A recently issued report from the World Gold Council surmised that it was “feasible” for as much as 1,000 tons of physical gold to have become entangled with financing deals in China last year. That would/might account for some portion of the physical metal that has moved East in recent years, as metal inventory has long been a popular staple in China trade credit.

While there is some uncertainty about whether there have been official purchases of gold in the domestic market, such doubts do not exist when it comes to the large-scale use of gold for purely financial operations in China. Restrictions on credit and cross-border capital flows create an incentive for the use of high value, internationally-traded commodities as a means of bypassing such restrictions by both companies and speculators. Copper has been a very high profile vehicle for such activity. In recent years gold has increasingly been used in a similar fashion, although this is much smaller and has received much less publicity.

Western banks and interbank markets have used gold, obviously, for as long as gold has traded, but what we are talking about with China, on the margins, is a dollar short. That has been a much more recent development for Chinese finance, where the rest of the world had been in such a massive short position since really 1971. The concentration of the dollar issue is with Chinese corporates, not the PBOC, as the net terms of trade under a dollar reserve ensure Chinese importers pay dollars – and so they must acquire them from somewhere at some external cost.

That would certainly be strong motivation for Chinese officials to try to circumvent the dollar payment system (colloquially known, wrongly in my opinion, as petrodollars). For the government in China, it has to be a grating strategic weakness to be dependent on US dollar channels, even eurodollars that aren’t directly tied to the US itself, for its resources.

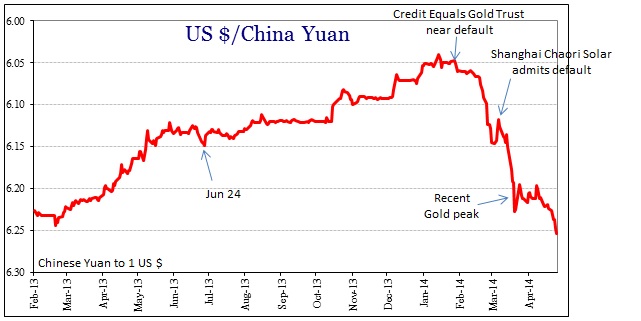

The most recent devaluation in the yuan against the dollar I believe is tied to this dollar channel, or more precisely, growing tightness in dollar supply to China (and not a controlled PBOC program). That would increase the importance of alternate collateral terms, including gold.

Copper, for its part, has rallied in the past week or so, but gold seems stuck. As I noted previously, there is not a directly observable link between the yuan and gold (yet?) but my sense is that it is one factor keeping gold prices from breaking higher. With the treasury curve exhibiting major bear flattening you might expect more than a little safety bid, as seemed the case post-taper, but little traction has been obtained.

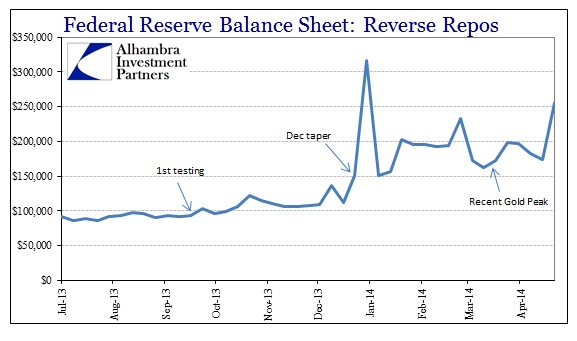

That does not mean, however, that the Chinese theory is the only negative factor on gold prices. The most recent weekly update of the Fed’s reverse repo data confirms a high degree of usage – the reverse repo program can be thought of as a (very imperfect) gauge of collateral need.

Given these two financing factors, I don’t think it much of a shock that gold has remained in a narrow range. If there has been a surprise, to me, it is that gold prices did not move even lower under this minor financial duress. That might actually be a good sign of at least relative safety bid, which would be a particular contrast to 2013’s numerous cascading episodes.

That continues to be, I believe, the calculation for gold in the short run. Intensity of safety bid vs. intensity in these unrelated financing externalities.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch