The disappointment from retail sales has been foretold by numerous other indications for months now. The idea that the economy would suddenly shoot higher after the “aberration” of the wintry first quarter was predicated almost exclusively on the mainstream interpretation of payrolls. For all that hope and optimism, it has never gone further than the BLS’ Current Employment Survey as other unrelated data shows quite the opposite.

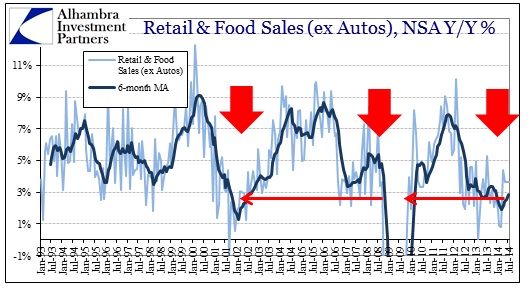

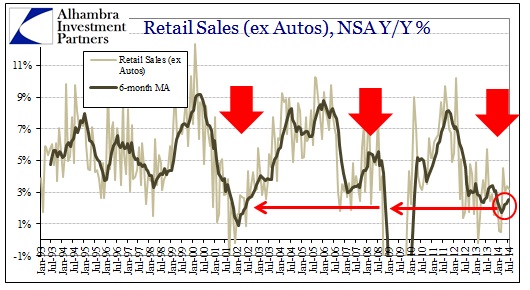

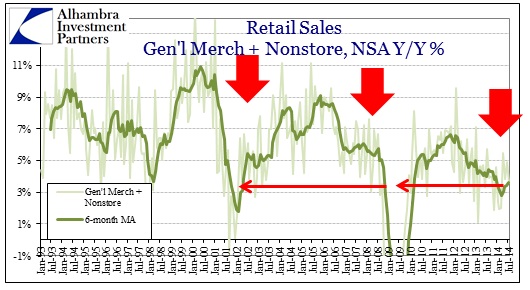

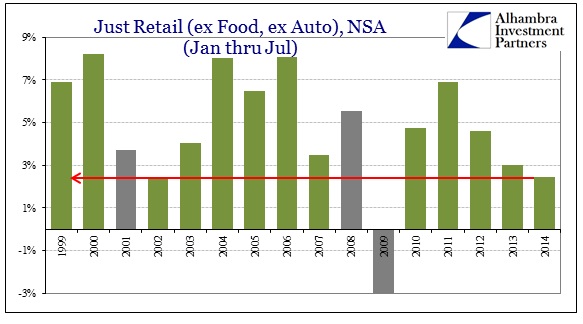

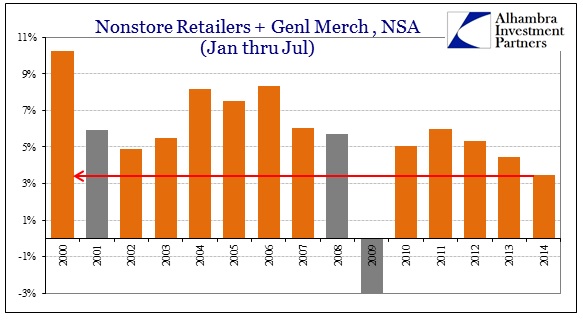

So retail sales in July are basically unchanged from June, which gets Q3 off on the wrong foot (remember so many of these economic accounts are measured second derivatives). In a wider context, the “rebound” in the spring was only a rebound in comparison to the months immediately preceding it. When viewed in full, what we have recently is just a continuation of the slow descent that began in 2012. Perhaps that is imperceptible to most because attention is so often focused and construed very narrowly, but the downward trend is still intact and corrosively durable.

I think that is the most unappreciated aspect of the economy as it is now, that growth rates may be slowly eroding but doing so not from levels that would be considered robust or even acceptable, but decelerating from a starting place already consistent with mild recession.

The bounce in April and beyond (becoming undone more so by June) simply moved retail sales (of whatever slicing) up closer to the 2013 trend – doing nothing like inaugurating a new trend that would be typical of recovery. A true recovery is something like 6% – 10% growth month after month after month. In a true growth period, 6% is actually the down months; now we are lucky to see 4% and only every once in a while.

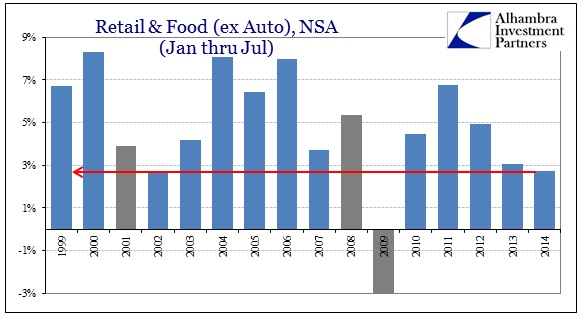

By every comparison, so far 2014 is the worst of the “recovery” age, as the trend could not be more obvious or clear:

By now, the year spanning January through July, weather should no longer be a factor in anything. Whatever growth has been mostly due to macro factors alone, and that is totally depressing, rather than suggestive of better days ahead. I’m not sure what can drive that point home any more than the data presented here, yet it continues to be ignored raising the question of whether it is intentional or just blind faith.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch