Gallup’s latest figures on consumer spending in June put to rest any idea of a major surge, completing a picture of the second quarter that is far more tepid than any weather-related symmetry with the first would have you believe. It has been an ongoing theme for several weeks as incoming estimates (aside from sentiment surveys that never mean what economists try to make them mean) are bitterly disappointing to those that cling to the idea that job growth, if actually real, is the light at the end of the seven-year tunnel.

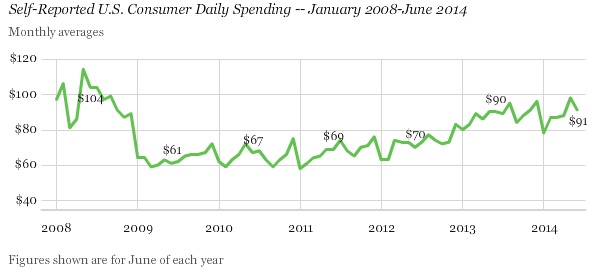

Gallup’s estimate of “self-reported daily spending” for June 2014 is not appreciably different from June 2013. And that is the larger point that gets missed by constant appeal to “eventually.” Consumer spending has been stagnant for more than a year, curiously (or not) dating back to right around the time then-Chairman Bernanke was first mentioning taper, making declarative assessments about expectations for payroll “strength.”

In a November 2013 speech, Bernanke said,

We have seen meaningful improvement in the labor market since the latest asset purchase program was announced in September 2012. At the time, the latest reading on the unemployment rate was 8.1 percent, and both we and most private-sector economists were projecting only slow reductions in unemployment in the coming quarters. Recent reports on payroll employment had also been somewhat disappointing. However, since the program was announced, the unemployment rate has fallen 0.8 percentage point, and about 2.6 million payroll jobs have been added.

The insinuation of mentioning how prior projections only foretold “slow reductions” in unemployment was obvious. That “strength” set up what would take place the next month, the first actual QE taper. He stated that quite clearly in the same November speech, “When, ultimately, asset purchases do slow, it will likely be because the economy has progressed sufficiently for the Committee to rely more heavily on its rate policies…” In forgoing taper last September, the committee was both playing games about “forward guidance” (Bernanke even said that the “surprise” of not tapering actually strengthened the “tool”) and making a statement that payroll expansion needed to be, in their words, sustainable. The combined inferences add up to an economic assessment where job growth was “faster than expected” and finally self-supporting; as the December taper showed the FOMC’s expectations for sustainability had been met.

It is highly odd to reach that benchmark without having “meaningful” growth in either spending or, tracing that backward, income. As if right on cue for that highly conspicuous dichotomy, the economy “somehow” was seized by winter – a tailspin that no orthodoxist saw coming (GDP expectations for Q1 and the rest of 2014 were still around 2.5% and 3%, respectively). Again, logical consistency demands some kind of explanation for the difference between assumed sustainable and more than acceptable job creation expansion, enough to convince actual taper (or so they say), and consumer spending and income. Typically, as in every prior circumstance, these are all linked and correlated in the same direction.

There is a lot encapsulated in Gallup’s results shown immediately above, from the stagnation to utter failure of the recovery to achieve actual recovery. June 2014 spending is still “somehow” significantly below 2008 despite all the mountains of “stimulus.”

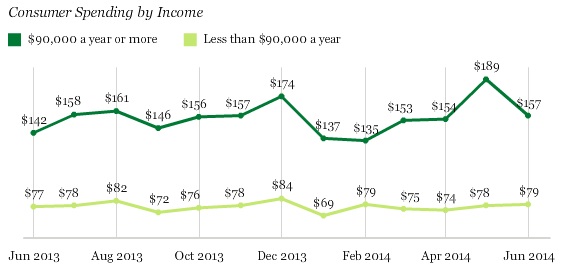

To show this problem more clearly, Gallup provides a breakdown of spending by income segments (tiered at $90,000). While there is much more volatility in the upper income segment, responsible, it seems, for almost all of that in the series as a whole, the stagnation in lower incomes is more than a little striking. There has been no growth at all going back more than a year. That would seem to validate everything we have seen in not just government data like retail sales, but also the hard dollar difficulties at Wal-Mart, Target, McDonalds and the rest of the consumer-focused economic pieces.

Even in the upper income portion, the seasonal and monthly volatilities mask what is also an unsatisfying trend, particularly given the scale of asset inflation and redistribution (concentration).

In a companion piece to the consumer spending polls, Gallup also provides a look into consumer behavior, concluding that Americans are being more than a little frugal. But what caught my attention was not just that the additional data more than suggests continued struggles rather than recovery escape velocity, but the very real damage orthodox economics has done in some of the softer, less noticeable manners of even thinking about the subject.

Consumers’ spending decisions this summer underscore the tension between doing what is right for the larger economy (more spending) and doing what is right for their own personal or household economy (spending responsibly and reducing expenses). Overall, Americans’ spending habits are bad news for the larger U.S. economy.

That is a dreadful and ultimately absurd piece of analysis that highlights everything that is wrong about monetarism’s vast infestation. The narrowed focus on only the short-term is the vilest of the symptoms, as consumers doing what is best, in their own judgment, is axiomatically best for the economy in the long run. Repairing balance sheets and taking a more cautious tone in personal finances will only create positive forces once past this period of adjustment – which “for some reason” continues now more than seven years since the first strains appeared.

The shift here is subtle in its language, but gargantuan in its implications. The US economy is no longer believed to be a collection of individual exertions, aggregated from the bottom-up. Instead, it is a collectivization from the top-down, where individual desires and decisions are secondary (if considered at all) to the authoritative decrees of those that see the economy as a socialized institution belonging to the collective and to be run by ruling committee. Your personal economy is no longer your property, as it is to be determined, and often repressed as we see plainly now, by the “wisest” of the economists who have to create linear regressions just to determine if household income matters as compared to price increases, but cannot at the same time factor simple snow.

There are no mysterious “headwinds”, and “fiscal drag” is textbook CYA.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch