles. If it takes 10 years to regain the previous peak, that is an indication of very broad and dire dysfunction, not economic success. That is what we see here and in the data above.

Again, real recoveries are unambiguous because they are evident in the broadest possible sense. All we have here is ambiguity layered under an undue focus on minor relative changes. Unfortunately, that is not limited to Europe.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch