It is worth furthering the point raised by San Francisco Fed President John Williams. Just as when QE2 ended it wasn’t the end of QE in America, the belated end of QE3 and QE4 also may be just a temporary interruption. Mr. Williams gave essentially two criteria, though I added a few more from my own observations:

“If inflation isn’t moving above 1.5 (percent) and we get stuck into that gear, that would argue for a later liftoff” in rates, he [John Williams] told Reuters. “If we don’t see any improvement in wages, that would be a sign that we still have a lot of slack in the economy and we are not getting any inflationary pressure to move inflation back to 2 percent.”

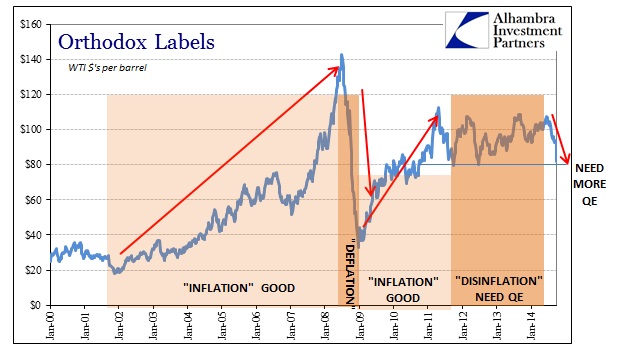

The lack of wages has been written about extensively, a conundrum that orthodox economics will never be able to solve under its current framework that views “inflation” as an economic aid rather than a redistributive nightmare. In terms of actual prices, the current run of oil selling has to be more than a little concerning toward Williams’ own benchmarking. That works not just in the simplistic world of “inflation” but also as it relates to what certain “markets” may be viewing as economic opportunity (which ties back into wages).

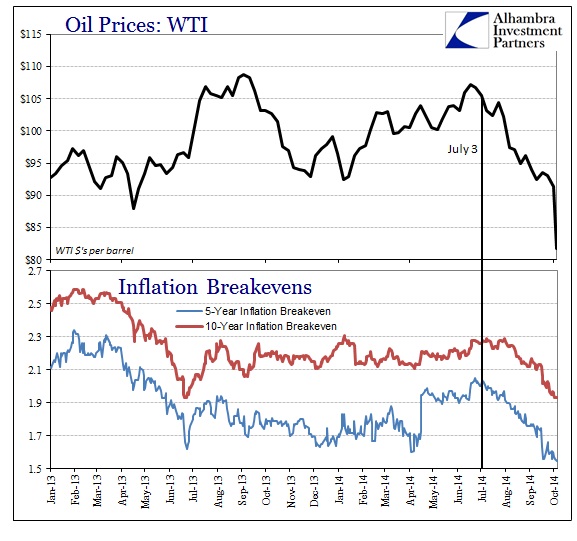

There is a resemblance between the track of oil prices and inflation breakevens in TIPS trading. It appears as though inflation expectations in credit were unconvinced of the recovery/inflation narrative as long as oil prices did not rise above $105 for any extended period. It is that corroboration in recent weeks (especially in comparison to late 2013) that makes this all the more compelling this time – so many indications moving at the same time in the same direction. When oil prices fell in October 2013, inflation expectations barely budged, seemingly at least somewhat attached to the preferred idea that QE may eventually work. Now, there is nothing of the sort to even cling to, belying any notion that QE may have done anything beyond fashioning a temporary, flimsy artifice.

In recent days, oil prices have fallen close to a level that seemingly has triggered threats of continued monetarism that eventually led to continued monetarism (might Williams’ interview be the first in the next “cycle”?).

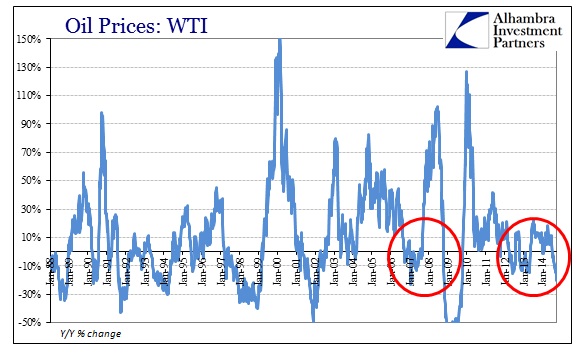

WTI has only touched the $80 level on two prior occasions during this “recovery”, neither of which would be confused with robustness and both occurring during QE’s absence. In fact, both were quickly followed by the textbook approach of flooding “reserves” which is now off the table across many of the larger jurisdictions (in favor of “targeting” allocation subsidy).

The essence of oil in October 2014, then, is perhaps filling up half the required necessities in gaining further QE before the current QE even ends. For his sake, and what little credibility central banks have left, the Establishment Survey better suddenly and quickly regain some correlation to wages and actual jobs.

Stay In Touch