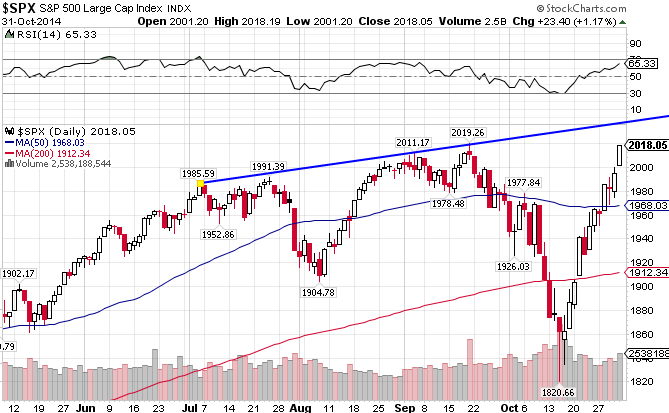

Not even geopolitical events in Ukraine, Iraq, and Syria, nor a third European recession in five years, can dislodge the US markets. Two weeks after hitting the 1820 level, the S&P 500 Index (IVV) broke resistance at the 50-day and 200-day moving average on its way to a new all-time closing high. That’s an 11% gain in 13 trading days! The S&P 500 is up 10.85% YTD.

The EMU Index ((EZU)), or the European Economic and Monetary Union, is mired in an ugly downtrend and under both moving averages. News out of Europe are pretty grim right now. It looks like it’s the end of the line for the once-heavily-favored European stocks. The index is down 7.88% for all of 2014.

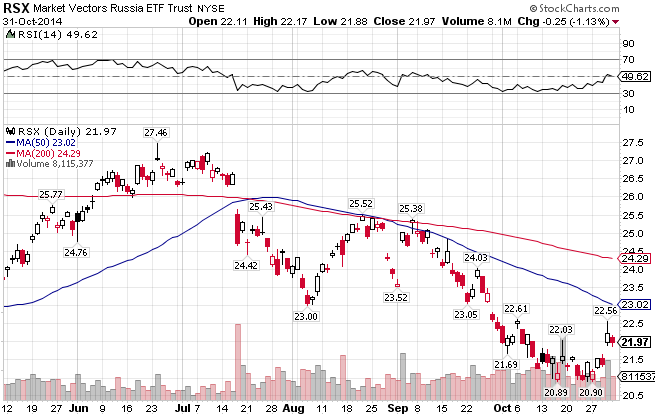

The Russian Index ((RSX)) has been hit pretty hard by the US-EU-imposed sanctions, and also finds itself mired in an ugly downtrend line. If Russia continues to provoke and antagonize, expect the index to fail at these levels. RSX is down a harsh 23.90% year-to-date.

Despite a strong US dollar, crashing crude oil prices, and the IS caliphate raiding the region, the Middle East Index((GULF)) is still holding tough. The index is still above its 50-day and is up 18.65% YTD.

The Latin American market ((ILF)) broke down in September in emphatic fashion. It broke through both the 50-day and the 200-day moving averages on its way to a 15% loss in a little over a month. It was moved concurrently with the crashing commodities market and is still struggling to hold support. The index has recorded a 0.13% gain so far this year.

Africa’s market ((AFK)) has managed to grind higher for most of 2014. But the deadly Ebola outbreak and continued upheaval in Northern Africa, coupled with a weak global economy has finally dampened Africa’s run. Africa is now down for the year, after a horrible September and October, losing 4.43%.

The Chinese economy, along with the Indian and Southeast Asian economies, had been trending up before succumbing to the strong US dollar. It now finds itself just above both moving averages after hitting the 45 level just two weeks ago. The Pacific x-Japan index ((EPP)) is up 5.64% YTD.

Japan ((EWJ)) broke out this past week as the BOJ unexpectedly eased monetary policy. Japan is now up 0.03% for all of 2014.

Stay In Touch