I get so caught up in the minutiae of esoteric function or financial plumbing that it is worthwhile to take a step or two backward and review the financial system from a bit more afar. The repo market’s strain recently and even the idea of liquidity itself are actually features (or symptoms) of the “dollar.” The idea of “money supply” is as old as banking sophistication, but in the modern system it means something entirely different from what’s in the textbook; or for that matter, what the FOMC members themselves know about it.

To most orthodox economists, the “money supply” is a tangible concept that is easily absorbed by generic variables in a regression equation. “Loose” monetary policy is supposed to be just that, an idea derived from the “printing press” of olden legend. But you cannot shoehorn the repo market into that concept because just in that one aspect of liquidity there is more than a single element of “currency.” Currency is taken as “dollars” that do various jobs, but in the modern system of shadow banking and repo, collateral functions far more like currency than actual currency (even of ledger dollars).

It is because of these kinds of sophistications and variations that I actually detest the term “petrodollar”; it misses out on so much of this important (actually vital) nuance. The “petrodollar” standard is not just ill-fitting by description, it leaves out important distinctions of function.

Even the term that I use, “eurodollar standard”, may be similarly deficient even though closer to the matter. What emerged from the ashes of the gold standard was a “dollar” standard driven by banks operating in London eurodollars. At first it was focused, as it should have been, on providing liquidity for trade – but to do so meant offering debt instead of money (gold). That is an enormous change, and it was disastrous from the very start (Latin Debt Crisis).

Such corruption has been maintained and given new vernacular and a gloss of objective “science” under the guise of complex statistics, as the corrosive nature of using debt instead of money in trade has been “elevated” into an everything. Eurodollars still finance trade balances, unfortunately allowing them to build to obscene and dangerous imbalances, but that had been surpassed by simple financial speculation. It began around 1985, for various reasons that I have discussed prior, taking full advantage of the monetary environment heading into the 1990’s which paired debt with economic soft central planning through interest rate targeting.

That system built itself upward through global participation, particularly from European and Japanese banks (there was more than a small dollar element in the Asian flu of 1997-98 for this reason). The biggest sponsors of the housing bubble were beyond Countrywide and Wall Street. That is why when it all fell apart in 2008 the Fed expanded its dollar swaps to almost everywhere around the globe, to something like $600 billion at one point after the panic. It was a global panic of only global banks.

The reason for that was “dollar” liquidity. In using speculative debt in the 1990’s and 2000’s, global banks did what banks always do – stretch their resources as far as they can possibly get away with. That meant using a greater and greater amount of leverage, including the “carry trade” between assets and liabilities among the yield curve’s time premium. Liabilities ran ultra-short while assets pushed more and more into longer maturities. The intent was leveraging the shape of the yield curve itself.

The development of the eurodollar standard meant a steady supply of “dollars” at the short end, not from some central bank (the Fed does not run the “printing press”) but rather global banks themselves. It is in this sense that “money supply” and “dollars” separate into all manner of different instruments. The European bank wanting to participate in the mortgage securitization frenzy would add its balance sheet of local currency (French francs, German marks and especially euros when they were developed) and transform them via derivative instruments like eurodollar futures, interest rate swaps and cross currency basis swaps. So what is the instrument of dollar supply in that process, the original European currency liability, the eurodollar counterparty bank that transforms it into “dollars” through derivative use of its own balance sheet capacity, or the end loan? All of that forms a derivative chain of liabilities each expressing various elements of what might fairly be called dollar supply.

In a very important sense, all of that is distracting focus on semantics and accounting definitions. What does matter is the ultimate destination of such a global “reserve” system – the systemic and global dollar short. Regardless of wherever a bank may have been located, the net result of participation in the eurodollar standard meant that the bank was short the US dollar. When I use the term “short” here, that is not to say that the bank was expressing a position about the “price” of the dollar falling, but rather that in terms of liability structure the bank would need “dollars” consistently to maintain its dollar-denominated assets.

Holding a supersenior and/or mezzanine tranche of a private label ABS security backed by a pool of US dollar loans meant taking on the asset side something that was ill-liquid of dollar derivation. To fund that meant often pledging the very security in repo transactions rolled daily or short-term (and far too often re-pledging the exact same security in other repo arrangements). That was one of myriad liquidity elements that maintained this dollar short position.

The drastic change in outlook for dollar collateral was what began the disruption on August 9, 2007. Haircuts suddenly and often sharply adjusted higher, meaning less margin for that dollar short to be maintained. Rehypothecation chains became impaired, as did, as the FOMC never quite understood, operation in unsecured dollar terms. These global banks running their dollar short began having problems funding it from all sides, and were thus forced into a smaller space and then eventually to close out that short – to return dollars borrowed. The only way to do that was to sell the dollar assets into a “market” of illiquidity where almost everyone else was doing the same.

The “price” of the dollar shot upward (and gold prices collapsed) not as a result of dollar “flow”, but in what amounted to the largest short squeeze in history. There were no dollars finding the “cleanest dirty shirt” as it is so often still described, but rather the dollar shorts trying to exit that short by “raising” dollars through any and all means (often very “expensive”). That view extended to the price of collateral, as interbank “currency” came at a huge premium because availability was so impaired in repo of everything: MBS, UST and agency. And so the prices of what was in short supply skyrocketed (LIBOR showing eurodollars, t-bills at negative rates showing demand for collateral, etc.).

That means that the “value” of the dollar exists not in trade or even economy, but in light of this peculiarity of modern/shadow finance. The dollar short is everywhere a factor, though it will morph and change and evolve with circumstances.

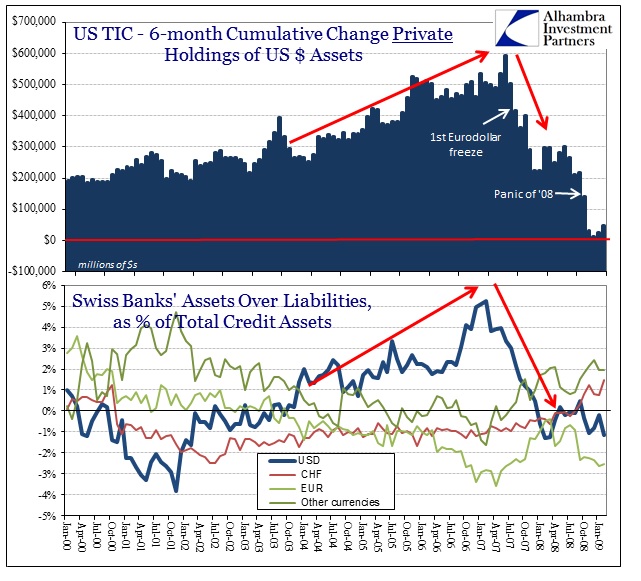

We can see it in action during the housing bubble, very cleanly observed in the financial structure of Swiss banks (mostly the Big 3). There was no printing press via the Swiss National Bank or Federal Reserve, simply unadulterated balance sheet expansion delivered into US “dollars” via wholesale markets and derivatives. By early 2007, Swiss banks in the aggregate held a short dollar position (defined here as the net of liabilities minus assets) equal to 5% of their total assets.

Even that understates, somewhat, the degree to which the Swiss banks were a full part of the eurodollar system. What is shown above is the net, but in truth they were active on both sides as a supplier and ultimate demand user of “dollars.” At the peak, June 2007, Swiss banks held 1.32 trillion francs worth of dollar denominated assets, balanced by 1.18 trillion francs in liabilities. What that looked like is a “flow” of dollars into the US, easily seen in the TIC framework as such.

Yet, during that period, the US dollar actually fell against most major currencies as the “apparent” flow of dollars did not directly translate in that manner (higher flow into dollar assets “should” put upward pressure on the dollar). That did not occur simply because it was the symptom of an overriding and hidden “supply” of dollars that did not (and do not) conform to geographical boundaries. In other words, it is a mistake to view dollar conditions and “flows” on a domestic basis, it must be done holistically.

Central banks, for their part, were aware and not aware. In 2006, the Fed stopped producing the M3 “money supply” figure (which included both repos and eurodollars) because they claimed it was too costly and did not convey meaningful information. That was actually true, but no one really cared then (outside conspiracy theorists) because it seemed as if orthodox economics had hit upon a sweet spot in monetarism. Instead, if they had actually investigated, they would have seen the absolutely massive size of the dollar short for what it was – a huge imbalance that decried monetarism’s formula as hugely inefficient, and ultimately an extremely dangerous proposition.

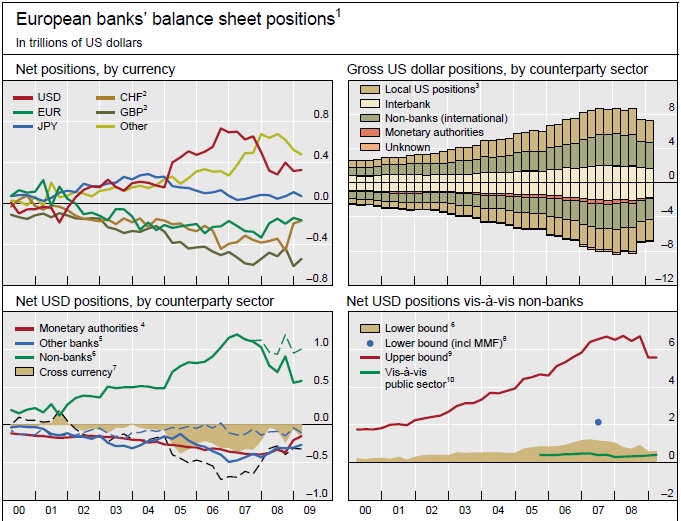

To this day, we still have no idea how big the dollar short is, or really how exactly it has evolved and changed in the days since August 2007. The Bank for International Settlements once tried, and did a very thorough job, but all they could come up with was:

This [estimating] requires breaking down banks’ US dollar-denominated assets and liabilities further, by residual maturity, to quantify the degree of maturity transformation embedded in banks’ balance sheets. Although data limitations make direct measurement of the maturity of banks’ positions impossible, we argue that information on counterparty type (bank, non-bank or central bank) can serve as a proxy since the average maturity of positions is likely to vary systematically with the sector of the counterparty, with interbank positions having a shorter maturity than positions vis-à-vis non-bank entities. This yields a lower-bound estimate of banks’ US dollar funding gap – the amount of short-term US dollar funding banks require – measured here as the net amount of US dollars channelled to non-banks. By this estimate, European banks’ need for short-term US dollar funding was substantial at the onset of the crisis, at least $1.0–1.2 trillion by mid-2007.

Even today, a trillion dollar short position is nothing to be trivialized, but that was exponentially more of a problem in 2007 during a period when nobody (save a few curious onlookers) saw anything wrong with this kind of setup – and were thus so lethally ill-prepared for the shift. And that was just European banks. As we saw above, the Swiss contributed a substantial amount too, as did the Japanese.

Until the onset of the crisis, European banks had met this need by tapping the interbank market ($432 billion) and by borrowing from central banks ($386 billion), and used FX swaps ($315 billion) to convert (primarily) domestic currency funding into dollars. If we assume that these banks’ liabilities to money market funds (roughly $1 trillion, Baba et al (2009)) are also short-term liabilities, then the estimate of their US dollar funding gap in mid-2007 would be $2.0–2.2 trillion. Were all liabilities to non-banks treated as short-term funding, the upper-bound estimate would be $6.5 trillion (Figure 5, bottom right panel).

Since those estimates are focused on European banks that meant the global dollar short was easily something of a multi-trillion affair. With that proportion, the behavior of “markets” in 2007 and 2008 becomes much more logical, as does the flailing of traditional central bank measures like laughably reducing the federal funds rate and for the tragically ill-suited Discount Window. The context of 2007 and the massive shift that started then is also clear – holding an aggregated multi-trillion dollar short, banks would be extremely sensitive not just to changes in dollar financing (including repo) but perceptions about ease there.

Another example of why psychology has played a (if not the) central role in the monetary response now going back seven full years.

More on this in Part 2.

Click here to sign up for our free weekly e-newsletter.

“WEALTH PRESERVATION AND ACCUMULATION THROUGH THOUGHTFUL INVESTING.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch