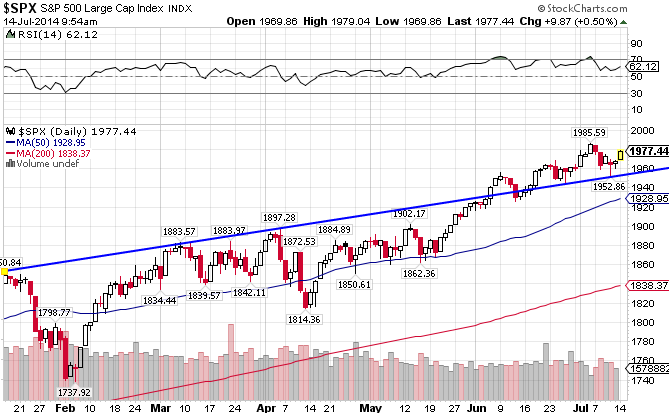

Under uncertain yet seemingly improving economic conditions, the S&P 500 Index((IVV)) has inched its way forward for much of the year, gaining just over 7% during this low-volume, low-volatility period. It remains above support at the 50-day moving average, and is poised to make new all-time highs this week. The index is up 7.57% in since the beginning of the year.

The S&P 500 Value Index ((IVE)), which consists primarily of US large-cap value stocks in the financial services, industrial, and consumer cyclical industries, tend to have lower price to earnings ratios and higher dividend yields than the market as a whole. This index is just below its all-time high set two weeks ago. Over the past two months, the value index has been outperforming the S&P 500, returning 7.06% YTD while also staying comfortably above its 50-day MA.

The S&P 500 Growth Index ((IVW)), which consists primarily of US large-cap growth stocks in the tech, healthcare, and energy industries, tend to have higher earnings growth rates, higher earnings multiples, and little or no dividend yields. The index is slightly ahead of pace set by the S&P 500, returning 7.87% YTD.

In the past three months, a short-term trend of growth stocks outperforming value stocks has emerged, but over the longer term, value stocks seem likely to continue its dominance.

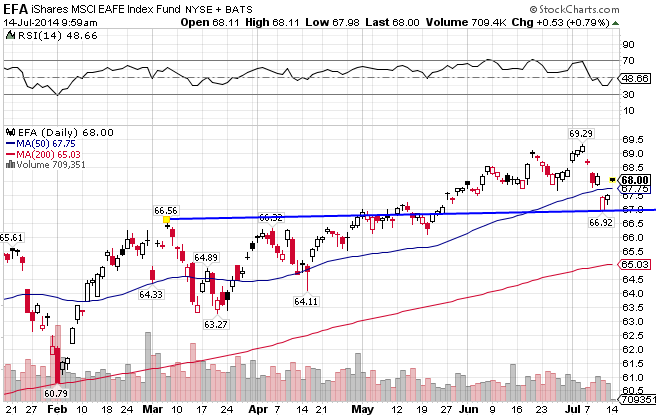

The MSCI EAFE Index ((EFA)), a global developed market index that encompasses Europe, Australasia, and the Far East, has underperformed versus the S&P 500 and looks a bit tired, having broken the 50-day MA in the last week. The index is above support at the 67 level though. It is up 3.03% YTD.

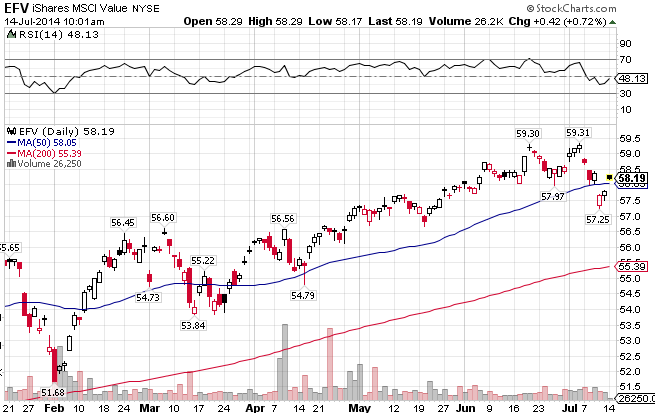

The MSCI EAFE Value Index ((EFV)), which consists primarily of low P/E international large-cap value stocks in the financials, energy, and communications industries, is also weakening of late. Unlike the US markets, international value stocks are outperforming growth stocks of late, and the trend seems to be strengthening. The index is up 4.12% since the beginning of the year.

The MSCI EAFE Growth Index ((EFG)), which consists primarily of high-growth international large-cap growth stocks in the industrial, healthcare, and consumer cyclical industries, has underperformed in the short-term compared to the value index. The index is up 1.60% YTD.

In the past three years, a longer-term trend of growth stocks outperforming value stocks has emerged.

Stay In Touch