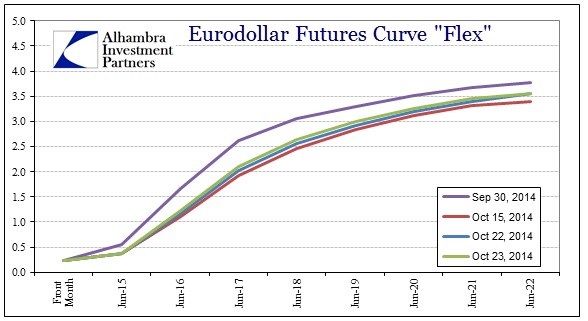

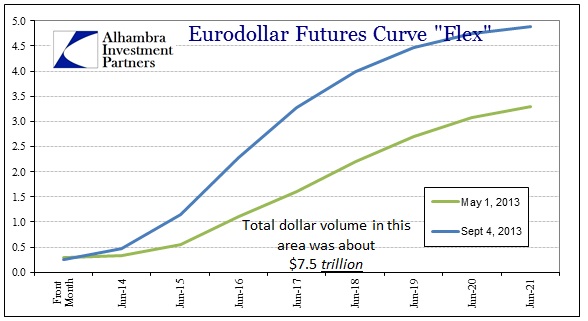

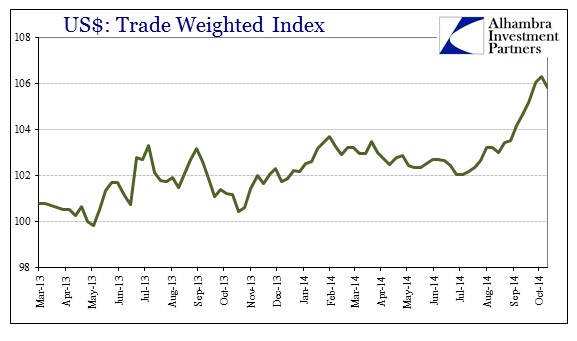

While this morning’s post was more about longer-term implications of “dollar” changes, there are a couple of observations pertinent to the shorter-term that I think need consideration too. For whatever reason, whether it was, like September 4, 2013, an anticipation of countertrend “dovishness” on the part of the FOMC, the eurodollar market gained a sudden appreciation of the economic downside not just in the outer years but very close in. In episodes past, eurodollars in the “money” part of the curve (where trillions in notional outstanding futures reside) were almost squarely focused on policy alone.

That is why eurodollar futures are used as a gauge for “market” expectations for policy changes (though that is somewhat circular in nature). In that interpretation, eurodollar “providers” seemed suddenly to re-assess the idea that the Fed might actually ever get to something off ZIRP.

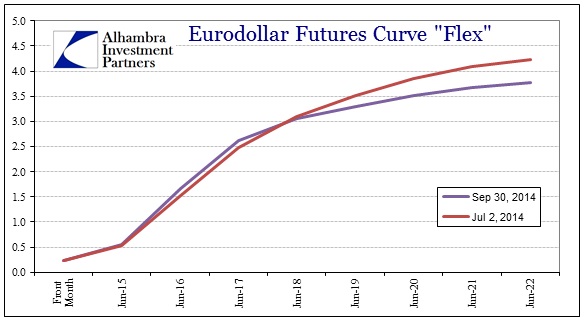

By comparison, the “tightening” of future expected rate hikes from July 2 to that nadir or inflection on September 30 is quite small; very small.

There were more than a few ups and downs in the curve along the way, but for the most part the eurodollar market was not really that much “tighter” during this update of the dollar’s “rise”; certainly nothing like what took place in 2013:

The net effect of these trends, to me, says that there has been very little acceptance of a non-ZIRP paradigm in eurodollars for much of 2014. In that respect, the curve seemingly is in good accordance with other credit market aspects like inflation breakevens and the flattening bear curve. In other words, funding markets were not ready to believe what the FOMC was saying (flattening in eurodollars too was a contrary notion), but at the same time did not want to bet directly against it. Yet, in the moment where the FOMC’s narrative was at its weakest, the movement was outsized against it.

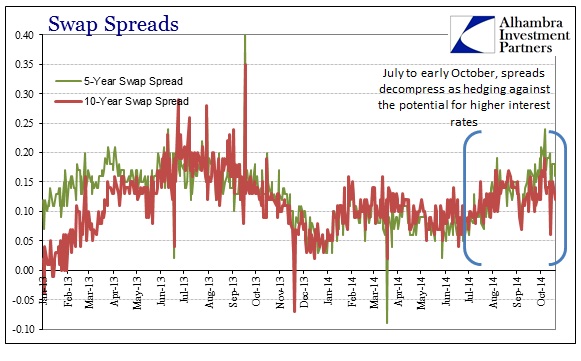

Instead, what took place was hedging against a rate hike, largely in swaps markets. So where the eurodollar curve moved very little upward as the FOMC promises and “forward guidance” grew louder and more sustained, swap spreads decompressed by a noticeable amount, if not immensely obvious.

The implications of that are profound, given in comparison between the two episodes (May-June 2014 vs. July-September 2014). Where an immense shift in the eurodollar curve and swap spreads produced global disorder in 2013, a barely perceptible shift in the eurodollar curve and a much less, though admittedly significant, shift in swap spreads produced in some respects an even greater response this year; certainly with more asymmetry.

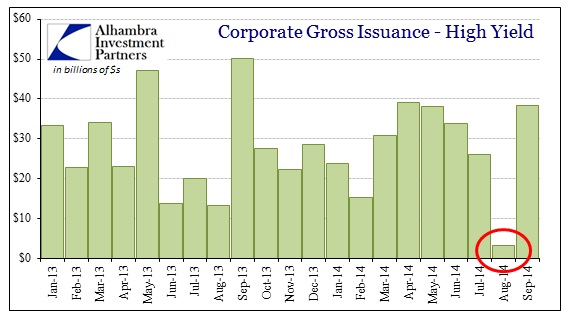

I think that fits in with what I described this morning of systemic erosion in liquidity capacity globally for the eurodollar standard. It may not penetrate the mainstream consciousness that is fixated solely on stock prices in the US, but that doesn’t mean it hasn’t impacted even domestic “markets” – or that it won’t at some point. For example, high yield credit issuance nearly dropped to ZERO in August, far below even the worst months of the 2013 event to the lowest level since the worst days of crisis.

And while issuance rebounded in September, a traditionally heavy month anyway, it was nearly one-fourth less than September 2013 at the same time there was quite a shift in “quality” away from the riskiest obligors. Ba-rated bonds were 56% of the mix, which tied a record high (rather than proportionally more of lower-rated triple hooks, CCC or less, that has been the “norm” of late). While the presence of cov-lite continues to be a serious concern, I think there is a tight relationship with “dollar” liquidity and even US credit via leverage shifts manifested even here.

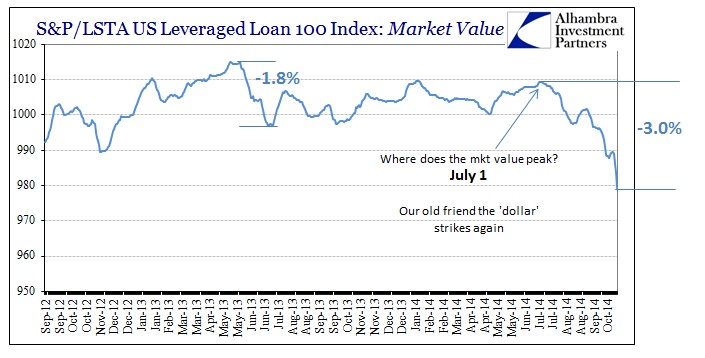

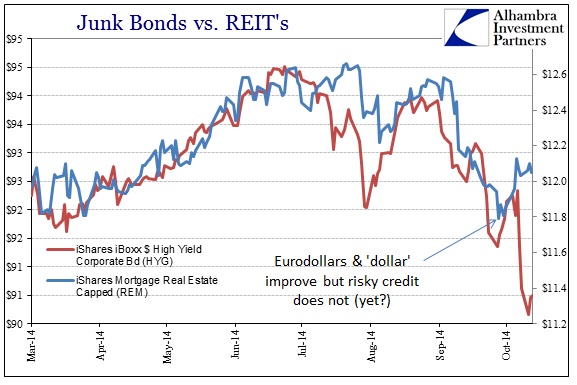

That was at least plain in the price behavior of high yield debt, including leveraged loan syndications.

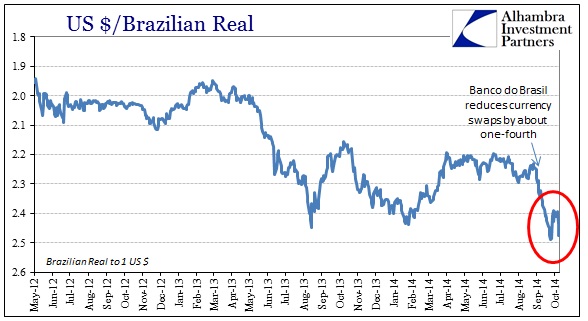

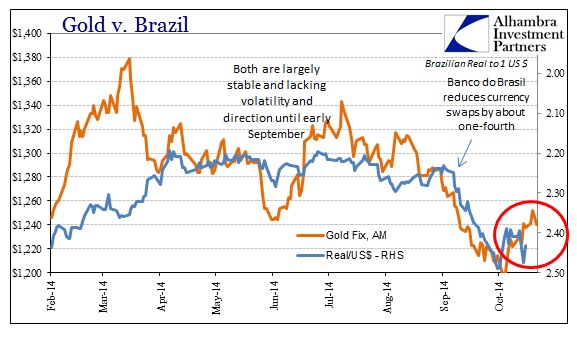

Again, that raises the specter of asymmetry where such seemingly small shifts in the “dollar” are met by wide and significant disruption to not just global economies and markets, but even domestic credit and risk. In that respect, the TIC data remains helpful in defining the contours of the big picture, which, if the potential inflection in eurdollars again toward tightening in recent days lingers, means this episode may have yet to run its full course. That would be consistent with last week’s drama, as well as other indications of how various global dollar attachments, like the Brazilian real, have again experienced violence.

This pattern is certainly consistent with markets “on edge” despite the lack of big and resounding moves in funding.

Stay In Touch