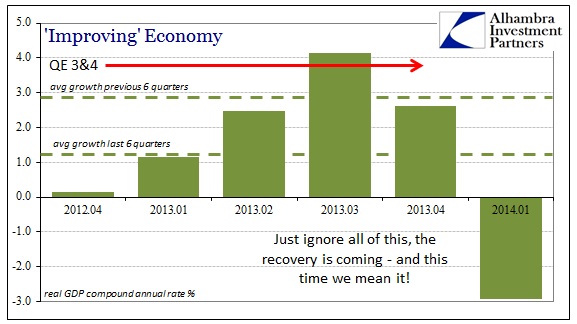

If it seems as if there is a proportional relationship between the disappointment of economic growth and predictions about the vitality of the recovery that is supposed to follow, I think that captures the newest state of policy psychology. I don’t think at any other moment in recent history, going back probably to the founding of the Federal Reserve central bank system, we seen such a frenzied state directed toward ignoring economic reality. The dire nature of the first quarter is being totally disregarded as an aberration when no such other aberration has ever occurred.

As I said earlier, this is not the first experience with which policymakers and orthodox economists have persisted at optimism despite relevant and powerful empiricism directing otherwise. However, in 2008 there were very visible signs that all was not “contained” and that the economy was foundering, and deeply so. Even the stock market peaked in October 2007 despite all the assurances.

I don’t think there is enough appreciation for how much modern economics has become dependent on psychology for both setting policy and measuring expected results. That starts with ZIRP and QE, of course, as the FOMC fully believes that if they state clearly their intent to “lower the cost of lending” that will translate into expectations of financial and economic agents. Thus, the act of engaging in what is really manipulation of psychology is believed to lead directly to economic activity in the short run.

The QE corollary to that, which in the IS-LM framework posits the persistence of a negative natural interest rate (the only way to get the math to work), is inflation expectations. Again, the Fed believes that if they can “credibly” manipulate investor and economic agent expectations into thinking that policy action will lead to inflation, that will create activity now – the so-called “pump priming.”

There is much validity to the theory, rational expectations, though there is heavy debate about the “rationality” of it all. I think there is a great deal of rational behavior in response to policy manipulation, only that it isn’t as simple as believed. For example, companies may not hire or accumulate workers under the belief that the FOMC can foster inflation through policy action, they may instead over-manage their cost structure and favor financial investment. Whatever the outcome, there is a solid basis for the theory, though the dependability in policy terms is very much debatable (and I think has been discredited over and over).

Traditional thoughts about even nontraditional policy measures (like ZIRP that never ends) are about “stimulating” more than anything. However, modern policy theory also posits a great deal of psychology in recession. It is certainly not uniform across various strains of thought, but it is believed that recession itself more often than not has a basis in the psychology of economic agents and their expectations.

In the May 2011 issue of the Economic Journal Fabio Milani of the University of California, Irvine, published a study that accounts for half of business cycle variations due to nothing more than emotion and expectations. People, consumers, businesses tend to be “overly” pessimistic leading to recession, and “overly” optimistic leading to cycle peaks. That is a tremendous amount of variation explained by rational expectations, according to the study. Manipulate emotion to end recession.

For economics as a “profession” (it is decidedly not a science, other that perhaps a social science) there is no clear path to incorporate even the original rational expectations hypothesis of John Muth first published in 1961. But that discussion itself gets lost in the weeds of what economists have become: statisticians. Whether or not recessions are creatures of emotional pessimism or not isn’t the point here, but rather that is what policymakers largely think and attempting to accomplish.

The basis for Greenspan’s hubris in the late 1980’s and early 1990’s came out of so much scholarship of the Great Inflation as it related to expectations. The business cycle, if it was indeed a primary factor of psychology, could be overcome by policy “accommodation” or what amounts to manipulation of psychological predilections of first investor expectations, and then economic agents. The very idea of “fill in the troughs without shaving off the peaks” is grounded in rational expectations theory about the heavy psychological component of recessions (in the orthodox view).

Taken to the extreme then, especially in the current case in the aftermath of the very recessionary first quarter of 2014, the textbook response to that result is to once again appeal to manipulation. If they can convince you that recovery is coming, despite all evidence to the contrary, including crying recovery wolf too many times previous, then they believe that we can skip recession entirely. That amounts to deceit on a certain level, for your own good, of course, but taken from the orthodox view it is nothing more than the belief that recessions themselves are “unnatural” and non-beneficial. In other words, the orthodoxy believes that, like market panics, recessions are the cumulative responses of idiots and rubes (the end result of more than a century of distrust and outright contempt of actual markets and free movement and thought). That all justifies, in the orthodox view, the interventions that include what amounts to intentional deceit.

I don’t think it too much to assert that such an idea takes rational expectations way, way too far. That goes for both the academic pursuit of how much psychology plays in rational behavior as well as what amounts to a totalitarian command and control system of economic arrangements – it really is nothing short of 1984-ish. Free markets depend on the free flow of information, not having the FOMC command everyone what to think and believe. That goes beyond just trying to convince you through speeches and statements, as it includes actually intervening in markets and cajoling market participants.

As it relates to the ludicrous blaming of mother nature, that fits well within what I am talking about here. They believe that if you will “buy” the winter explanation any negative or pessimistic impulse toward recession will be overcome and it will be avoided entirely. That is the nature of a demand-view of the economy, that people will spend when they “feel good”; meaning the ultimate job of a central bank in the modern age is to disperse sunshine and unicorns, and to do so in ways that further stretch the imagination when conditions actually worsen as they inevitably do in the real economy that doesn’t really run on feelings.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch