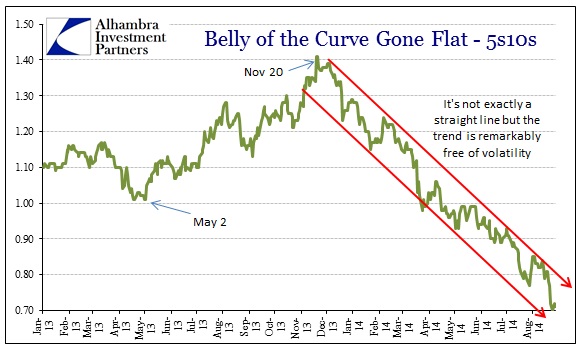

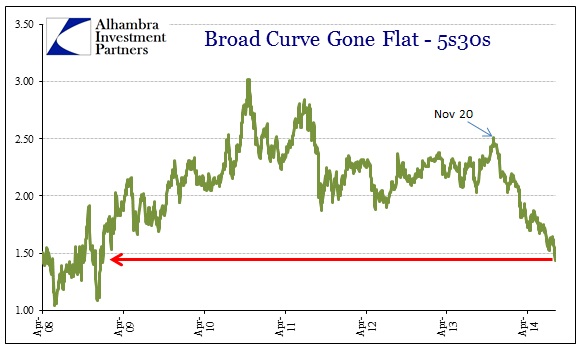

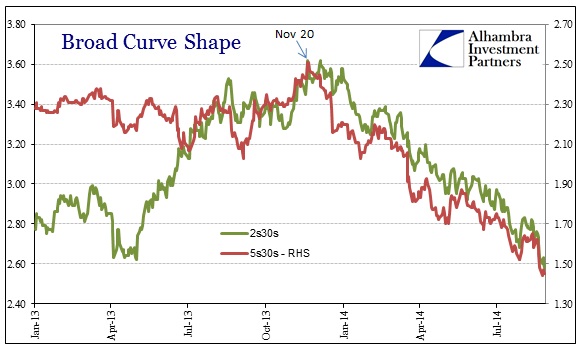

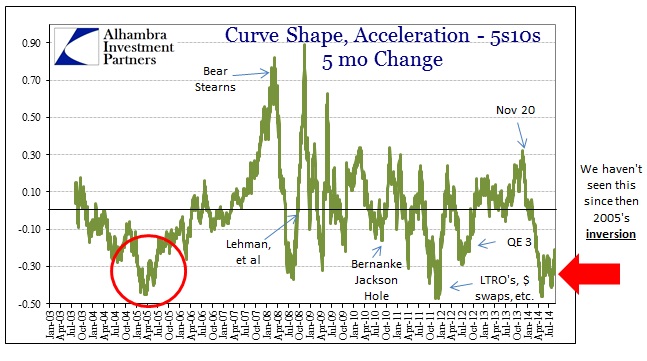

I have already written enough on a Friday before a long weekend about the growing pessimism in credit, but it bears reinforcing that such removal of central bank faith is not limited to Europe and Japan. US credit markets and dollar systems are equally partaking in the speed and depth of the bear flattening. Just this week, the UST curve was not to be outdone by Germany or Switzerland.

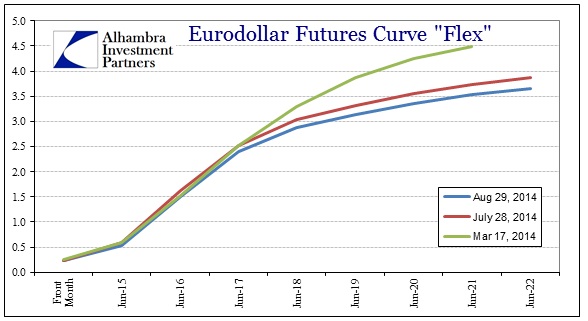

The uniformity is what stands out most, making this broad curve movement all the more compelling – as is the concurrent flattening in eurodollars.

The Fed’s grasp on the shorter end may only be disguising what might have been in an otherwise less-manipulated situation inversion or something very close to it:

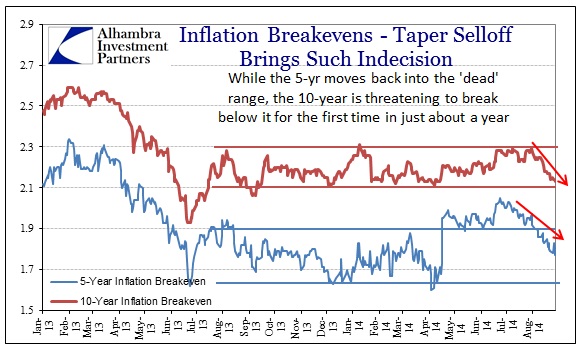

That obviously is impossible in the age of ZIRP, but all the signals are there especially the persistent and global diminishment in the time value of “money.” That extends even to inflation expectations recently, in what may be a worrisome signal about the “recovery” itself.

While it still remains possible that TIPS are largely irrelevant in their “dead zone”, with the 10-year breakevens now moving sharply toward the lower end of that zone the possibility grows larger that credit market pessimism penetrates even here. If nothing else, there is no longer even the slightest indication for inflation like the FOMC expects of a recovery.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch