The GSCI Commodity Index ((GSG)) consists primarily of Energy, but also includes Agriculture, Industrial Metals, Livestock, and Precious Metals as part of its holdings. The index broke out to the upside in the beginning of February and after retreating back to support in March, seems poised to continue its run higher. The index moved above both its 50-day and 200-day moving averages and held support at the 32.20 level. GSG is up 1.90% year-to-date.

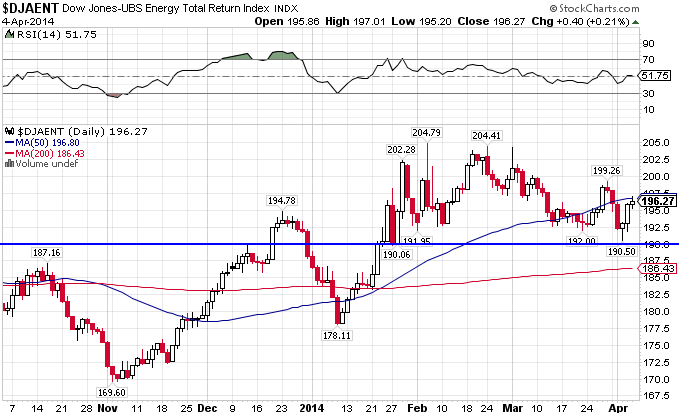

The Dow Jones-AIG Energy Index (JJE) consists of Natural Gas, Crude Oil, Heating Oil, and Unleaded Gas. Since the beginning of November, the index has been on a tear, breaking resistance at the 200-day moving average while holding support at the 190 level. Next up is the 50-day MA. The index is up 3.93% for the year.

The DJ-AIG Grains Total Return Index ((JJG)) consists of Corn, Wheat, and Soybeans. After a rough 2013, this year has been a spectacular one for the index, as it has blown through both moving averages on its way to a 20% gain in the last two months alone. Holding support at the 122 level is key to keep this run going. The index is up 16.09% so far in 2014.

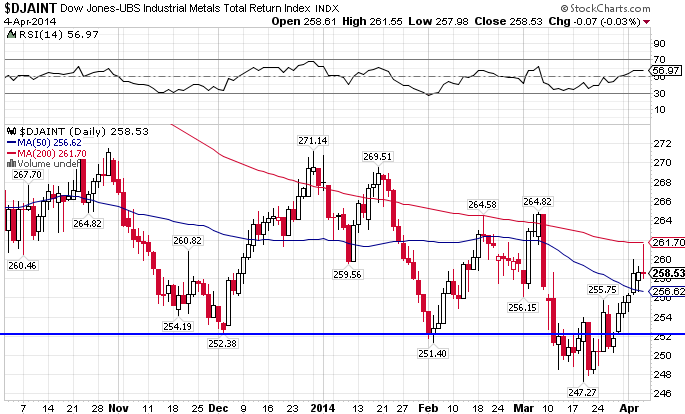

The DJ- AIG Industrial Metals Total Return Index ((JJM)) includes Aluminum, Copper, Nickel, and Zinc. The index is in the process of forming a bottom. It currently resides just below its 200 MA but just above strong support at the 252 and 256 levels. JJM was one of the hardest hit by the weakening global picture in 2013, and it’s not looking any better so far this year. JJM is down 4.11% YTD.

The DJ-AIG Precious Metals Index ((JJP)) includes Gold and Silver. It seems that the index may have finally reached a bottom at the 350 level after a volatile and tough 2013. In the last two weeks, it broke through support and was at risk of breaking down entirely, but it held support at the critical uptrend line. Watch for it to rise further if it drives through the 385 level, which could happen this coming week. JJP is up 5.30% YTD.

The DJ-AIG Softs Index ((JJS)) includes Coffee, Cotton, and Sugar. JJS has been on an absolute tear since the beginning of February, up over 25%. It was one of the hardest hit commodity markets before a Brazilian drought brought about worries over sugar and coffee crop damage to the top grower of both commodities. The index is up 22.09% YTD.

Stay In Touch