The speed at which standards for judgment and analysis have eroded has been slow enough over the past few years as to be nearly imperceptible. There is, of course, a tremendous difference between a company analyst and a macro observer, but that does not necessarily and directly lead to special divergences. In fact, most of the time one flows into the other, as most top-down analysis ties the two together.

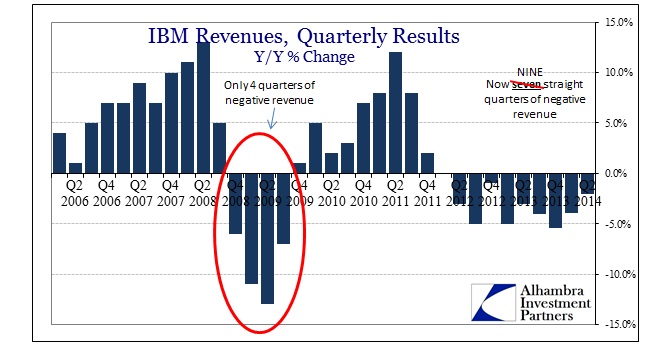

In the case of IBM, optimism continues to be the operative mode despite its obvious struggles. The cheering of the shrinking firm is harmonized at the macro level by the persistence of an “any day now” capex resurgence based on cash. That is particularly ironic given IBM’s preferred mode of cash deployment which has nothing to do with capex and productive investment.

Given the changes taking place in the technological landscape, cloud adoption and SaaS among others, you might make the intuitive leap that such cash might be better used to keep IBM ahead of the curve (hardware, once the core operation, now a drag), or at least catch up in areas where it is clearly behind, rather than almost exclusively on share price. You can’t “prove” a counterfactual, but you also can’t help but wonder if IBM might have been better served with internal assets deployed with an eye more toward long-term expansion.

The difference, then, between the optimistic economist forecasting great things these past two years and the IBM analyst recognizing, without much choice, IBM’s revenue problem is always taken as aberration or idiosyncrasy (for both the company and the economy – the two are never co-located as one and the same).

Yet, setting aside all the gloss and excuses for how one does not represent the other, IBM’s trajectory shown above is exactly the same as the larger trend in capex. There is certainly a global reach in what ails the company, but revenue problems extend far beyond the more publicized Asian difficulties – Americas revenue fell again in Q2, “allowing” analysts to reduce their standards to “at least the decline was only small.” IBM is not some outlier struggling with new technological adoption, but rather a representative bellwether of business investment in general, not just in terms of global malaise but also the very local deficiency.

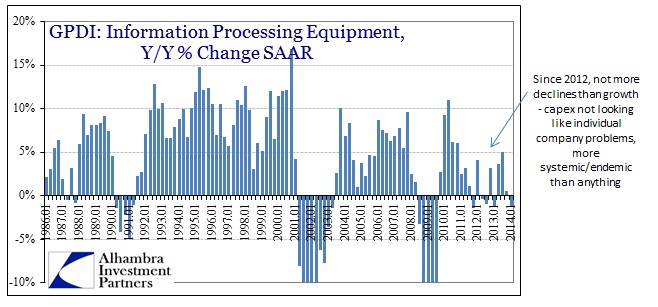

Taking GPDI components from the GDP series, overall business investment in “information processing” has clearly sagged in tandem with IBM, accelerating declines in Q4 2013 into Q1 2014.

On a year-over-year basis, the timing of this depression in activity fits exactly with IBM’s revenue problems.

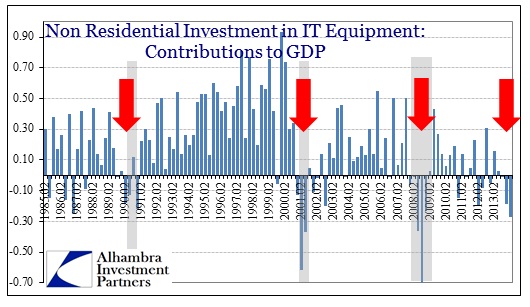

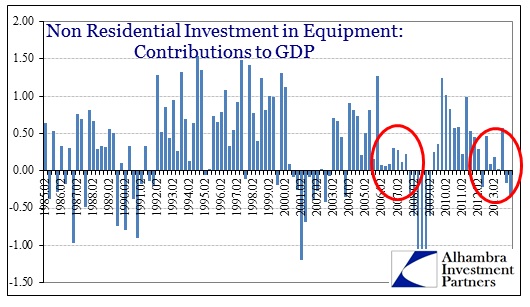

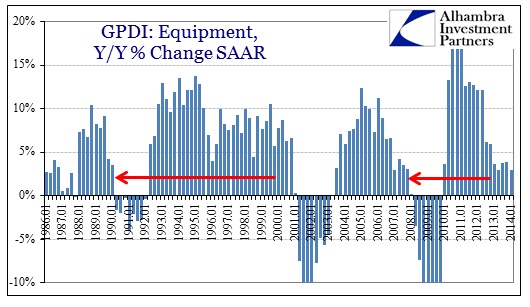

But this pattern does not end with microchips and mainframes, cloud and all, as overall business investment, which includes tech, has been following the same exact track. It’s not just that businesses in the US are failing to invest in technology upgrades, they are simply failing to invest, period.

The chart immediately above looks a lot like the capital goods series, as companies have downshifted in the past two years to something like only replacement level investment. What should be denting the persistent optimism that pervades all of this is that businesses did the same just prior to the Great Recession (and also the 1990 recession).

Of course, I use the term “investment” here in the purest, and what I think is most correct, sense. Management at each of these publicly traded firms has different ideas about investment, pouring inordinate resources, a great proportion of the cash borrowed, in financing the stock bubble. It seems that the higher stock prices go, the more cash flows in that direction – which is exactly the same timeframe as productive investment and capex diminishes. This inverse proportionality argues directly against monetary neutrality and stock repurchases as a benign tool for shareholder-focused CFO’s (why do share repurchases only rise when stock prices do, concurrent to quarterly struggles, belying the notion that share repurchases are only intended to recognize “undervalued” firms).

Perhaps the worst part of IBM’s results, even though the decline “beat expectations” of being less severe, is that this was a second quarter figure of hard dollars (rather than simply sentiment). If IBM is indeed a representative bellwether of capex, there is likely to be no boost in the second quarter, speaking in macro terms, contradicting the sunshine narrative once more. The economic implications of that are as they have been since this all began, namely that monetary interference is highly corrosive beyond just asset prices, in a manner that is more permanent in nature than the orthodoxy will permit itself to even countenance.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch