In contrast to existing home sales there has been no real bounce in new home sales. Again, that more than contradicts the idea of a home shortage (or at least a true market shortage, there may be a shortage when only factoring monetary targets) and further explains why builders are reluctant to close the purported supply gap. It makes no sense to build new dwellings at a faster pace when there has been no real change in the demand for them; worse than that, the latest readings on demand point slightly downward.

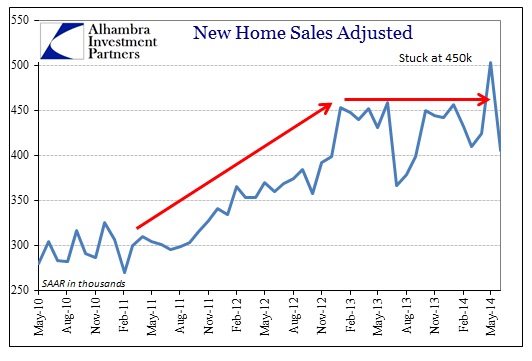

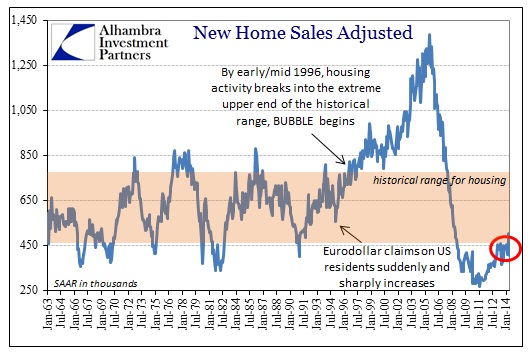

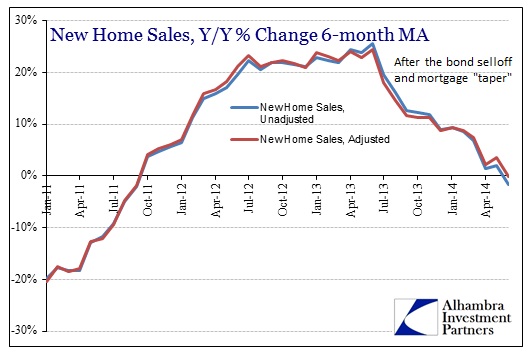

Going all the way back to early 2013, the level of new home sales has essentially hit what looks like a ceiling, monthly volatility aside. In macro terms, that is highly disappointing since it was assumed, with QE3 providing MBS “support”, that housing would be durably turned to an economic tailwind. This lack of growth, in contrast, appears as further confirmation that housing and construction will continue to be instead a minor drag – even into the always hopeful second half.

What is perhaps more important overall is how definitively new home sales are at odds with existing sales. That isn’t necessarily significant by itself, but in the context of what I was trying to describe a few days ago I think this fits the idea of “froth.” In other words, there is an artificial element to the real estate market, evident once more even to a smaller degree in May and June, that is pumping the “market” for existing sales without having a direct boost in new home sales – and thus construction.

In 2012 and later 2013, that was clearly the role being played by institutions as they had no interest in procuring new structures with so many sitting idle before them. The great wealth transfer from former home owners, turned upside down in the housing bust, to financial institutions was distorting the “market” for real estate. In that sense, I think the flatness in new home sales recognizes at least a lesser element of artificiality outside of institutional activity.

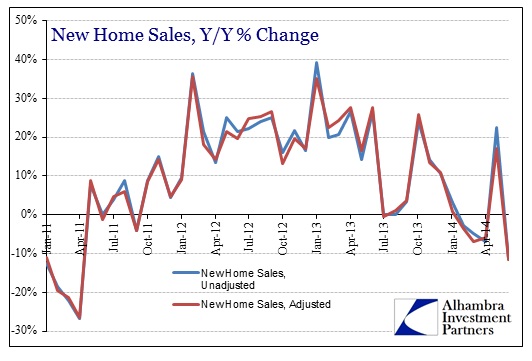

The latest updates on new home sales, even factoring the volatility of the past two months, show what looks to be now a decline in activity. That sets directly against existing sales, which suggests either a return of institutions (even in a different segment) or another factor at work which is far less evident. A third possibility is that existing sales have been artificially heightened in the spring (for whatever reason) and will converge lower with new home sales at some point.

Whatever is the case, and I don’t see enough information to render a judgment in any direction, the persistence of negative factors and potentially negative factors is not where housing was supposed to be after almost two years of MBS spread reconfiguring. The housing market was believed to be headed toward a full and economically relevant rebound, alongside the economy itself. That it is questionable now in so many ways, including this “divergence” between new home sales and existing, suggests nothing good for the future.

At the very least, the construction side is moving in the “wrong” direction and very much against the shortage narrative.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch