In February 2013, more than a year ago, Jeremy Stein, Federal Reserve Board Member, openly expressed concern over behavior in certain sectors of the financial markets. He categorized this as “reaching for yield”, but there was more than a whiff of caution in his exposition of leveraged loans and junk debt. “The annualized rates of PIK bond issuance and of covenant-lite loan issuance in the fourth quarter of 2012 were comparable to highs from 2007. The past year also saw a new record in the use of loan proceeds for dividend recapitalizations, which represents a case in which bondholders move further to the back of the line while stockholders–often private equity firms–cash out.” That was just 2012.

At the December 2013 FOMC meeting, “several participants commented on the rise in forward price-to-earnings ratios for some small-cap stocks, the increased level of equity repurchases, or the rise in margin credit.” What was left out of the minutes (and may have been included in the broader discussion, but I doubt it) was the behavior of all these “risky” asset classes in relation to what had transpired everywhere else. The price and volatility pyramid had by then totally inverted, as these segments had attained a sort of invulnerability not shared elsewhere, particularly UST & MBS.

I have commented before on the behavior of leveraged loan pricing, this cycle’s version of subprime. Leveraged loans are syndicated loans to “low quality” corporate borrowers, the bank loan equivalent of a junk bond. That covenants are being removed almost as fast as these loans can be written is another piece of that asset price-risk inversion. In fact, nothing screams bubble more particularly than when the riskiest asset classes are fully and totally insulated from everything else – a cone of rationalization that serves to cleave any fundamental pressure from consideration of value and context.

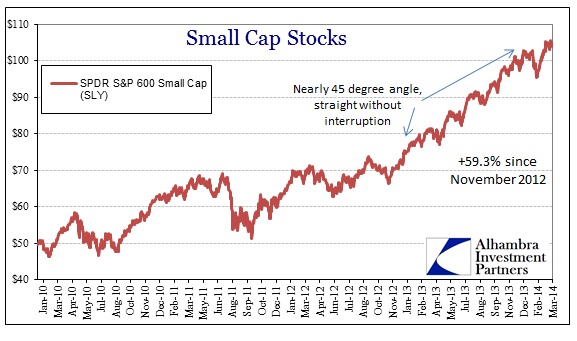

Where leveraged loan pricing was continually “reaching for yield”, you can’t make the same generalization about small cap stocks – yet the pricing pattern is consistent in both.

That would seem to suggest that perceptions of risk are common in those classes, particularly with regard to the systemic reset of interest rates and dollar funding in the middle of 2013 that had no larger imprint in either. Again, the inversion here between expectations for risky assets and those elsewhere is more than conspicuous. “Everyone” wants to be in on leveraged loans and small cap stocks, but at the same time is more than cautious about UST and MBS?

As if that weren’t suspicious on its own, any review of valuations would only add to the cause. Bloomberg yesterday noted the valuation comparison of certain small cap indices to the dot-com mania.

As prices surged and earnings increased at a slower rate than analysts anticipated, smaller companies have become more expensive than they’ve been 86 percent of the time since 1995, according to data compiled by Bloomberg. The Russell 2000 is trading for 49 times reported earnings, compared with a multiple of 39 in March 2000.

First note that the leading sentence above indicates the primary problem, namely that prices are surging but earnings are not. That is the only way to reach such extremes in valuations, particularly in the very unflattering comparison with what is universally acknowledged as a bubble period. Taken together, all this means is that there is not a “reach for yield” inasmuch as a total disregard of risk as it is classically understood; a “reach for risk.” In the context of monetary “control”, that is as intended – but only to a degree.

When the riskiest pieces are in such demand that there is no perturbation in price history then how does that not obtain the definition of a bubble market? In the past two bubbles, dot-coms and housing, this was known widely as “mania”, or more precisely an overriding fear of missing out. That inversion of investment concerns is what describes the price behavior I detail here – where fear of missing out is greater than any considerations of loss. That is a full measure (or two) beyond what the Fed had intended, simply to push investors into risk assets after the 2008 panic. That “push” is no longer applicable, as it has been replaced by a self-fulfilling rush.

Admitting as much in these discrete asset segments perhaps does not make it generally applicable. In that same Bloomberg article, the author makes it plain that there may be a divergence between small cap and overall equities. Immediately following the passage I cited above is this qualifier:

The S&P 500 has a price-earnings ratio of 17.2, close to its average since 1937, data compiled by Bloomberg and S&P show.

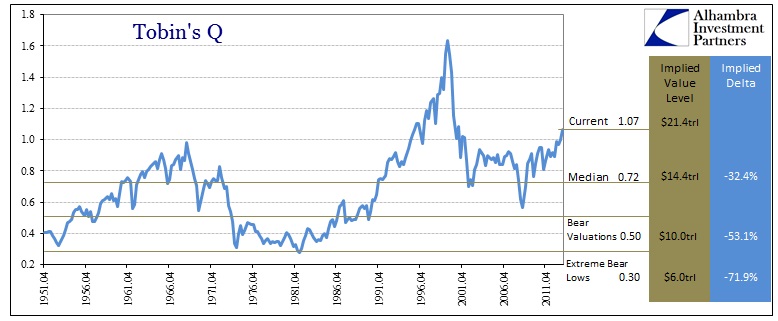

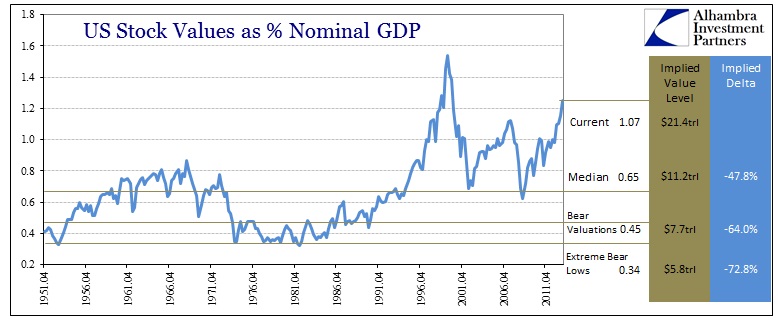

The only way that number is true is if they use pro forma earnings per share rather than reported earnings. Applying actual earnings, the PE on the S&P 500 is greater than 19, well above the median of 14.5 (using Shiller data stretching back to 1871). But as we have noted previously, the various and sundry methods of valuing stocks in historical context show exactly this kind of overextension. In historical terms, we see a broader market that is very much in comparison with only the dot-coms.

Just to revert back to median conditions would require a decline in prices comparable to some of the worst “bear market” movements (or a dramatic surge in earnings which, given the economic context, is increasingly less likely; particularly since we have already experienced such a surge in the years after 2009).

In totality, the only way to end up in such a state is these combinations of factors. That now risk is totally inverted is the height of rationalizations taking hold inside “rational” expectations. I completely understand the urge to fight against this analysis, as the alternative of bliss is far more comforting and reassuring, thus the overall appeal of rationalizing how $1 trillion in leveraged loans and junk bonds per year aren’t really dangerous, how small cap stocks are “supposed” to be valued as such, larger companies should be valued on what companies think they earned and might earn in the future rather than what actually happened, and that with all the “stimulus” there can’t possibly be a reversal. Yet that illusion of control applies to both sides – if monetary policy has indeed overdone the upside, why is there any reasonable expectation for control in reverse? History of leverage, particularly built toward policy, is not kind in that regard, as in the immutable dynamics of all social creation.

The price behavior above screams mania, as when small cap stocks and leveraged loan prices move in narrow-channeled and uninterrupted ascent. Unless someone has repealed not just the basis of basic finance, but the laws governing complex systems, this will end as all previous iterations have. What we can surmise is that the growing sense of rationalizations and the stretching of them to fit increasingly extreme conditions are but echoes of past “exuberance” and warnings to be heeded.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch