The long-awaited “clarification” in GSE housing expansion is about due, and coincidentally it will be released at the same time other central agents are getting their work done. So as the global economy falls into at least a changed mood out of complacency and disinterest, suddenly the ECB has its covered bond “purchase” finalized (as if that is any different from them accepting covered bonds as financing collateral, which they have been doing at great debasement since December 2011) and now Fannie and Freddie are to relax lending standards.

Earlier this year, Mel Watt, regulatory chief of federally controlled mortgage-finance giants Fannie Mae and Freddie Mac, announced several moves aimed at supporting consumers’ access to credit, including relaxing terms for when Fannie and Freddie demand sellers repurchase a loan. According to WSJ, FHFA will soon clarify those terms. Industry executives and economists say the housing market’s recovery has been hampered over the past year by overly restrictive standards that prevent credit-worthy borrowers from getting a loan.

Faith in housing as an economic agent, which was ripe given its historical placement as the primary monetary channel, has been severely tested by a housing market that won’t do much other than inflate price-wise. In that respect, housing has been much like the rest of the economy, struck by a tendency toward price inflation but not much else.

The latest construction figures simply confirm that, and offer evidence as to why “they” want the GSE’s to “loosen.”

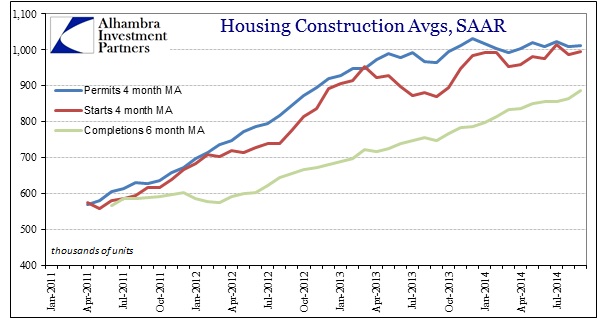

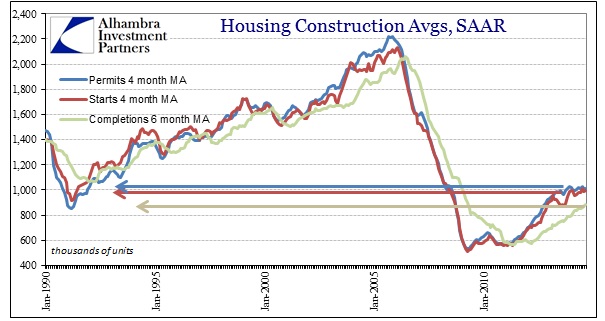

As a means to an economic end, housing construction has essentially flattened out since early to mid-2013. That presents a huge problem given that construction is still taking place at only a fraction of where it was prior to the collapse. So in economic terms, there just isn’t much boost to the economy at these levels.

In fact, the pace of construction, including the highly volatile apartment segment, is seemingly stuck at a rate that marked the low point at the bottom of the 1990-91 recession. That is especially poignant since that low level was actually due to the destruction of the primary mortgage conduit, the savings and loan industry (the removal of S&L’s made “room” for the shadow system to completely dominate from that point forward, and thus bubble-time). In that respect, “they” are trying to do it all over again.

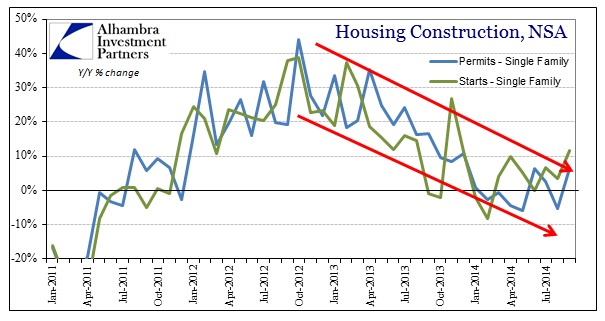

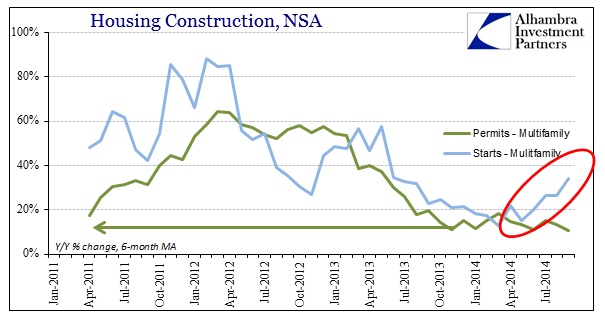

But it is not just the lackluster pace of construction that is the problem (structural), there are also very real concerns about cyclicality to go with that. Housing advance has clearly slowed; and though it has been better in the past few months there has been nothing to indicate that will turn upward once more – thus the impetus to “inject” more finance.

While starts in both single family and multi-family have shown an upward bias, there is ambiguity about what that may mean given a clear divergence with permits. That itself isn’t especially significant given the volatility of the data, but in the context of predictions and economic factors it has to be very uneasy for those seeking to engineer a turnaround.

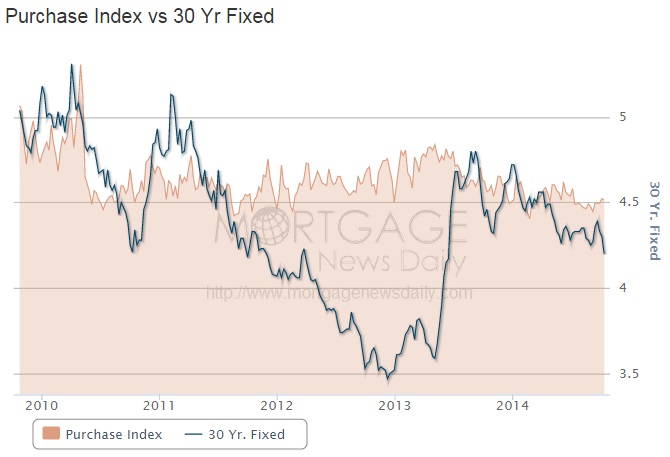

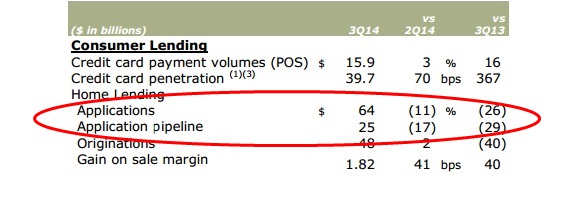

The continued derailment of mortgage activity, even for purchases that remain subdued despite a clear drop in mortgage rates recently, only adds to that unease. That has been seen in broad purchase application indices (below) as well as in the quarterly bank reports from the big mortgage lenders (I included Wells Fargo’s latest quarterly presentation, also below).

The sense of urgency is then palpable given all these housing “headwinds.” With that in mind, I would not at all be surprised if Mel Watt intends to be surprisingly “loose” with the new terms. This all, I’m sure we will be told, bears no relation to doubts about an economy policymakers are “unshakably” confident about.

Stay In Touch