Mario Draghi was out yesterday with comments about the recent strength of the Euro (via the WSJ):

WASHINGTON—European Central Bank President Mario Draghi on Saturday ratcheted up his warnings about the strong euro, saying a further rise in the exchange rate would trigger additional monetary easing to keep inflation from falling too low.

“A strengthening of the exchange rate requires further monetary stimulus. That is an important dimension for our price stability,” Mr. Draghi said at a news conference during meetings of the International Monetary Fund.

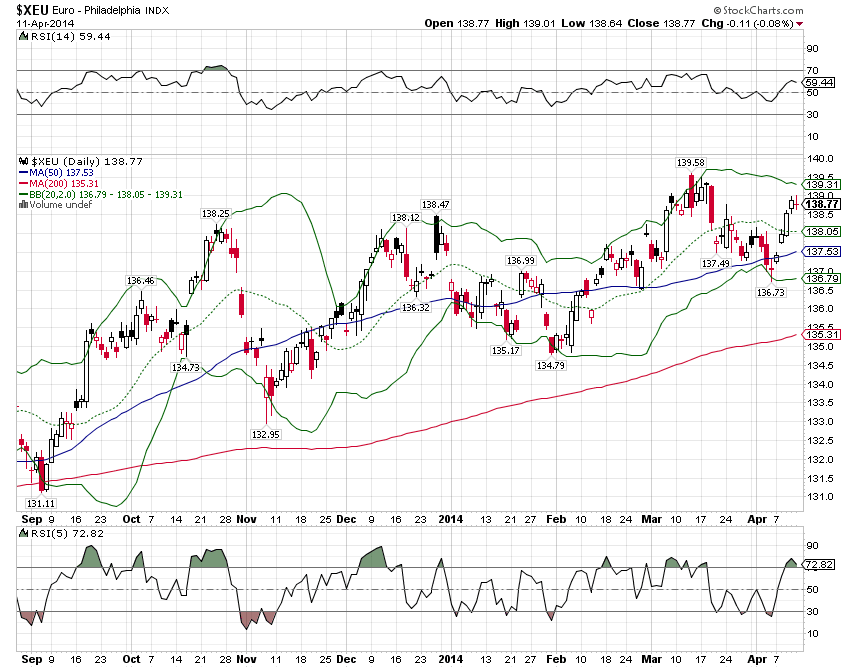

Draghi has hinted at this before but I think this is the most direct statement he’s made about the Euro specifically. With inflation below the ECB’s target it isn’t exactly news that they are considering further stimulus and speculation about what form that might take has been rampant. So, if the market already knows this, why has the Euro been rallying?

What if the Euro has been rallying in anticipation of further stimulus? If monetary stimulus, in whatever form, is perceived by the market to be positive for European growth wouldn’t that attract more capital to the region? It really doesn’t matter whether the stimulus actually results in more growth – at least at the beginning. What matters is the perception of it and as we’ve seen in the US, QE has a powerful psychological effect. Believers have been waiting for better growth in the US for years now and stocks and other assets reflect those expectations. And now that QE is ending, the dollar is falling. So, Draghi may think that “further monetary stimulus” will reduce the value of the Euro but the market doesn’t have to agree with him. He may get the exact opposite of what he expects.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, Joe Calhoun can be reached at: jyc3@4kb.d43.myftpupload.com or  786-249-3773. You can also book an appointment using our contact form.

786-249-3773. You can also book an appointment using our contact form.

Stay In Touch