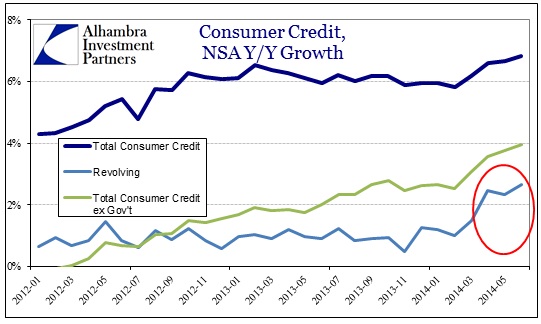

For now, it seems as if the attempt to recreate 2005 is being born by revolving credit. There was, until the middle of last year, the holdover hope for the then-burgeoning mini-bubble in real estate, but events since the taper-driven bond selloff have conspired against that factor. While revolving credit might represent a restarted channel for monetary intrusiveness, the primary flow in that regard has been really ongoing since 2009 in student and auto loans without much avail toward economic recovery.

Whatever the case may end up being, I still think the mainstream narrative about revolving credit has it exactly wrong. That includes not just misidentifying 2014’s “surge” in usage, but also misaligning it with the calendar. In percentage terms, revolving credit looks very much like a recent trend, particularly since March/April.

While 2.5% annual growth is better than zero, it is a far cry from 2005 and the object of monetarist affection.

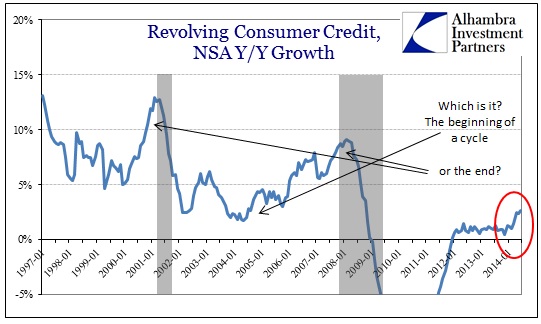

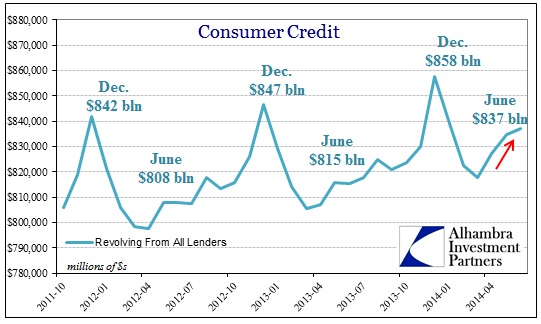

What is noteworthy to my analysis is the behavior of revolving credit as it relates to the holiday shopping period. While the growth rate trend makes it seem very placid, the overall change in consumer credit around Christmas is actually of similar scope as we see now.

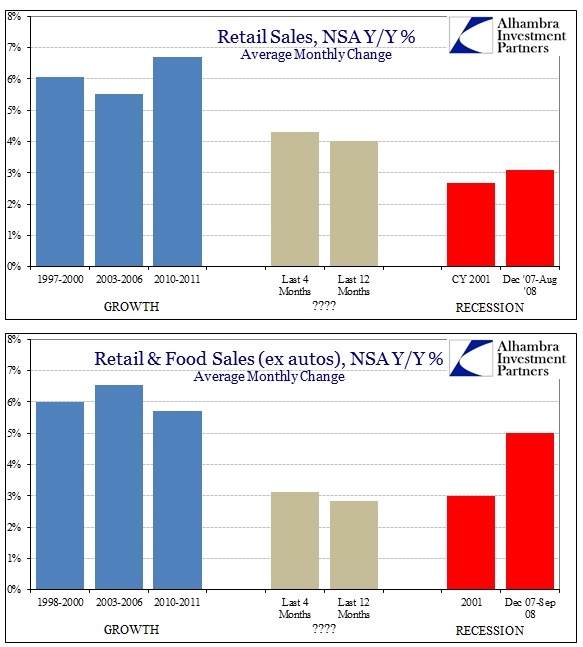

Since last Christmas was the worse retail holiday season since 2009, we might fairly conclude that the increase in revolving debt was more for maintaining tepid levels than expanding toward that still-mythical recovery. That observation applies equally to the trough in March as to the peak in December – the growth from March 2013 to March 2014 was $805.5 to $817.6 and produced this:

The main idea from the monetarist expectation point of view is for debt accumulation to lead to generic spending activity (regardless of wealth creation) which is supposed to create more “aggregate demand”, and thus hiring, income and then even more spending. That is the basis for the “pump priming” experimentation, covering all the attempts at market intrusion. The incorporation of all that cycle priming would fall into inflation, as wages define, for the monetarist, success in pushing prices upward.

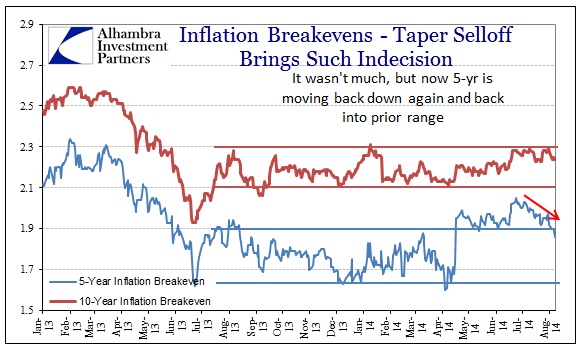

For the most part, credit markets have been wholly ignoring this idea as bear flattening continued at an alarmingly robust rate, contradicting the stock-born expectations for generic spending and central planning success rates. The only credit-based indications that may have been slightly supportive were 5-year inflation expectations. Just prior to the Easter holiday weekend, 5-year breakevens moved up above their recent range-bound meaninglessness.

While it was nothing major, it was at least, assuming any meaning at all to the behavior, possibly supportive of minor hope/positioning on some inflation. Since the middle of July, however, such possibilities have ended and even the 5-year breakevens are now falling back into that ridiculous trading range that goes suspiciously all the way back to June 2013’s selloff. Given action and movement in swaps markets, my suspicion is that the 5-year TIPS has been more aligned with hedging of the yield curve shape than actual inflation expectations (though that could have been embedded deep within any hedged positions, though I don’t think it was even a partial priority).

Whether TIPS hold meaning or not, it was the last actual market indication of the possibility of holding the full monetarist equation from start to finish – credit accumulation to wage-driven inflation. As noted prior, actual wage growth has been nothing like the orthodox cheering, amounting more to wishful thinking (and hoping) than anything more tangible. Then again, this should be unsurprising given the actual surge in consumer credit away from credit cards that have produced nothing like a recovery to this point.

The credit element here, again factoring the holiday and seasonal movements, seems to actually run counter to that hope. Revolving credit usage looks more and more like the end of collective tethers than the start of something bigger and better (or, from a common sense standpoint, wasteful and bubbly). Trying to go back to 2005 is at least a partial measure of insanity given the inevitable results, which include widespread, systemic impoverishment not robustly thoughtful long-term economic health. I suppose that is consistent when you only think of the short run without spending even a little deliberation of the longer term. We may all be dead at that point, but at least our children won’t be enslaved by creditory economic malaise and serial bubbles.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch