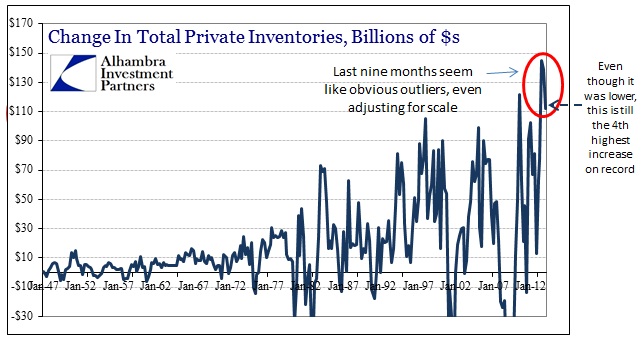

For a simple frame of reference, the seasonally adjusted annual rate (SAAR) of increase in GDP in the first quarter of 2014 was $60 billion in nominal terms. The BEA calculates that nominally business inventories grew by $112 billion in the same period. On a back of the envelope basis, inventory growth was twice that of GDP and without it GDP was contracting.

It has been this way for three straight quarters, as inventory growth has been the bulk of marginal expansion. In that “escape velocity” third quarter, the inventory increase of $145 billion was well more than half the estimated $252 billion increase in GDP. In the final quarter of 2013, inventory additions of $139 billion were, by far, the bulk of the $177 billion gain in GDP.

It is not uncommon to see such results in one quarter, perhaps two together. But three consecutive quarters (really four, as inventory was more than half of GDP growth in the second quarter of 2013 as well, though both were of lower absolute levels) of such high inventory growth is to say the least very unusual (more like unprecedented).

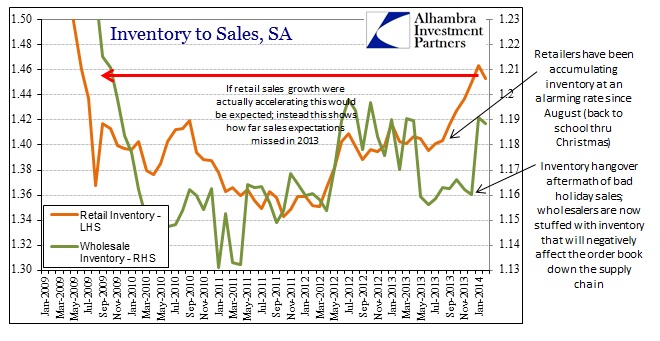

Inventory gains such as these are commonly associated with the first stages of cyclical recovery. And so they are usually accompanied by healthy sales gains as most of the supply chain reacts to changing cyclical fortunes for the better. However, in each and every case of cyclical inflection, it is sales that lead. The only explanation that seems both comprehensive and plausible for the current inventory predicament is QE fantasy leading to overestimation of economic health.

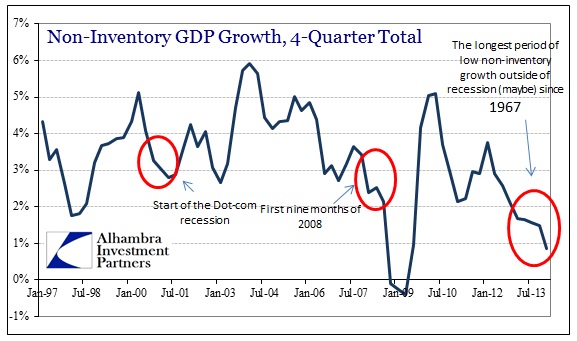

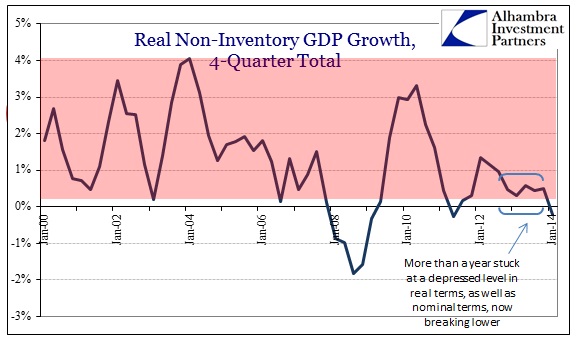

Absent inventory, as noted at the outset, GDP looks rather rotten – and recessionary to boot. That presents two simultaneous problems. First, current estimates of economic health are overstated. And that leads to a situation where future growth is threatened by this accumulation of unneeded production and storage of goods.

This is perhaps most evident in the Census Bureau’s data series of wholesale and retail sales and inventories. There has been a sharp rise in the ratio of inventory to sales, meaning inventories are out of alignment with sales by a large and growing degree. That is particularly true at the retail level, as the ratio stands now far above at cycle highs (not a good sign for future growth). The rise in wholesale inventory is the backup of the supply chain pursuant to the accumulated overestimation at retailers.

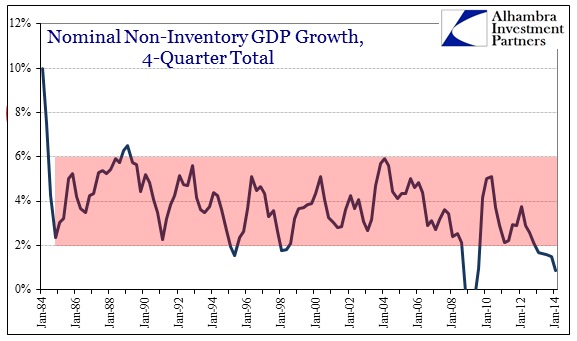

With a wider perspective, this problem becomes clearer. Nominal GDP growth outside of inventory (and inflation) has been remarkably consistent since the end of the Great Inflation in the early 1980’s.

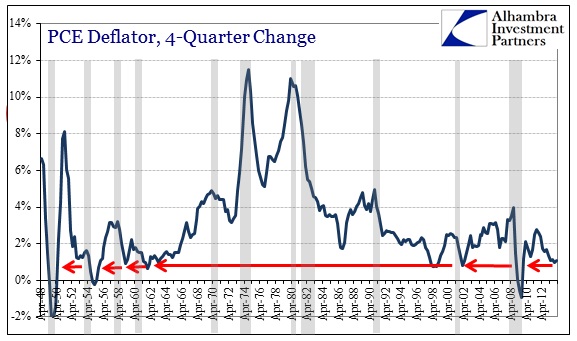

That would seem to suggest more than the typical ebb and flow to the latest swing lower in the economy. Even at relatively low levels of inflation, it appears a decisive change in cycle rather than fulfilling any peripheral monetary mandate. Inflation levels themselves confirm such analysis, as low levels like what we have observed lately are usually an indication of nearing or existing contraction.

These two indications, inventory and inflation, are actually complementary and very much related. High levels of inventory (relatively) reduce the pricing power of businesses, and so the interaction of lower prices and high inventory around a recession-type cycle is unsurprising. The current reading of the PCE Deflator, the Fed’s preferred inflation estimate, has been largely unchanged since the middle of last year – conspicuously coinciding with this surge in inventory.

While the FOMC targets and expects a 2% level, even initiating additional QE to “ensure” reaching it, the last four quarters have been 1.07%, 1.12%, 0.98% and 1.07%, respectively. Such a run of consistency is highly unusual at this level of around half the monetarist target. That too says a lot about both monetary efficacy and the state of the economy, including these trends that certainly and visibly predate winter.

Even if we ignore the economic travails elsewhere, nothing says cycle like a period of intense inventory accumulation. Only in this case, where inventory grows beyond sales, the cycle changes not toward recovery but the opposite.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch