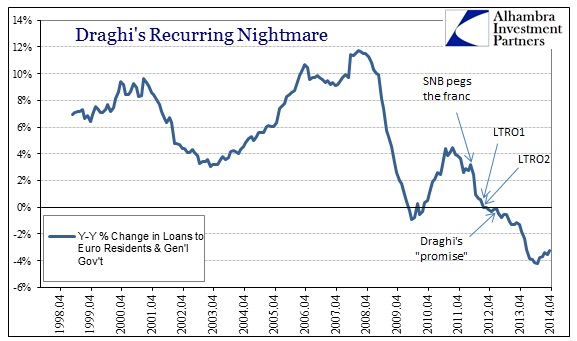

The ECB is widely expected to cut rates again tomorrow, and may include a program to “encourage” securitization of loans to small and medium businesses (SME). For now, the idea is to reduce the “drag” on Europe’s purported recovery, as, once again, the central banking regime turns to debt as the one and only solution. As I noted last week, bank liquidity was not enough going back to late 2011, and lending in Europe has reversed ever since banks were encouraged to buy sovereign bonds. The logic here is somewhat circuitous, but it ends up in largely the same – encouraging banks to lend where the ECB wants.

Central banks are not supposed to engage in determining allocation of credit, a function in a truly capitalist system accomplished by intermediaries in freely priced markets. Since, however, the typical “rules” have been ignored for some time, why not one more violation in a sea of them? If the European economy does not want to respond in the manner decided aforethought by the central planning committee, the central bank will by coercion make it happen.

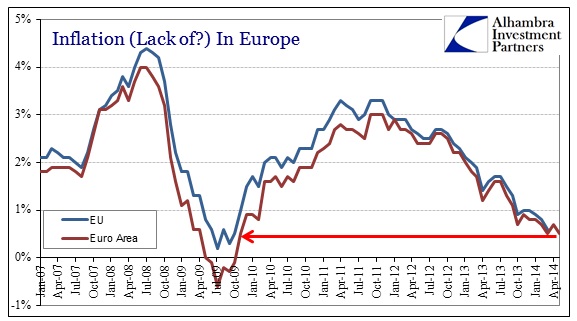

The resistance to the “irresistible” force of monetary policy has been striking, to say the least. The latest inflation figures match the lowest since the depths of the Great Recession and crisis, an incidence that the ECB and economists are loathe to admit has a direct reflection on this current “recovery.” Why cut deposit rates negative if recovery is becoming embedded? Reducing drag is not a serious explanation, as this is no optimal control attempt.

I think the real answer may be found ironically in the new Goldilocks element of global growth. In jest I pointed out some days back how it seems the weather needs to be “just right” for the economy to apparently avoid “unexpected” setbacks. That would seem to suggest, in a more serious examination, that perhaps the economy itself is operating on a much narrower margin. In other words, if conditions stray too far afield, the whole affair crumbles – with the latest rumors of actions conveying muffled worries that it may not take much straying at all.

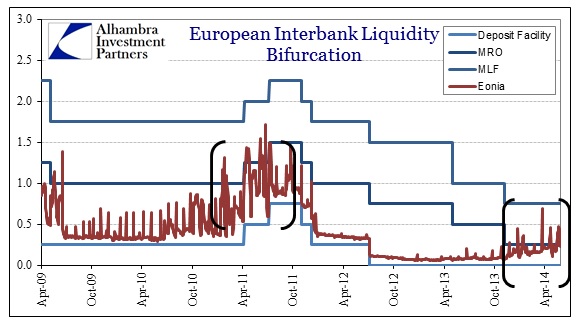

We know that the rate cut in November 2013, and narrowed rate corridor, had an imprint on basic interbank function, but it should have been far tamer. Instead, Eonia, the primary interbank, unsecured rate, has become noticeably more volatile and uncertain as LTRO’s are returned and “excess” reserves disappear once more. Again, what looked like “normal” function as late as October 2013 suddenly changes to something less certain with only a minor policy alteration.

Normally, a healthy economy would on its own readily lend to small and medium businesses as a matter of opportunity. The retreat from that sector, and the ECB’s determined effort to countermand “market” decisions, speaks to this fragility.

A negative deposit rate might produce disruptions in these very money markets, which then might further disturb the artificial peace that is slowly being revealed as otherwise. Repo rates could follow below the zero bound, and banks could begin converting deposit account balances (now with a negative interest attached) into actual vault cash (which isn’t entirely cost-free). Both would cancel out the purported liquidity benefits of pushing against deposit balances – and the ECB could very well cancel those out by limiting currency availability and changing its own repo operations. In terms of direct effects, it’s far more muddled than settled.

But one further effect of negative deposit rates might be a reduction in money market trades, thereby causing a shift out of Europe by corporations and their large balances of “liquidity.” In addition, a small negative rate just might have some moral suasion toward FX trading, in combination with any corporate retreat. Even if limited to symbolism and the always ephemeral “potential for”, this might be enough to influence the euro.

The most prominent and recent use of a negative deposit rate was Denmark, which during the height of the PIIGS crisis wanted to control inflows seeking shelter from the shaky euro. For the most part it worked, at least in the big picture sense. There were complications, to be sure, but the krone was restored to its peg and investors moved to other sources of currency “shelter.”

I think what the ECB is doing amounts to a covert attempt at stirring inflation via currency – hiding a little Abenomics glossed as this credit “drag.” It clearly does not want to be overt in that policy because of where the euro was only two years ago. They wanted a strong euro, but then got one and now it is “too strong.” In short, the ECB is looking at “just right” currency values. In a very backwards way, the European economy may be forcing the ECB to actually engage in currency stability because even slight moves outside of some range produce negative (even existential) results.

The problem, as with so many other facets, is that the central bank gets to define the range of “what works.” And every attempt at doing so to this point has been met with “whack-a-mole” problems – fix one and another appears. Again, this is evidence of strange and dangerous fragility, not recovery.

The “market” does not want to allocate lending to SME’s, particularly in the most affected areas, because the strangle of the euro enforces the “need” for economic adjustment, i.e., recession. More than anything that is why, I believe, the margin for error in the currency is so narrow, and thus why the ECB is intent on violating central banking precedence. But it’s not a solution, as narrowing the operational and economic window amounts to tightening the noose. The only other choice would be market rates and true price discovery for everything, and we know that will never be allowed.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch