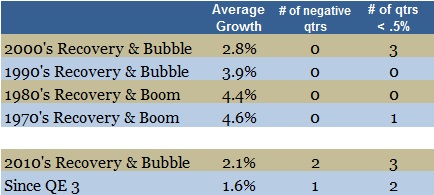

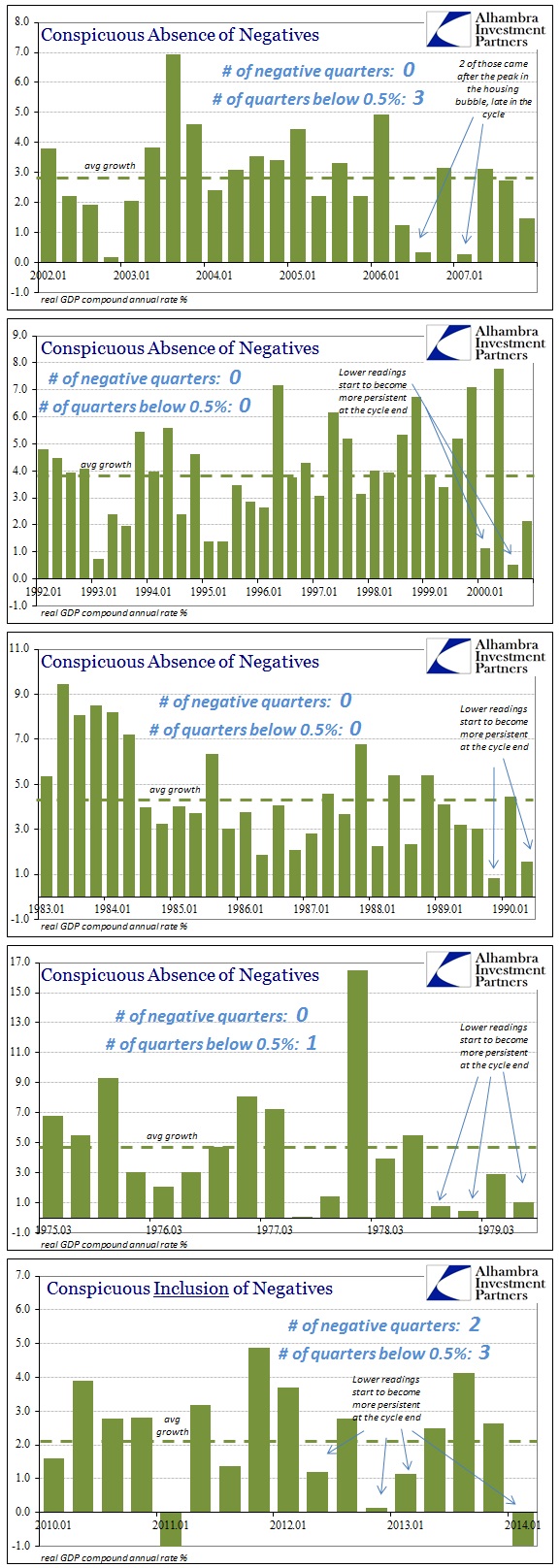

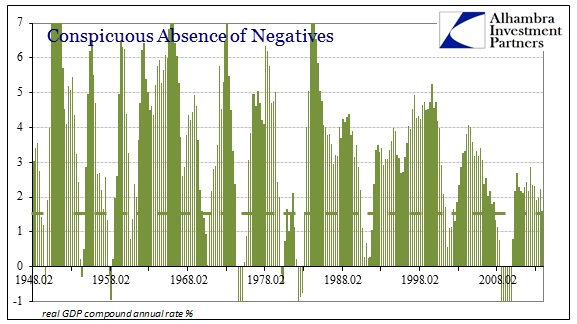

Now that GDP in Q1 has been revised significantly below expectations, particularly in comparison to the +3% that was expected at the outset of 2014, rather than dwell on the individual components I think it is useful to note that negative result in the context of cycles. Negative quarters are actually exceedingly rare in the circumstance outside of recession. In fact, going back to the 1970’s, there are actually no (zero, none) negative quarters outside of recessions and their immediate aftermath. That outcome cannot be overstated. In the current “recovery” period we have already been visited by two.

These results speak to both structural/trend issues with growth during the ultr-activist, QE-age and more recent weakness indicates, I believe, cyclical potential. In every one of the prior “boom” periods, bubbles or not, the incidence of low growth quarters increases as the cycle ages – that’s almost a tautology, but it does give us some indication about cycle peaks.

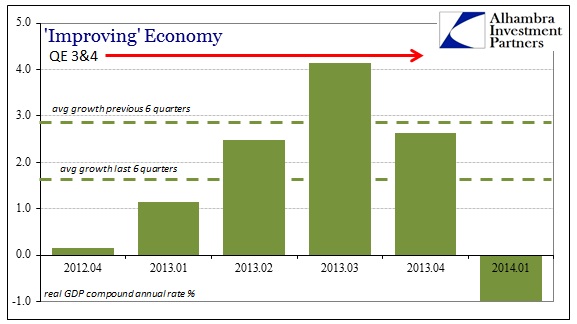

Since Bernanke’s great experiment was recommitted at the outset of Q4 2012, GDP growth has actually dropped by 1.3% from the 6 quarters preceding it. In the longer term view, that 6-quarter average of just 1.6% has only been seen during previous recessions.

Either that means we are on our way in, just on our way out, or into something totally different than we have seen since the end of World War II. It would be foolish to completely ignore that last option given how messed up the economy has become under the restrictive monetary repressions, but I think bond and dollar markets are leaning toward the first option. Economists and stocks are, of course, only considering the middle option despite all historical experience.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch