The problem with being long gold, or even a fan of gold as anathema to central bank “flexibility” in central planning, is that you are often reminded the messiness of its modern nature. Gold as money, properly understood, meant money as property which is why physical metal fit so well for maybe all of “civilized” human history. However, the unassailable conclusion of the world of finance from the second half of the 20th century (when eurodollars started in the late 1950’s) forward is that we currently occupy a totally non-monetary world; it is all gone now.

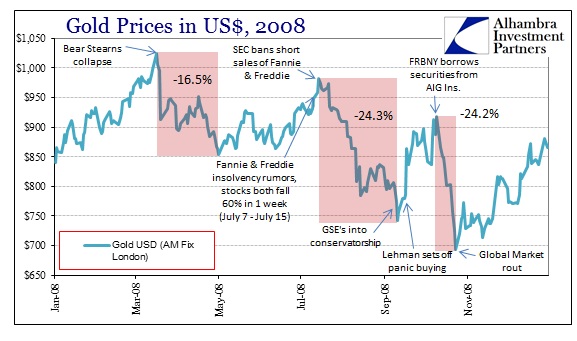

In that respect, gold has been not just diminished in relevance but bastardized in function. There is no clearer example of this than 2008. In the end, the function of gold as “tail risk” insurance “won” the day, as the price of gold vastly outperformed the S&P 500 from peak to trough (Oct 9, 2007-Mar 9, 2009: gold +28.2%, S&P 500 -56.8%), but getting there was more than a little uneasy.

In between, there were three discrete episodes that seemingly defied the nature of gold as “good” insurance against financial meltdown. But in looking at each, as I did during April 2013’s violent gold smash, it is clear that the slide each time related to that bastardized financialism into which gold now “belongs.” When collateral and funding grow too short, gold functions as the last line of defense against dollar disruption. That is both maddeningly frustrating to gold prices and to the memory of gold as money since it upends that historical pyramid (dollars on top of gold now).

This was perhaps the most evident and proving in the month and a half after Bear Stearns had failed in March 2008. Gold prices fell almost 17%, which was used as evidence by many that the worst had passed. These orthodox interpretations, which somehow included every member of the FOMC, amounted to only wishful thinking, betraying any kind of knowledge about how the financial plumbing actually works. In other words, there is an important inversion in gold prices that risks upsetting valid interpretations (and, conversely, seemingly confirming invalid interpretations).

As gold prices fell between March and early May 2008 it was actually a signal that everything was far worse than feared.

Physical prices in London hit an all-time high of $1,023.50 on March 17, 2008. That happened to be the Monday morning after Bear Stearns “failed”. From that point until May 2, gold prices dropped more than 16%. Banks had become keenly aware of counterparties and collateral, particularly with daily rumors of monoline insurers heading for bankruptcy filings. But ultimately, the price of gold stopped falling on May 2, 2008, which happened to be the very same day the FOMC expanded the list of eligible collateral in its TSLF Schedule 2 to include private label MBS and asset-backed paper. The Fed also increased the ceiling on its dollar swaps with the ECB (to $20 billion) and to the SNB (to $6 billion).

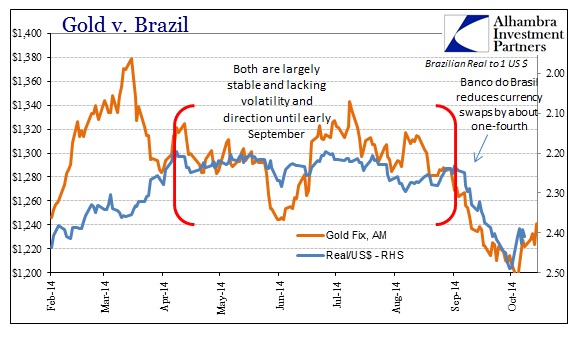

While nothing quite as serious exists at this moment, there are still the same elements at play right now. There is again a clear relationship between global dollar “liquidity” and the inversion of gold prices. That extends to visions of global growth contrary to the orthodox interpretations of how gold prices behave.

The Brazilian real, a good proxy for the global dollar short position, nearly touched 2.5 to the dollar Thursday and Friday October 2nd & 3rd. Gold prices reached their latest low point, under $1,200 for the first time since December 19, 2013 the following Monday morning. That also matched, not coincidentally, about the lowest point after the dramatic selloffs during the credit event in the middle of 2013 (the low in gold then $1,203.25 morning fix of June 28, only a few days after the bottom in credit).

We are reminded over and over that gold is no longer the gold we wish it might be, but also that mainstream commentary over it is often in opposition to what is actually occurring. I still believe that the track of gold these past few years is all about that balance – between the dollar short and the bid for safety. Since QE3 began, that balance has been decidedly tailored to the latter, as the former has been curtailed by very artificial views on risk.

All that in mind, my own view is that the dollar short will likely remain a “problem” for gold prices but that now the other side of the dynamic might begin to assert itself more and more. It certainly has not yet, but I have little doubt that is at least partly due to this mistaken convention that passes for mainstream analysis, a condition that seems to be correcting itself by events.

Stay In Touch