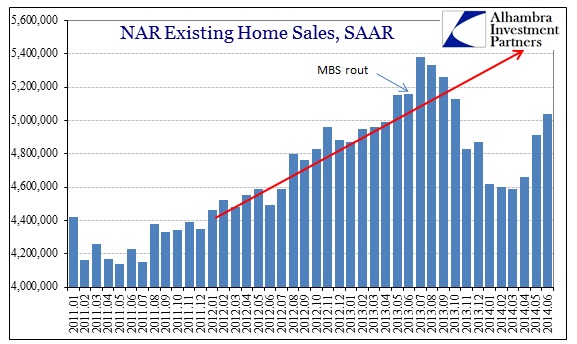

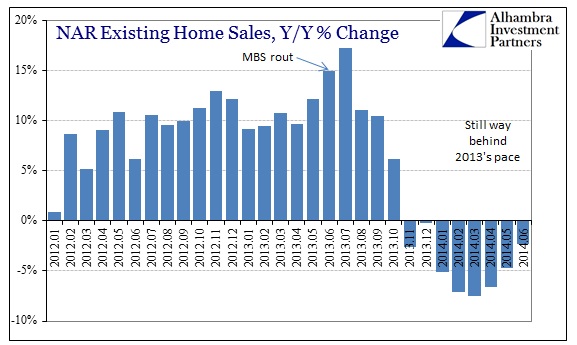

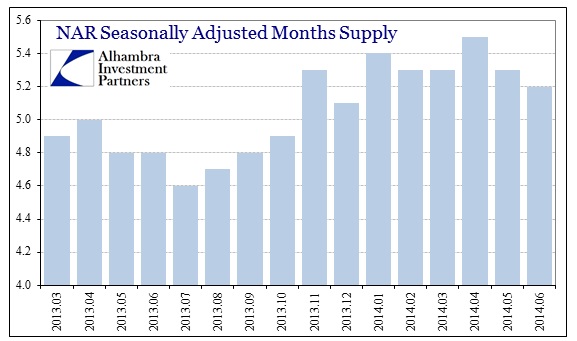

Existing home sales re-attained the 5 million SAAR level again in June, but that remains well behind last year’s trajectory. In other words, the bounce in sales after the most recent trough is not nearly as robust as predicted when it was simply assumed that the housing market would just revert back to 2013’s trend. In terms of yearly comps, June 2014 is still behind June 2013, with inventory growing.

The National Association of Realtors’ prepared statement noted the payroll/pay dichotomy as a factor in keeping the sales pace underwhelming:

Yun also noted that stagnant wage growth is holding back what should be a stronger pace of sales. “Hiring has been a bright spot in the economy this year, adding an average of 230,000 jobs each month,” he said. “However, the lack of wage increases is leaving a large pool of potential homebuyers on the sidelines who otherwise would be taking advantage of low interest rates. Income growth below price appreciation will hurt affordability.”

Assuming that the number of workers is actually valid beyond the statistical sense, so what? It doesn’t matter how many jobs there are, what matters is the income they produce – the vital circulation of earned income in creating wealth. Without the mortgage pipeline, the lack of actual economic recovery is a dual-drag on housing that is actually growing in importance despite the appearance of this “bounce.”

With sales purportedly rising for the “right” reasons now, and with the narrative of a shortage still ringing, the lack of enthusiasm in construction stands in stark contrast to the idea of a healthy housing turnaround. I write this every month, but it bears full repetition, namely that if there were a shortage with good and rising demand, including prices, home construction would be booming. That it is doing the opposite shows a lot about the hidden aspects of this housing “market.”

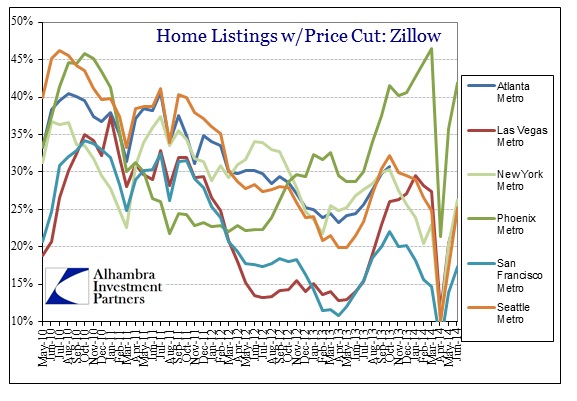

That begins with fragmentation. Inventory is rising, but that is not a homogenous feature, nor should it be assumed as such.

Inventory this year compared to last is noticeably higher, but when viewing sales and inventory through other factors it becomes clearer that marginal sales might be due to the “wrong” elements.

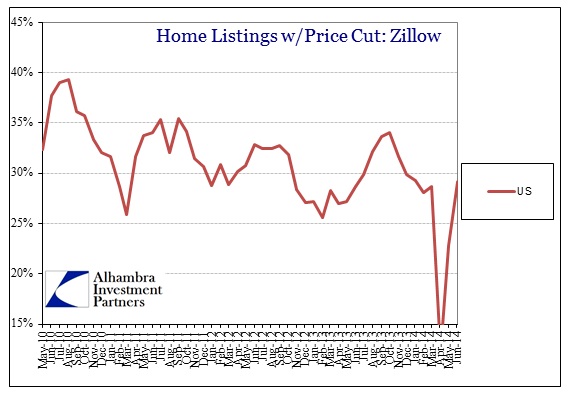

According to Zillow, for example, for some reason the proportion of sales with a price cut dropped dramatically in April when the sales pace was essentially at its recent nadir; only for that ratio to run right back up in May and June. In Phoenix, one of the most extreme ends of the spectrum, just about half of homes sold had to see list prices come down to close deals later last year when sales were far more robust. But now, even at a much lower sales rate, prices are still being cut in the same percentage (with only an April reprieve) as October. That suggests the price problem penetrates much deeper than it seems from the surface sales pace.

That might indicate something like “froth.” When sales were far lower in February and March, list prices throughout the US were being met with contracts. Now, at only a slightly greater sales pace, price discounts are again moving up rather quickly. That might mean the “natural” sales pace is somewhere closer to the winter months rather than the latter part of 2013. In the parlance of financial markets, bid depth may only really extend to around 4.6 million SAAR, not 5.6 million (or even 5 million). From that we might also infer from that any such deviation upward in sales is what is “abnormal.”

As with so many other economic factors, the overall impression here is that conditions are better than winter, but nowhere near what they “should” be given so much abounding optimism. There is growing recognition that something deeper has been disturbed and that there isn’t a lot of consistent sense in those “best case” mainstream expectations. As such, I think housing will continue to be a drag, particularly as the pace of price appreciation continues to slow (and once it turns negative, what might happen then?).

In other words, the actual “market” is trying to show a much lower real estate level, but that is not good enough for central bankers that wish to enforce “order” upon it. Efficient allocation of resources, which would include financial, is not so much a consideration, particularly in comparison to the narrow bounds into which the central planners will allow such “markets” to operate.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch