Janet Yellen began the debate, loosely termed, when she classified recent CPI and other measures of price changes as “noisy.” That created sort of an odd wedge between the FOMC policymaking orthodoxy and the wider set of orthodox economists that typically share the same exact dispositions on everything (especially since one feeds the other). The former “need” such badly calibrated figuring to be low (but not too low) in order to maintain some semblance of an orderly transition. The latter group desperately wants it as confirmation, finally, of the other part of that orderly transition, namely a full recovery. It is not quite a paradox but it is mildly amusing to see them try to square that circle.

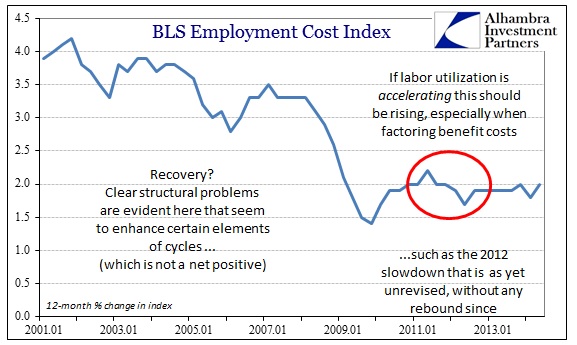

For all the talk of noisy data in the interim, the BLS’s Employment Cost Index, which has been completely ignored until now, created a buzz in economic commentary. For anyone that wants to believe in the recovery, the possible end of labor slack would be quite a start in the right direction. Not only would it cement the recovery narrative, it would add no small measure of conviction to the assumed strength in payrolls.

So it has to be more than a little disheartening to see such “evidence” contained only to economic commentary and chattering. For all the assumptions flying around and appeals to data, very little of it is actually reflected in credit and funding markets. Economists may be impressed, but trading has largely ignored it altogether.

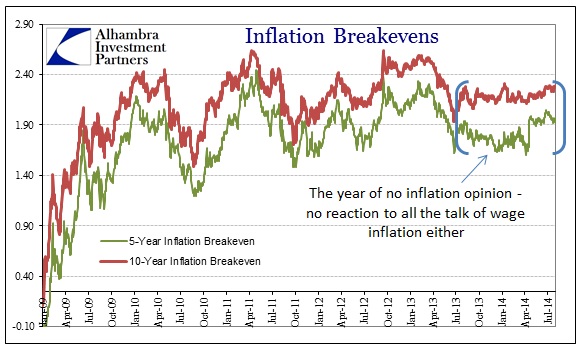

Inflation breakevens maintained their silence as they have for more than a year now. If there was conclusive proof of inflationary pressures building, you would at least expect some repositioning into what would fairly be called a forming trend. Instead, more of the same straight sideways nothingness.

If TIPS “markets” are indeed dead to either side, then at least other pieces of the credit and dollar markets should be picking up the whiff of cost pressuring and the coming growth panacea. Yet, it is conspicuously absence across the credit complex.

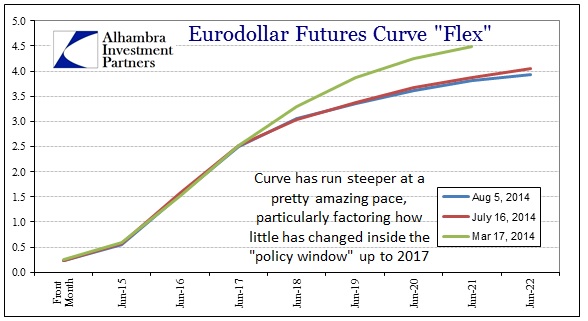

The front end of the funding curve is “magically” stapled in place, while the movement in the outer years is only slightly less flat (a few bps) over the second half of July and into August. That would hardly qualify as much of anything other than continued listlessness with a minor hedge adjustment (more on that below).

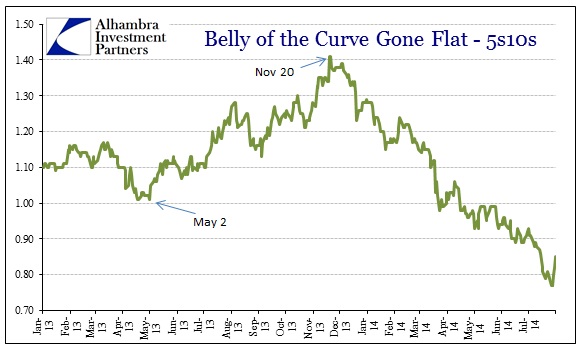

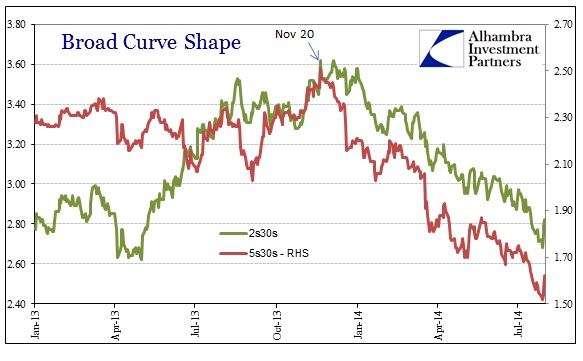

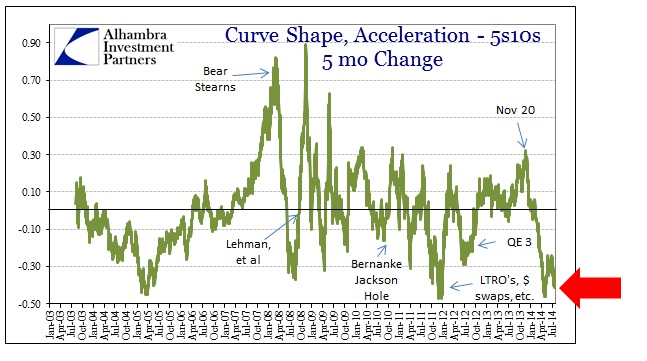

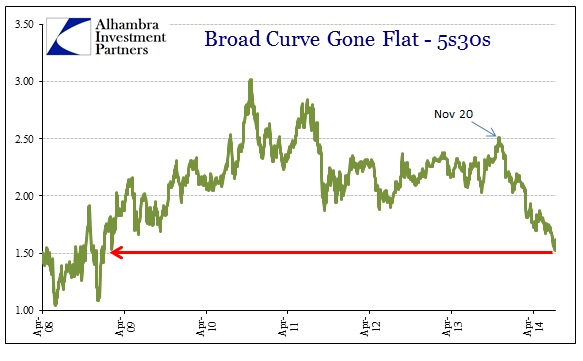

In treasury “markets”, the entire yield curve continues to run in the opposite direction of the inflation/recovery narrative. Not only is flat the operative mode, the scale of it is starting to reflect not just rejection of economists’ pensive hoping but significant and sufficient pessimism by way of historical comparison to turn the entire narrative (if there were more honesty in assumptions).

In every part of the curve, outside the policy window, movements are consistent with prior conditions of less order, especially of the recent past.

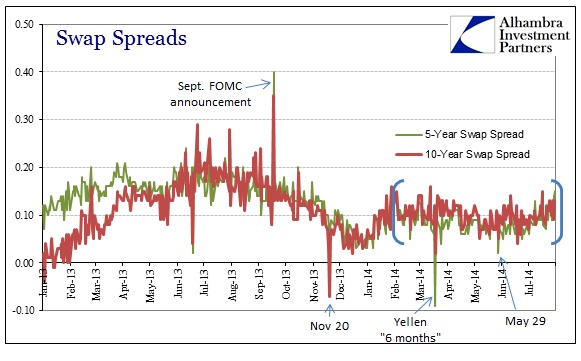

About the only indication that might offer some positive consideration upon the inflation idea has been a slight rise in swap spreads, particularly the 5-year.

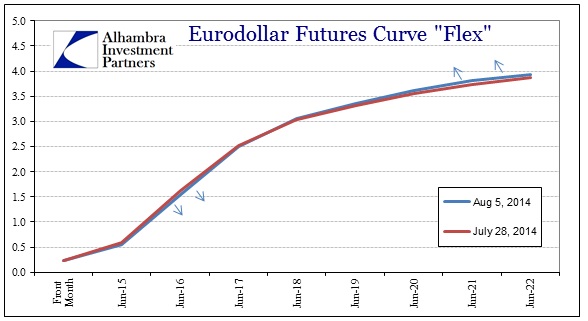

In this case, however, that decompression is pretty small in stature and clearly within the recent static range. Further, I would actually attribute that increase more to hedging of the recent curve shape more than economy-driven transposing; the yield curve flattened so much in July that it was bound to move in the other direction at some point, creating a counter trend where some technical risk had to be offloaded somewhere. That idea is seemingly confirmed by eurodollar futures in the past two weeks.

Again, the movement is very small and barely noticeable, but contains all the hallmarks of rate investors hedging against the rebound in curve shape (slightly steeper) after the most recent and persistent leg of the massive flattening trend. In short, none of these markets look at all like they are buying the inflation idea, and are in fact pushing more towards economic pessimism than anything else.

Perhaps the reason these markets seem so immune to the inflationary wage molehill is the actual track of wages in the US:

In other words, the viral nature of “wage pressures” is lost in actual context. Of all the economic and financial problems, this would, unfortunately, be last on the list. Toward the top of that list, and what is most concerning now, is the widespread and durable nature of financial poverty created in the past three decades of bubble appeals, and how far behind the economic system really is to withstand any coming paradigm shift in policy and beyond.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch