While commentary has already taken off with the latest GDP estimate, given recent history I am fully confident that GDP growth will not be 4%. What is taking place in the statistical bureaus is nothing like what we have ever seen before. The constant revisions, and major changes at that, can only have a deleterious effect on trust in accuracy.

The current “advanced” report is based on incomplete data, largely from April and May, with June extrapolated from those months. However, we know that June was significantly less than the preceding months, so that leads me to believe that already revisions will tend toward the negative. And while Alan Greenspan’s comments about a “false dawn” are valid (which makes me supremely uncomfortable), as he would know more than anyone, having authored more than a few himself, I think it is actually more important to review the massive rewriting of the recovery that just took place.

I will comment on the current data at some point in the future, but for now the revisions are so severe as to be nothing short of revisionist. Again, it is hard to maintain any faith in the numbers when there is no consistency in which to anchor that faith. It is one thing to update data sources and recalculate with additional information, but it is entirely something else to constantly change definitions and so drastically alter prior data.

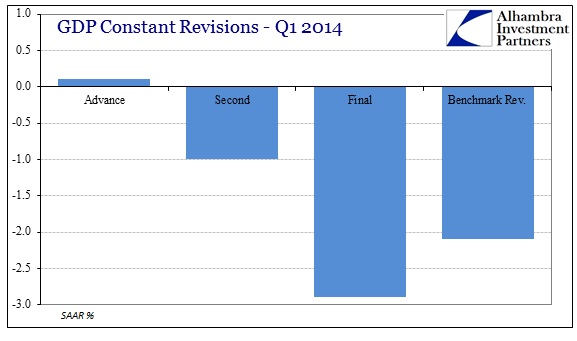

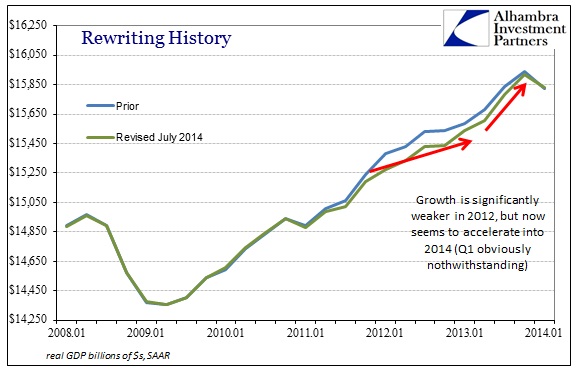

That starts with the various and wide-ranging “estimates” for the first quarter that continue. But the latest benchmark revisit further back changes the entire complexion of the recovery trajectory – without much by way of confirmation or reasoning.

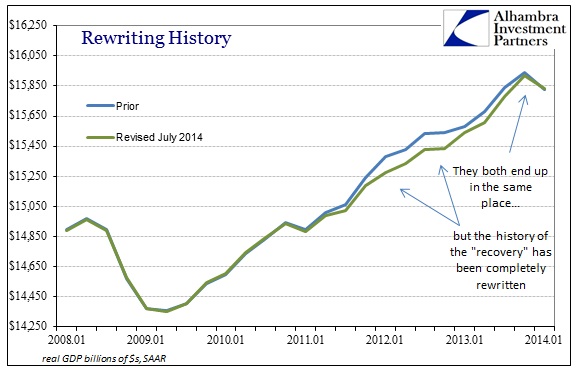

It may not appear like anything significant in the chart above, but it really is in context. According to the latest revisions, GDP in 2012 was consistently about $100 billion less than previously thought (only a month ago). That is an exceedingly wide gap that does more than rewrite figures.

That divergence apparently began in the middle of 2011 after that year’s negative first quarter. By early 2012, the “acceleration” of GDP had convinced most economists that the recovery was real and taking hold. In February of that year, Bloomberg counted the growing optimism that was based in full part on economic statistics that purportedly showed as much:

Now that employment is accelerating, economists wonder if the central bank again will prove to be mistaken, this time by being pessimistic about the outlook.

An improving job market, stepped-up U.S. bank lending and resurgent financial markets all could combine to boost demand. The jobless rate fell to the lowest level in three years in January, while consumer credit racked up its biggest two-month gain in a decade at the end of 2011.

That quoted passage sounds as much at home in July 2014 as February 2012, based as much on confirmation provided by rising GDP estimates. Some economists extrapolated too hard, but the major point needs to be taken (using Joe LaVorgna is admittedly low hanging fruit, but he is often representative of the regressionists):

Joseph LaVorgna , chief U.S. economist for Deutsche Bank Securities in New York, said policy makers will have to raise rates sooner because the economy will expand faster and joblessness will fall further than they project. The first increase will come in the second half of 2013, after GDP grows 3 percent this year and unemployment drops to 7.8 percent by the end of 2012, he predicted.

Chairman Bernanke echoed that full sentiment in contemporary speeches and Congressional testimony:

Federal Reserve Chairman Ben Bernanke said annual growth for 2011 was low due to slow growth during the first half of the year, but the GDP grew at a rate of more than 2 percent in the second half.

“The limited information available for 2012 is consistent with growth proceeding, in coming quarters, at a pace close to or somewhat above the pace that was registered during the second half of last year,” Bernanke testified before the U.S. House of Representatives’ Committee on Financial Services February 29.

Again, that sounds suspiciously familiar, as if those words were spoken recently not more than two years ago. Now we find out, supposedly, that none of that was actually true. In fact, growth was persistently weak and devoid of any acceleration in GDP. This downward revision to that point completely changes the narrative, actually toward something more positive and favorable to the current circumstance. By reducing GDP in 2011 and 2012, but still ending up in the same place as previously believed, the growth rate in 2013 now appears accelerating (ignoring the first quarter, of course).

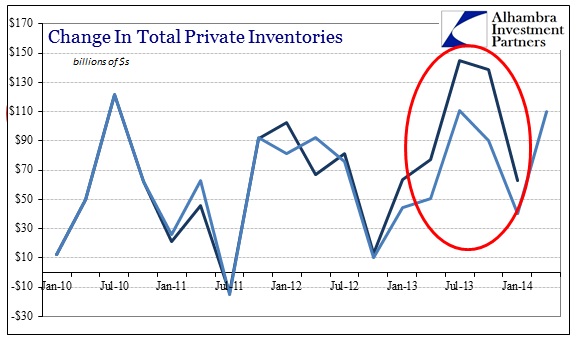

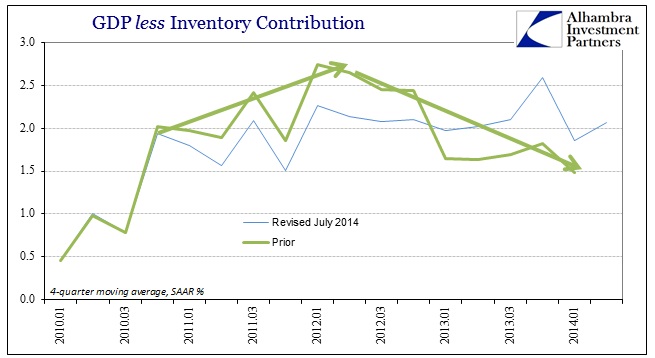

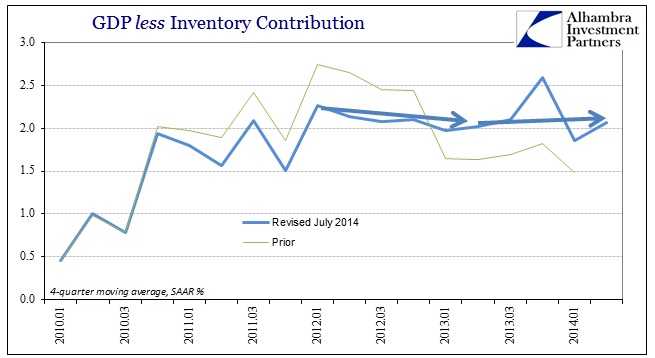

The primary mechanism for all these changes is, what else, inventory. The revisions to it are immense – nothing short of remarkable. Again, you have to question legitimacy (of one or the other – either the previous estimate was totally inaccurate or its revision) when the prior estimates have been re-plotted so far apart.

What looked far more like an insane spike in inventory is now just, what else, an acceleration. However, the net effect on GDP goes beyond just proportionally huge mis-estimation. The BEA now assumes that what was in inventory was sold, increasing the growth rates, somewhat, of PCE. That not only changes the level of GDP it makes current thoughts on growth appear far more sustainable.

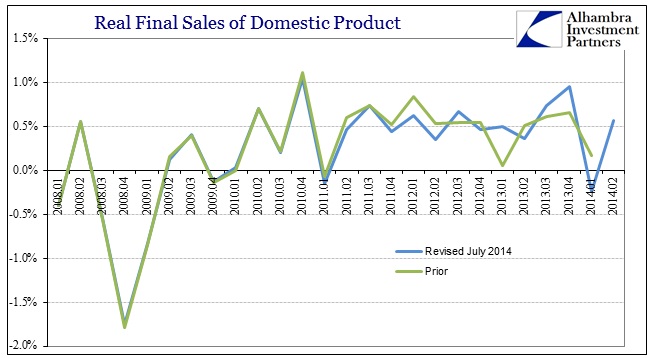

If it isn’t so clear in the volatile series above, the moving average of real final sales shows up differently before and after these revisions – with a major emphasis on 2013.

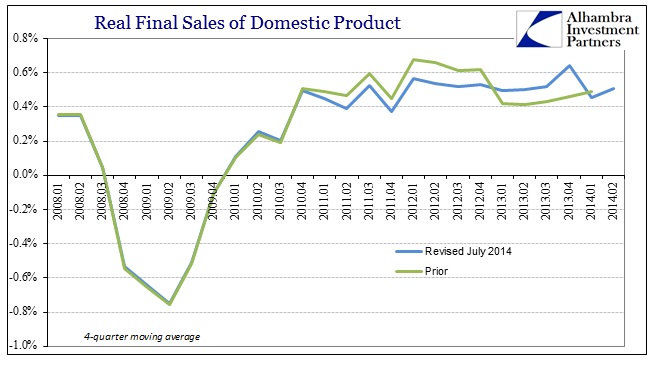

What was previously in a slightly downward trend now looks to be extremely stable; nearly a straight line (blue). That observation is heightened and enhanced looking at non-inventory GDP.

Before these revisions, the economy outside of inventory accumulation looked to be, as noted in contemporary accounts above, accelerating in 2011 and into 2012 and thus providing fodder for extrapolations. Then the major slowdown took shape and GDP picked up that “event”, seemingly in near total agreement with other data accounts. The trend was universally lower throughout 2013 and into the disastrous (now less disastrous) first quarter. Again, that seemed consistent with pretty much everything else, from other statistical surveys to hard dollar results from bellwether companies and industries.

Now, however, instead of a notable acceleration and deceleration, the BEA now figures instead quite remarkable stability.

There may be a slight downward bias in 2012, but nothing all that major, ending up with a slight upward bias through 2013 and into 2014. It’s certainly not the major and sustainable recovery that so many economists have been promising for years, going back beyond even those 2012 comments, but it seems much better than the alternative (which was “reality” only a month ago).

So that creates two large problems with these revisions. The first, related to the narrative that the recovery is intact and may be heading slightly upward, is that we have seen precisely the same before (and not that far back) only to be “revised away” at some point in the future. Again, the comments above were placing emphasis on a broad cross section of data, especially payroll growth, but including GDP that no longer supposedly exists. The problem of such major revisions is what we are faced with now, namely how confident are we that two years from now the BEA won’t do exactly the same thing – especially when the recovery “fails” to accelerate once more due to “unexpected” weakness not captured by the regressions.

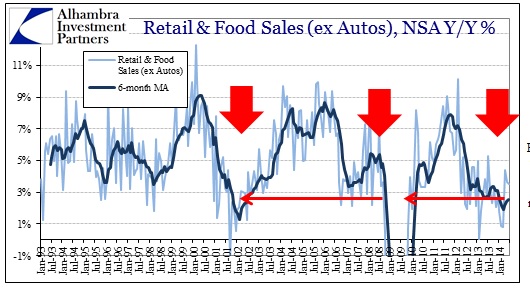

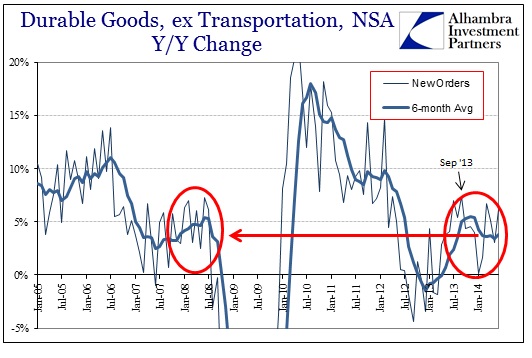

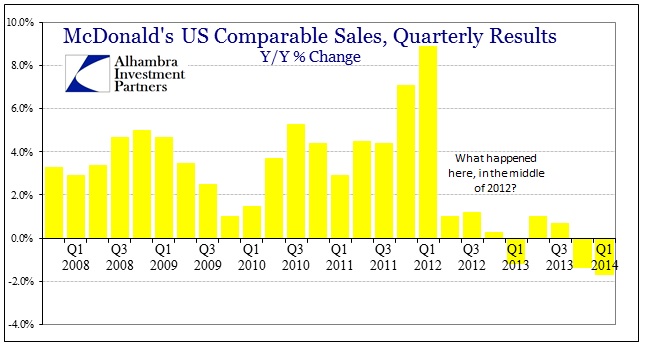

Second, confidence in these updated and revised figures would be far greater had they been consistent with anything else (other than the Establishment Survey). The acceleration prior to 2012 was actually captured broadly by non-statistical accounts; as was the large and growing deceleration thereafter. In other words, the GDP estimates before today’s revisions truly made more consistent sense in actual context. Below are just a few of examples:

So now in addition to the Establishment Survey, GDP estimates are moving also toward a straight-line sense of “stability.” Revisions are not supposed to completely rewrite history, and the more that takes place the less acceptable any of these figures become. Open data sources and methodology would go a very long way toward alleviating these concerns, but that isn’t about to happen. What is left is conflict, which is the “wrong” direction for all of this. Consistency matters more now than ever.

So now in addition to the Establishment Survey, GDP estimates are moving also toward a straight-line sense of “stability.” Revisions are not supposed to completely rewrite history, and the more that takes place the less acceptable any of these figures become. Open data sources and methodology would go a very long way toward alleviating these concerns, but that isn’t about to happen. What is left is conflict, which is the “wrong” direction for all of this. Consistency matters more now than ever.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch