You would think that if economists and policymakers were actually confident in the recovery idea that they would be mostly unbothered by monthly variation. Even in the most robust of periods there are no straight lines, and even the strongest job markets (the real ones that don’t need narratives) take a break now and again. Judging by reactions today to the payroll reports, it’s almost as if economists have been trying to convince themselves that all is well, all the while retaining those lingering doubts created by so many oddities and divergences. That was certainly the case with Abenomics particularly toward the end of last year, so it seems to just go with the territory of monetarism.

Outside of the disappointment in the August payroll figure, coming far below the lowest expectations, the months of June and July were revised lower by a cumulative 60k. That has left the track of the Establishment Survey looking vaguely familiar to something that was more highly controversial especially in the earlier days of this “recovery.”

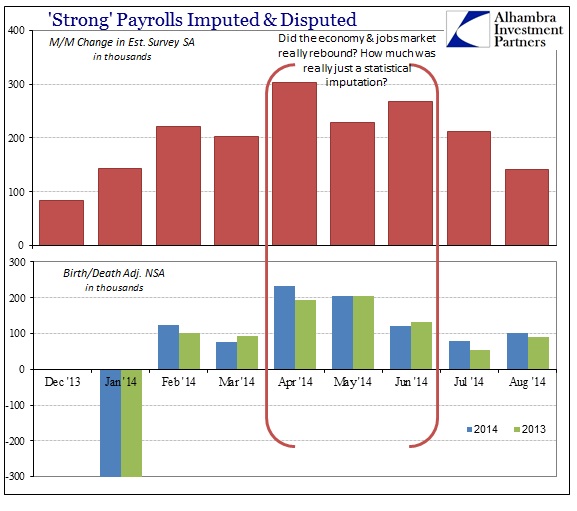

I don’t want to go off on a tangent to argue the validity of the birth/death imputation that the BLS engages – there is certainly a theoretical case to be made in doing so. However, given the narrative that we have seen both a “strong” rebound from the catastrophic cold and that has created the “strongest” jobs market in so many years, there most likely shouldn’t be such a stout resemblance between relative “strength” in “jobs” and the relative size of imputations. Now this is comparing seasonally-adjusted figures (M/M Establishment Survey) with raw(er) unadjusted birth/death, so this is not a case where you can subtract one from the other to “un-impute” and get an exact sense of just how much is fantasy. Rather, the most important point is how the two patterns match up so closely – the months with the largest birth/death adjustments, however they go into the regression mix, are in 2014 the same months that show all that strength that was purported as decisive in looking past the first quarter’s depressive indications.

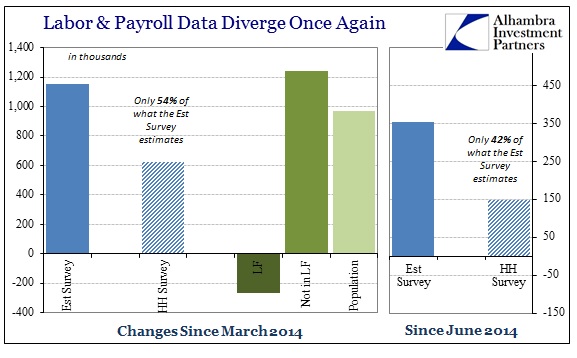

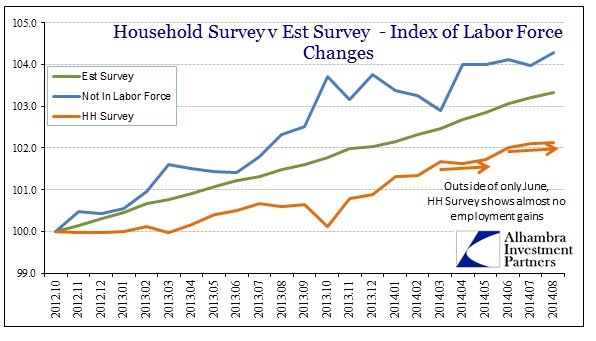

This observation is made even more compelling as the now-regular divergences with the Household Survey have once again emerged. Where the Establishment Survey was prosaically soothing to the recovery narrative seemingly showing great growth (finally), the Household Survey has had none of it. In fact, the Household Survey actually shows quite a downshift from even the deficient advance from the end of 2014.

Going back to March, when the weather turned and the rebound supposedly began, the Household Survey estimates only +600k net employees gained, or only about 125k per month (compared to the 231k per month that got convention so excited). In the past two months, the divergence has grown even further.

In fact, outside of that 400k gain in June, there hasn’t been much of any employment growth in the Household Survey this year.

And further, also highly suspicious, the labor force has again shrunk (by more than 200k!) over that same period covering the rebound narrative.

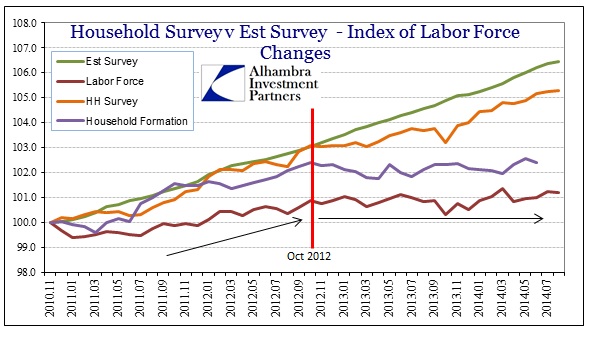

The Establishment Survey has been suspect for some time, really going back to October 2012 (above). That problem is very much heightened by this rebound narrative and the lack of follow-through with pretty much everything else. Now, adding the full pattern of the birth/death imputation, the Establishment Survey grows ever more distant from compelling and relevant. Little wonder, then, that mainstream nervousness remains, courting so much overreaction to monthly variation.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch