Ever since the December FOMC, the credit markets have seen a dramatic decline in volatility that had previously been a major factor in sowing turmoil. Perhaps it is markets simply settling in to the idea that the Fed finally tapered and it wasn’t the end of the world, but my sense is that there is still a great deal of uncertainty about which way this will all go. The primary reason for that now partially-obscured edginess is that markets remain at significantly different levels, with still-disturbed patterns, than the outset. In other words, there has not been anything like a full retracement.

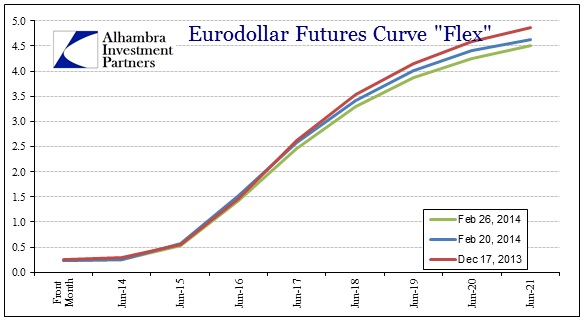

Starting in eurodollars, there has been only slight movements in the curve since the December FOMC meeting that announced the first taper. And that minor perturbation has been limited mostly toward the outer years away from the “money” part of the curve. In the 2015-17 segment, there has hardly been much change at all.

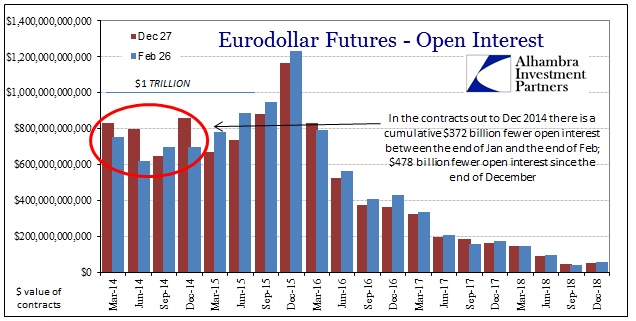

In fact, the only real movement has been in the placement of open interest. The total outstanding values of futures contracts in 2014 have fallen by nearly $500 billion since the end of December. Some of that has shifted into the 2015-17 sections, but it suggests that there is less demand for hedging and placing future currency in the trajectory of interest rates in the very near future.

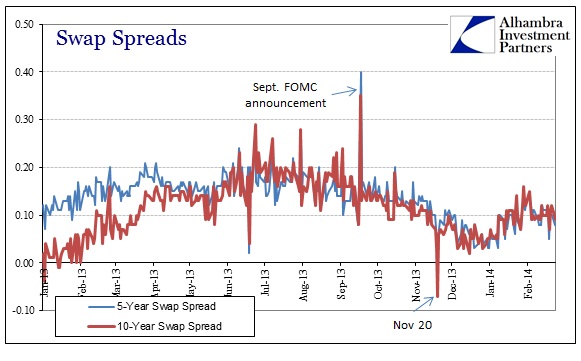

That is a sentiment I think is echoed in swap spreads, as they have likewise settled down into a defined range or pattern. Again, that would suggest either complacency about current conditions or, as I believe, true uncertainty about exactly where we go from here.

The initial reaction from the swaps market was a decompression in spreads, indicating that there is still residual resistance to the more placid interpretations of tapering QE. Since spreads have settled a bit wider than before taper, I think that interpretation remains and that swap demand is still unclear ultimately about rates.

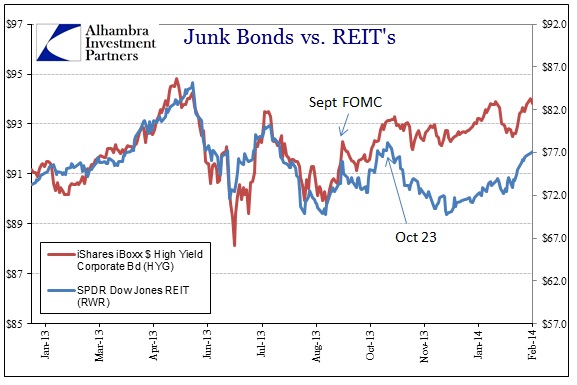

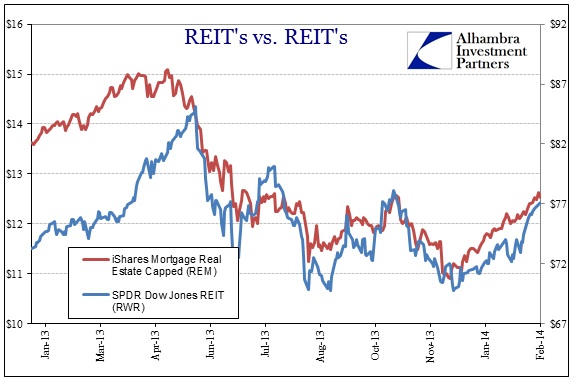

As the funding markets pause to try to make sense of all of this, complacency has returned in the retail segments, particularly high yield. Even REIT’s, which had a disastrous 2013, have seen some buying interest that goes back before the taper decision. Some of that has to be due to valuation, particularly mortgage REIT’s, since so many of the securities have been, and still are, trading at significant discounts to book value. Given this “pause” in funding markets, that translates into what looks like bargain hunting. If funding markets turn again, I suspect those “bargains” will be the first on offer.

As with any paradigm shift, there are ebbs and flows as nothing is linear. I have no doubt that credit market participants are fully aware of that, and, given this uncertainty about short-term conditions, the lack of conviction in either direction has created an ebb to which investors in certain segments of the markets are using as a buy signal. No matter the complacency that appears there, the “deeper” segments of the funding markets, in particular, seem especially reticent to follow.

In other words, while there is evident buying interest and commitment in junk and REIT’s, it is not at all matched by eurodollars. If there was widespread and broad support for the idea that credit markets have settled post-taper, I would expect heavy buying interest throughout the system, particularly eurodollars and equivalents. There is no obvious commitment to buying or selling; same with swaps, no commitment toward higher or lower interest rates. It is an uneasy stasis.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch