The core of 2014 Chinese defaults is really about control, as it ever is in 21st century finance. Central banks believe they have it and can exercise it with precision, a mysticism that is accepted widely by market participants. In allowing smaller firms to default, they are sending the signal that they want greater order in what is near-universally recognized as out-of-control.

A Financial Times article on Monday sums this up clearly:

“It’s quite clear what is happening. The central bank has been deleveraging the shadow banking sector and encouraging banks to bring loans back on to their balance sheets to monitor risks,” said Shen Jianguang, an analyst with Mizuho Securities. “They are trying to slow shadow banking activity but still want overall liquidity to be strong.”

That sentiment has been broadly backed by credit data from January and February. While overall credit growth slowed, the banking sector blunted some of that “control” being emphasized over the shadow sector of trusts and wealth management products.

On-balance-sheet bank loans accounted for nearly 64 per cent of new credit issuance in China in the first two months of 2014, up from 55 per cent last year. At the same time, lending by trust companies fell from nearly 11 per cent of new credit to just over 5 per cent.

Also in the Financial Times this week, another piece added that element of control to its growing sense of comfort with all these changes. This idea of control has been telegraphed to “markets” for months, and credit markets are reacting as you would expect, maintaining good order while adjusting. Therefore defaults are a symptom of that paradigm shift getting on reasonably well.

However, the domestic bond markets have so far treated the default as a non-event. Average yields on investment grade debt have fallen this year, while the spread between highly-rated and low-rated credit has been widening steadily for the past six months – an indication that investors had already begun re-pricing risk.

Rather than billing Chaori as an alarm bell in the credit markets, many analysts see it as a trial balloon being floated by the authorities as they seek ways to cut overcapacity in certain sectors of the economy.

I would agree with all of that except the extrapolation. I have no doubt that there is intent implicit in the sudden appearance of default, and that the PBOC is well aware, as everyone seems to be now, that credit in China has perhaps gotten too far ahead. However, that being said, this cautious approach also sends a message that the PBOC is actually unsure of its imposition of order in the first place – the need for a “test case” default with a small private firm is very telling.

That suggests, and strongly so, that even the central bank in China is really unsure of exactly how far ahead credit markets paced in the past two years (and really since 2009). It also reiterates the central imbalance at play, the very reason for all of this to begin with: the Chinese economy has no hope of regaining a firmer footing without a global economic renaissance. Internal attempts to re-orient the economy away from exports have not created enough sustainable advance to carry out an actual recovery.

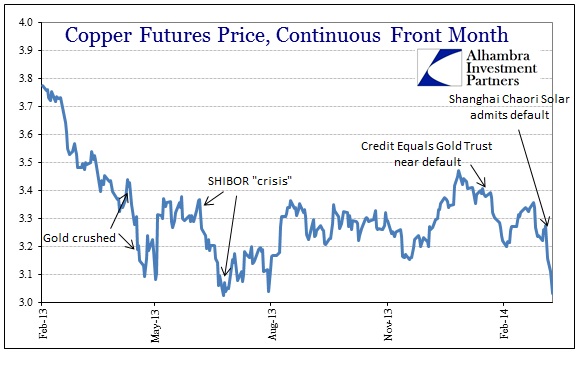

That was why the disastrous export figures have had such a massive impact on Chinese-only financing – copper. Without a return of end market demand more on par with 2006, the internal Chinese economy is basically a hamster wheel of credit creation reaching its very last legs. That does not easily lend itself to the idea of centralized “control.”

Taking that in mind, the massive credit growth was, in the first place, a similar exertion of assumed “control.” When the expected “cyclical” rebound in global export markets (read: US & Europe) failed to materialize on time, the PBOC allowed credit to get ahead to keep the Chinese hamster wheel in motion. It was always going to be an effort of diminishing efficiency because the limitations of efficacy grow with further manipulation. But they kept on with it because that recovery was always just around the corner.

In late 2011, however, the banking system began to show signs of oversaturation. The PBOC in response came up with an idea for “control”, capping bank credit growth with what amounted to a quota system. That simply pushed borrowers to the shadow system, thus giving rise to the very problem they now seek to once again “control.” This is usually how it goes, as the illusion of centralized control is essentially a farce. Thomas Jefferson’s allegory of holding a wolf by the ears is particularly apt here, including the parallels to slavery.

Unfortunately, the circus is not limited to China through both real economy channels and, as much as denials will be strongly issued, financial channels. Somebody had to lend dollars to Chinese counterparties backed by all that copper that is now suddenly being sold. In other words, there are dollar participants on the back end that are in danger – not so much do to loans that are sufficiently collateralized but rather when the sting of rehypothecation strikes.

Not to make any direct comparison here, but Lehman Brother’s bankruptcy destroyed the repo market not because of the potential for losses (that was the money market fund side) but rather due to repo counterparties understanding what rehypothecation meant into bankruptcy and insolvency, particularly the legal end. They knew JP Morgan (and BONY Mellon, to a much smaller extent) would get first pass at Lehman’s collateral (which, in my studied opinion was a major factor in Lehman’s demise to begin with) as triparty repo custodians. Beyond that, there was not a wide understanding of how collateral would work in a bankruptcy proceeding, particularly when competing claims were made of the same piece.

It took more than 5 years to actually sort that out of Lehman’s estate, and that was what directed repo market “contagion”, the knowledge that rehypothecation diminishes the assumed “value” of the collateral assumed to be in hand during a systemic reversal.

That is why, I think, copper reacts so violently to these dollar/China episodes. The institutions that seize first get paid first, but that also means fewer dollars extended as participants system-wide rethink their exposures. Contagion is a word that will grow in usage as more of these “test cases” spring up under the comfort of central bank “control.”

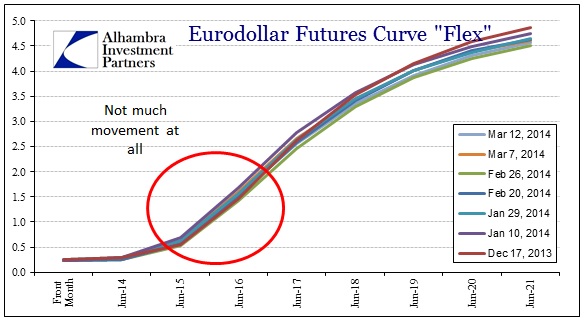

The eurodollar curve itself shows that there has been little spillover as yet, but rather than convey security all that does is highlight what may be fragmentation. The contrast is striking here, where copper moves to a low not seen since 2009, but eurodollars in general are unperturbed. In other words, China is being shunned (potentially) on dollar markets, which serves to highlight erosion far outside of the PBOC’s efforts. At first that is a reassuring sense for non-Chinese participants since the problem seems limited to “over there”, at least until it sinks in that there is no “over there.”

I highlighted on Monday some of those dollar extensions, as the falling yuan may in fact relate to alternate dollar channels. And let’s not forget that the TIC data from December showed a decline in PBOC treasury holdings – it’s a strained dollar market, and has been for longer than just recent events, and copper hints that most of the strain may be heading over Beijing’s way now.

I also think that is why the export figures, ominously for the PBOC, may have accelerated dollar market responses via copper. With less trade activity there will be more defaults coming as weaker firms finally become more exposed to revenue declines and accumulated losses. It is not unreasonable to expect that the PBOC, now set on this course to “tame” credit market imbalances it created in the first place, will continue to court and countenance defaults. This can go on for awhile until that nth iteration of default, the one that looks to be comforting and orderly but is ultimately rejected wholesale by markets for the accumulation of minute factors unseen in the centralized picture.

The fact that Chinese markets have been relatively unmoved so far is not very convincing to me in the case for the benign interpretation. American “markets”, indeed global markets, were pretty much unconcerned about wholesale finance and eurodollars until August 2008 despite some pretty good indications that fragmentation was both dangerous and durable. And let’s not forget that Greece, that tiny country of relative insignificance, was in obvious difficulty in late 2009 but nearly brought down the euro by 2011 (which, outside of bond yields and stock prices, remains unresolved). The panic in 2008 was a shock to so many, perhaps even most people, because everyone simply assumed the Federal Reserve had it all under control, particularly after Bear Stearns was so “expertly” handled. Complex systems simply cannot be controlled.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch