Last week, NBC News in cooperation with the Wall Street Journal reported that, “57% of Americans believe the U.S. is still in recession.” Given what has transpired not just recently, but over the entire stretch of “recovery”, that result is only surprising that it’s not higher. The pretext of the article linked that poll finding with very little support for US involvement in Ukraine, but whether or not there is any causative impact there is ultimately another matter.

There seems to be slightly more recognition that there are deeper economic problems at work here, stemming in no small part from the lack of policy to deliver on promises. The massive discrepancy between the size of policy interventions (both fiscal and unending monetarisms) and the fact that a majority still feel recessionary is very striking. It can only direct more questions into the reasoning behind it, but first there has to be such awakening.

That includes the full disparity between those that have close relation with asset inflation and pretty much everyone else. Stock prices are soaring, but that has meant so little in broader economic terms. If there has been a “wealth effect” it has been contained to an exceedingly narrow channel, thus creating a competency vacuum into which neo-Marxism has begun to fill. With that backdrop of record stock indices, WSJ sums it up for the rest:

There is another reason so few Americans believe that the recession has ended: The standard of living for most people has eroded. Median household income declined by 1.6% in 2008 and 2.6% in 2009. But after the official end of the recession, it continued to fall—by 2.3% in 2010 and 2.5% in 2011—before stabilizing in 2012. Analysis of more recent data by Sentier Research indicates that median household income grew only marginally in 2013.

That is the broad recognition that I sincerely hope leads to the second part of the reform formulation – figuring out why. Fortunately, the WSJ article also provides a second clue.

At the beginning of economic recoveries, hiring has typically trailed production increases. After the first seven downturns following World War II, the resumption of hiring didn’t kick in until two or three months after production rose.

But then things began to change. After the 1990-91 recession ended, the lag between hiring and production stretched to 10 months; after the 2001 recession, it increased to 16 months. The current three-year gap between the start of recovery and the revitalization of employment has no precedent in the postwar era. Something fundamental has changed in the relationship between economic growth and employment gains, and the American people sense it.

In other words, recoveries are far different processes today than they have been. The last “real” recovery to conform to the post-war cycle script was 1982-83. What has most changed since the early 1980’s?

To me the answers are obvious since the economic system has undergone a radical shift toward financialization. That entails a whole host of alterations and distortions, most of which have been allowed to fester and expand because of the reputation that central banks cultivated in pushing the Great “Moderation” narrative. In reviewing exactly what “stimulus” has been issued, it is not hard to see this financialism in practice. Central banks around the world respond solely and heavily in only financial mannerisms, provided with that pretext that they are simply following “successful” prescriptions adopted during that “moderation.”

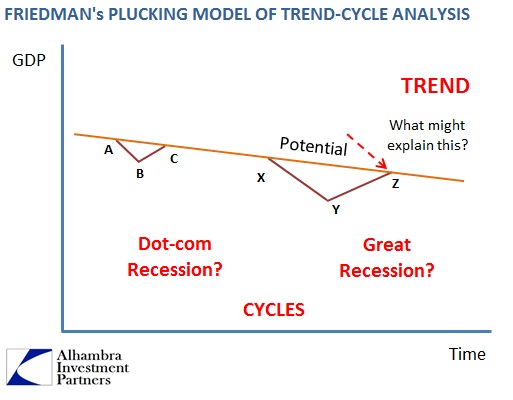

The stretching of the recoveries in 1991 and 2002-03 were written off as a tradeoff inherent in monetary intervention. Interest rate targeting in particular was assumed very effective at creating a shallower recession cycle (itself assumed to be a worthy policy goal), which thus obtained an elongation in the recovery. That conformed to the plucking model and thus gave orthodox economists at least a credible rejoinder to obvious and outward cycle changes.

Such speculation has been totally eradicated in this latest “recovery.” With the recession piece this time being the worst since the Great Depression, there is no way to maintain that consistency given the asymmetry hence. That is why the only explanation has to flow through a drastic alteration not just in cyclical occurrences but also economic potential. How else can anyone explain stock prices at records while real median household income remains below what it was in 2000? Bubbles are only the symptom.

In this “recovery” that has all changed, the equation is off and the spin of economic function has taken a seemingly new axis. The ire of the first major incarnation of this new Marxist fascination, Occupy Wall Street, was, I think, at least thoughtful enough in its eponymous target. There was and remains an obviousness in the game of inequality politics in demonizing the big banks, not the least of which is their durable unpopularity. “Too big to fail” cuts against every known fabric by which the capitalist system has forestalled those Marxist expectations of apocalypse. It is more than unfair; there is an unsettling nature of a kind of financial fascism to that arrangement, as if banking has obtained a pedestal unique in history.

What we have found out via direct experimentation, unfortunately, is that there is a chasm between money as property and fiat financialism. The financial system is supposed to be in the background serving as a productive vehicle toward real economic efficiency, and certainly functioned far more in that direction when money was limited as property. Changing money into a financial creature has delivered this recharacterization where banks are lorded, attaining primacy, and thus the downward spiral of real economic results.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch