While dollar credit and funding undergo their own version of policy-induced confusion, I can’t help but see something similar on Europe’s side of it – though for much different constructions. This week marked the inauguration of the highly publicized T-LTRO’s (again, the flood approach is past) that immediately deflated upon launch. Some expectations were as high as a €300 billion takeup, as surely banks would demand “free money” (in the Krugman formulation) from the ECB.

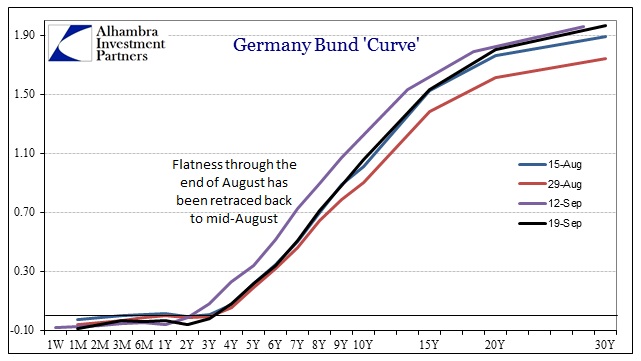

Actual results were well below anything anticipated, with only €82.6 billion tendered. Given what has transpired across European credit markets, I get more than the faint sense there was perhaps some T-LTRO optimism in the various bond curve “rallies” (steepening) so far in September. The other side of the actual figure has instead seen bonds, especially bunds, take up their previous flattening once more.

The German curve has sprung noticeably and bearishly flatter back to its mid-August position just since last Friday. The negativity on the front end is also deeper and more extensive, particularly as the last 2-year bond auction brought in the lowest yield on record (-0.06%).

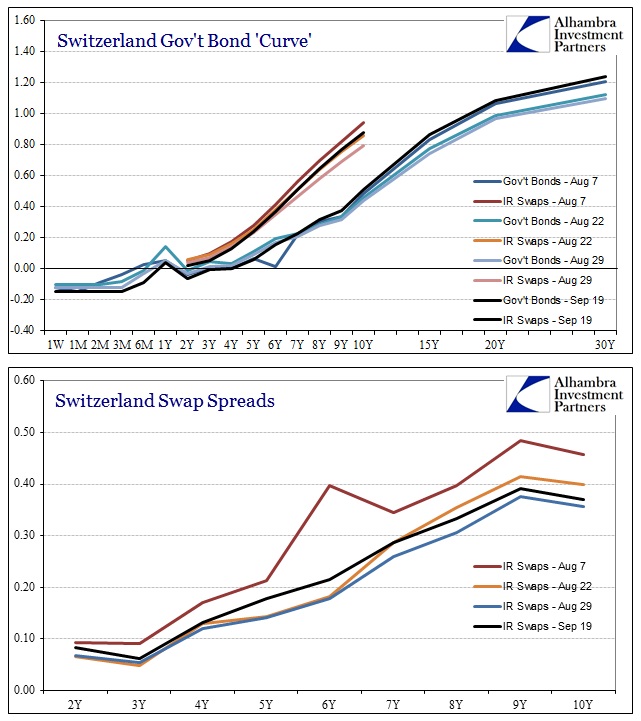

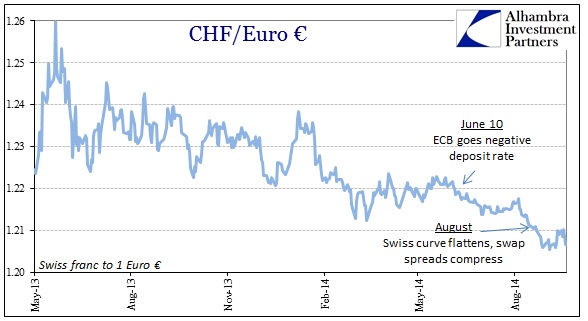

The Swiss curves are somewhat different, with a greater emphasis on the front end. Negative rates have past their lowest points at various places, and swap spreads are moving around both flatter and steeper. The front end, however, matches the continued pressure of the franc against the euro, renewing that “battle” of nervousness.

Today’s currency cross settled only just above the lowest point (for the euro) reached at the beginning of September – only 60 pips above the peg. If there was a T-LTRO effect in the short term money ends, it wasn’t much and certainly did not last.

Focus has already tried to shift toward December’s “window” for the monetary measures. However, there is no clear, to my mind, interpretation about what the ECB might do in light of these results. Some are expecting that such disappointing activity will lead to an ECB QE, while others caution against overplaying one tender. My personal thoughts are that the ECB cannot engage in QE, not just for political entanglements but also the operational difficulties in resolving the various NCB’s and their places in the process.

Whatever takes place with the ECB, the unease that was ubiquitous prior to September is back, only now with yet one more ECB program placed in the “ineffective” category. Official inflation measures continue their downward slide, as does lending (updates on both are due in the near future) which means the pressure to actually succeed at something is growing. That is far different than what I think took place in 2012, where the pressure was much more relaxed about ultimate efficacy; as long as the ECB did anything the market seemed satiated. Now, that is no longer enough, like anesthesia that loses its potency after repeated usage. What may matter now is actual progress rather than the far-less convincing promises for it.

Click here to sign up for our free weekly e-newsletter.

“WEALTH PRESERVATION AND ACCUMULATION THROUGH THOUGHTFUL INVESTING.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch