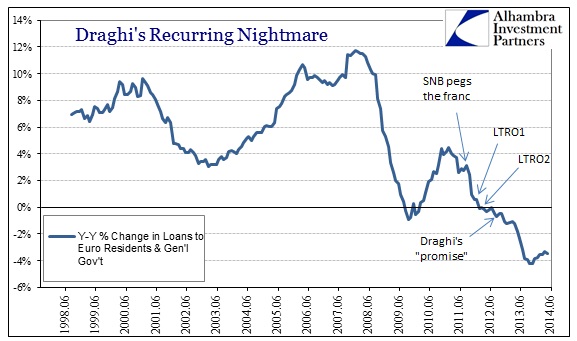

The ECB continues to sell the recovery in Europe despite any actual pickup in activity, Germany excepted. In financial terms, which are all that matter these days for policymakers, lending continues to contract. Despite the outward appearance of asset prices and certain economic accounts, there is no intent to extend further credit across the European zone.

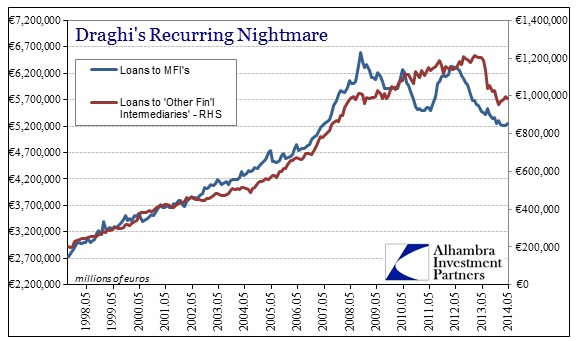

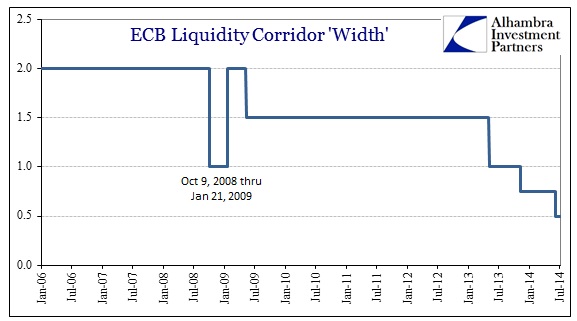

The latest figures through May show why Draghi’s ECB policy moved toward a negative deposit rate. Contradicting the idea of the recovery, lending continues to shrink at a rather alarming rate. November’s rate movements, further narrowing the rate corridor, has had no impact on lending preferences as banks still purchase sovereign debt. Again, that makes this problem all the more tragic, given that it was sovereign debt that the ECB practically directed banks to purchase with abandon in 2012. Having exercised a more implied function of resource allocation, the central bank now wishes to engage again in another sector.

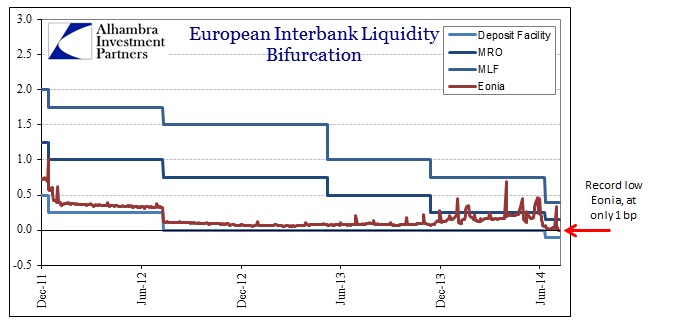

You can at least see why the appeal of a negative deposit rate would fit within the designs of the financialized viewpoint. Not only have European financials eschewed lending to consumers and businesses, they have also refrained from lending to each other at terms even beyond overnight. That, more than anything other than Eonia, directly contradicts the narrative that the financial system has been “fixed” on anything other than a cursory basis or for more than the sake of appearances.

That at least suggests a liquidity solution might have some chance of filling the financial debt void, with the ECB one more time stepping into the role of funding intermediary now with its TLTRO’s. So at least there is some outward plausibility underlining the effort.

But that would have to ignore the original LTRO’s which had no impact at all. If anything, the LTRO’s seem to have encouraged banks to stop lending broadly in interbank markets to instead place funds idly in the deposit account at the ECB. To this point, the negative deposit rate was supposed to address that deficiency, but the latest Eonia fixes show that banks have indeed simply opted for moving funds there rather than further out in the liquidity system. In fact, so much funding has moved from the deposit account to Eonia overnight that the rate on two occasions in the middle of June was barely positive.

While the ECB offers more liquidity once again as a comprehensive solution, the reticence of banking firms is directly related to the economy and the tortured financial system outside of those prevalent liquidity appeals. Draghi wants Europe to buy into the idea that its efforts of supplying funding for loans will create an urgency to engage in them (from both supply and demand for credit). In fact, a bank has to take into account far more than funding, including the rate at which the loan will accrue and the potential for default. In the low rate environment that exists due to this constant appeal to demand for credit, a bank is simply not gaining sufficient return to engage lending where default rates are elevated, and have remained persistently so. In pure financial terms, banks are not given a fair compensation for taking on the risk of lending – which is why they continue to pare back.

That mismatch is further heightened on a cash flow basis, as it is not even defaults that impact lending considerations so much as NPL status. The extremely high rate of NPLs, particularly in the Southern nations regardless of how much Italy and Spain are proclaimed as recovered, is of greater concern in lending than anything to do with funding new credit. The ECB may be offering leverage, but unless there is a guarantee for both capital suffrage and cash flow then lending simply is not attractive; to the point of being a losing proposition.

While we don’t know yet how banks have responded in full to the negative interest rate, the indication of Eonia cannot be what Draghi was looking for. That is the case at least publicly, though I still believe that the ECB is fully aware of the financial impediments to lending and instead was courting only currency devaluation as “pump priming.” If that is the case, and it is “successful”, count the Europeans to be impoverished along with their fellow Japanese sufferers.

There is a certain inevitability here, as the means and methods gain more extremes in action. There are no more orthodox alternatives. In fact, the only true alternative is to actually allow price discovery and markets to allocate resources efficiently as an economy actually requires. But that would likely lead to more disorder, so from the perspective of the orthodox central bank it is better to wallow in zombie status, bouncing between shallow recessions and lack of actual recovery, than to risk short-term violence in transition to actual economic health. That is all the more true when the foundation of your approach is purely financial.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch