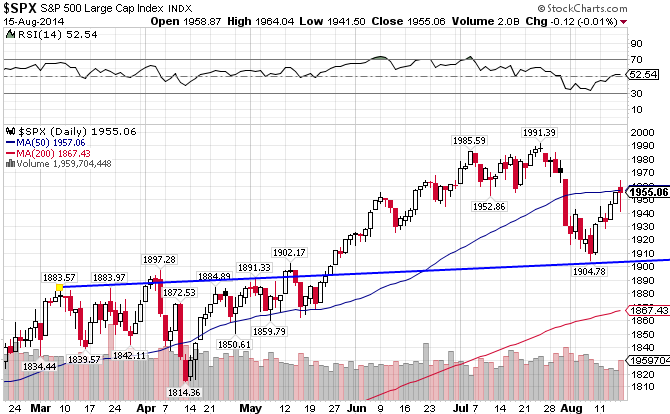

Under uncertain yet seemingly improving economic conditions, the S&P 500 Index((IVV)) has inched its way forward for much of the year, gaining just over 7% during this low-volume, low-volatility period. It remains just below support at the 50-day moving average after bouncing off the 1900 level in the last two weeks. The index is up 7.09% in since the beginning of the year.

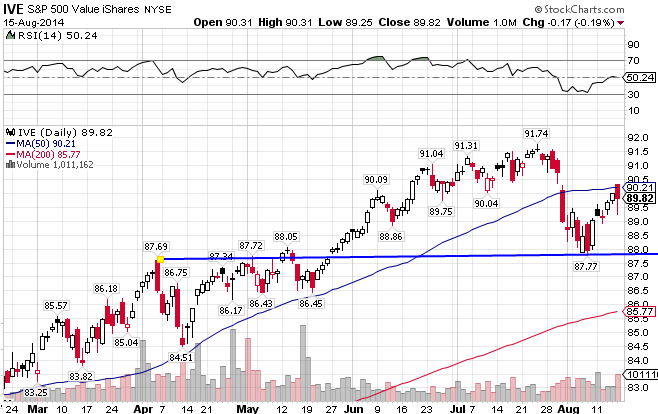

The S&P 500 Value Index ((IVE)), which consists primarily of US large-cap value stocks in the financial services, industrial, and consumer cyclical industries, tend to have lower price to earnings ratios and higher dividend yields than the market as a whole. The value index has been underperforming vs the S&P 500, returning 6.21% YTD.

The S&P 500 Growth Index ((IVW)), which consists primarily of US large-cap growth stocks in the tech, healthcare, and energy industries, tend to have higher earnings growth rates, higher earnings multiples, and little or no dividend yields. Growth stocks have been all the rage in 2014, as the index is ahead of pace set by the S&P 500, returning 7.72% YTD.

A short-term trend of growth stocks outperforming value stocks has emerged. Over the longer term, value stocks have taken the belt, but that trend might be reversing, as evidenced by this chart.

The MSCI EAFE Index ((EFA)), a global developed market index that encompasses Europe, Australasia, and the Far East, has underperformed versus the S&P 500 and looks a bit tired, having broken the 50-day and 200-day MAs in the last month. It is up slightly for all of 2014, 0.98% to be exact.

The MSCI EAFE Value Index ((EFV)) consists primarily of low P/E international large-cap value stocks in the financials, energy, and communications industries. Unlike the US markets, international value stocks are outperforming growth stocks of late, and the trend seems to be strengthening. The index is up 1.80% since the beginning of the year.

The MSCI EAFE Growth Index ((EFG)), which consists primarily of high-growth international large-cap growth stocks in the industrial, healthcare, and consumer cyclical industries, has underperformed compared to the value index. The index is down 0.65% YTD.

In the past three years, a longer-term trend of value stocks outperforming growth has emerged.

Stay In Touch