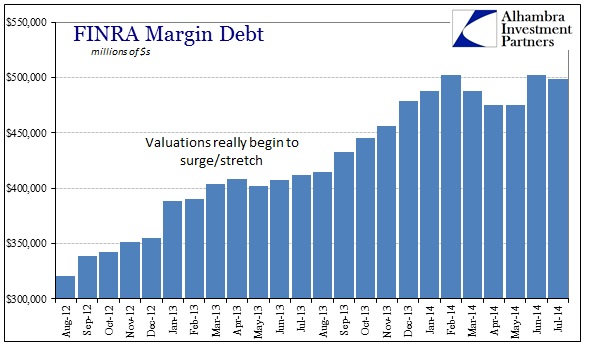

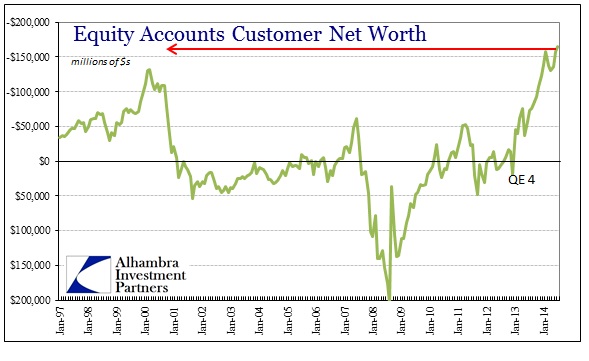

The actual total accumulated balance for margin debt in reported stock accounts fell in July from June’s record amount. But even with a decline in stock-related debt investors moved even further toward complacency, as declines in free credit and available cash more than outpaced the drop in margin. As a result, net worth has never been lower as we have far exceeded the dot-com bubble at this point.

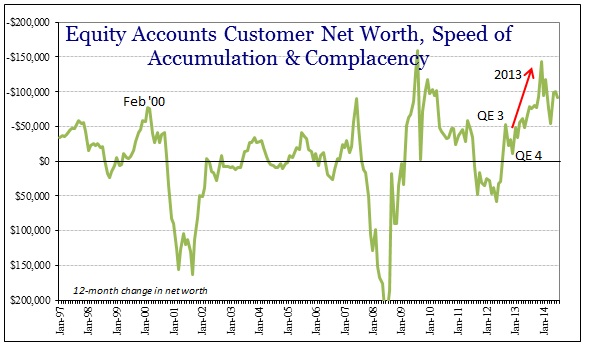

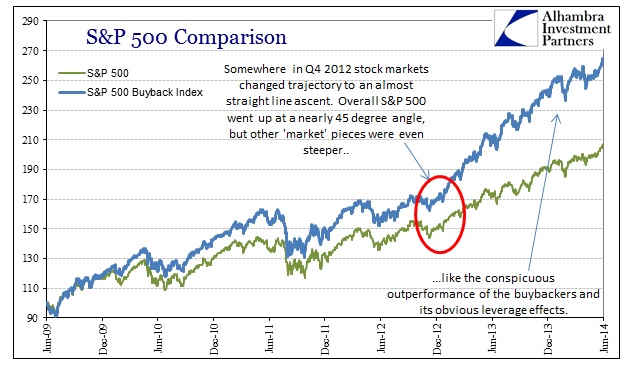

Net worth changes had until the implementation of QE4 looked not at all dissimilar to the pattern of individual leverage that had appeared during the housing bubble. However, suddenly in January 2013, as the Fed’s UST buying commenced to full strength, the amount of margin as well as the deterioration in net worth shifted violently “in favor” of stocks. Not only that, it did so at a rate that is normally reserved for the inflection that marks the very bottom rather than something so late in a cycle.

The only other time net worth dropped so far so fast was off the immediate bottom in 2009. That should be a very big warning to investors as the conditions of 2013 and 2014 are nothing like the end of the Great Recession. Further, the FOMC may only hint at a direct relationship between QE and stock prices, and even then qualifying where such intimations may be related, but it is pretty clear here that once then-Chairman Bernanke unleashed QE4 investors took that to heart. I don’t believe that there is a direct link, financially, between the Fed’s creation of inert and idle reserves through the QE process and margin debt, but rather psychologically it was all that many of these “risk-takers” needed to know about “tail risks” in what was really a self-fulfilling move that reinforces itself the higher it goes.

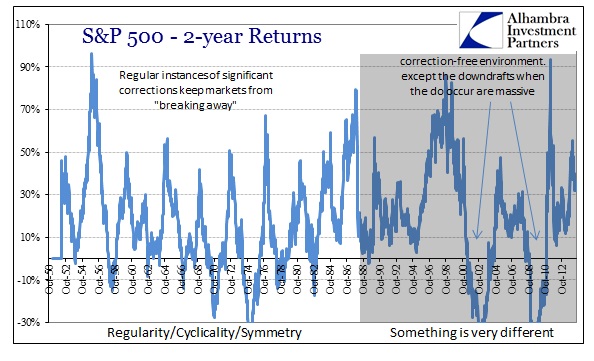

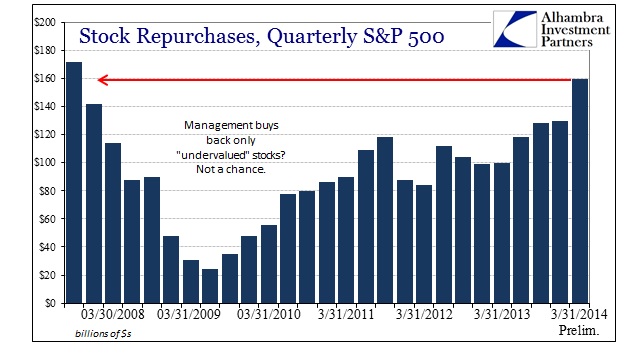

How much of this is a marginal driver of stock prices surging to new records will never be fully untangled, though I think the leverage flowing into stocks is proportionally more related to corporate “investment.” That all brings up an as-yet unanswered problem for QE and those so disposed and favored of monetarist interventions – these policies are all intended as psychological methods toward achieving an intended result. In the case of QE, that was not supposed to be limited to just stock prices, yet that is about the only place where such an obvious link exists. Why are stock investors so impacted by monetary influence where in exactly the way monetary theory posits, yet real economy agents are so clearly unaffected?

The standard answer might appeal to the idea of monetary channels, and thus “clogged transmission mechanisms” in the real economy (mortgage lending gone, consumer credit limited in capacity and reach) but full openness of leverage and debt on the asset side. Yet, QE was supposed to bridge that divide by at least creating a “wealth effect” that itself would become self-fulfilling and self-sustaining. That never happened aside from some low-paying service jobs, as concentration of asset inflation did very little toward the mainstream idea of “aggregate demand.”

I think the full answer lies in monetarism not being a flow of “money” and funds but rather a corruption of expectations, and thus activity. The idea of “easy money” now spans not just some marginal speculators touring the contours of the pink sheets for grand slams, but rather it has taken hold of everyone from the should-be-conservative retirees looking to regain their balances from even two bubbles ago to corporate boardrooms looking to get paid as much as possible before reality closes in once more and the bottom falls out. In trying to gear marginal economic activity toward financial means, central banks have instead totally financialized the entire affair to the point that far too much psychology, and thus attendant flow, goes only in that direction. In other words, instead of enhancing marginal economic activity it directly suffocates it.

This is simply another intangible corruption that violates the standard excuse of monetary neutrality. You used to have to work for money, now “everyone” knows your money should work for you. Should we be surprised that the economy, at the margins, reflects in full almost exactly that?

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch