Given the attention to oil prices lately, it sure seems as if the media is determined to make a case for supply causation rather than anything of demand that might harm the established recovery narrative. In almost every major financial outlet, and more than a few “mainstream” “news” centers, there is a uniform tale of how lower oil prices are going to be an economic benefit because of the shale/fracking boom. This may be the one instance, curiously, where convention and orthodoxy embraces “deflation.”

There is no doubt that reduced oil prices are beneficial, but this attention toward that direction still misses the truth about “inflation”; namely that it is not acceleration or deceleration that truly matters only the relation to income. In that respect, with the track record of the past seven years, oil prices have much further to fall to assume this magic elixir.

The other end of that story is more mixed, particularly given that there may indeed be a valid supply angle.

“Why is oil $80 instead of $95?” said David Hackett, president of Stillwater Associates LLC inIrvine, California. “All of a sudden all this oil is getting to the coast and pushing back world supplies.”

The shift is being felt 20 miles (32 kilometers) offshore in the Gulf of Mexico at the LOOP. Built in 1981, it’s the only U.S. port that can unload the world’s largest supertankers.

Shipments into the port peaked in 2005 at 1.18 million barrels a day, according to Louisiana state records. Imports have fallen to 510,000 barrels a day this year, and since May the port has received more oil from Texas than any country other than Saudi Arabia.

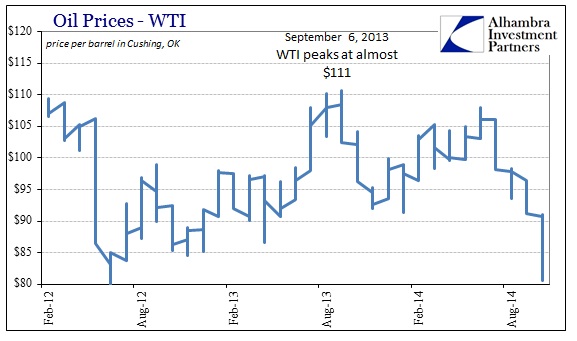

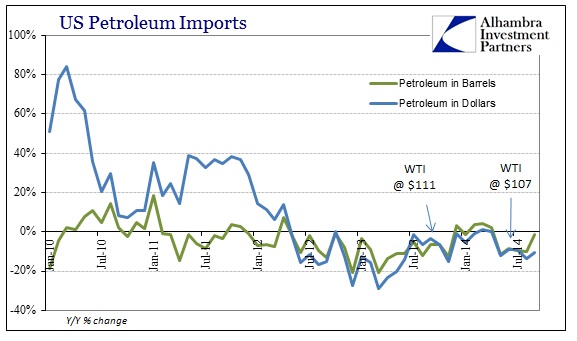

The latest import figures do seem to contour, roughly, to the Louisiana story. Petroleum imports had been rising earlier this year, but turned lower again right around where Texas crude picked up. Going back into last year, it does seem to match up the behavior of WTI (the price of all this “trapped” oil in OK) with imports. As WTI moved up toward $110 and above in September 2013, a few months later imports of petroleum increased Y/Y for the first time since May 2012. As WTI prices backed lower during the “winter”, imports began to decline once more.

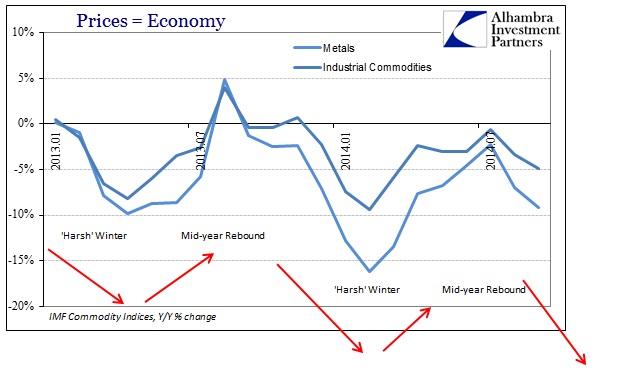

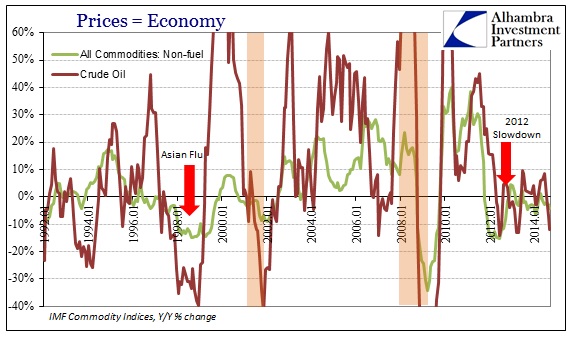

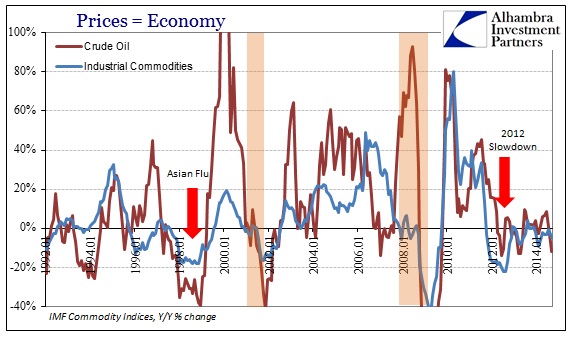

However, that being noticed, while there is a rough correlation between imports and WTI prices (this supply issue) there is perhaps an even better correlation with commodity prices elsewhere, particularly industrial and “economic” metals. The amplitudes of the changes in prices are to different degrees, but the general timing and inflections are more compelling than this “over supply” idea.

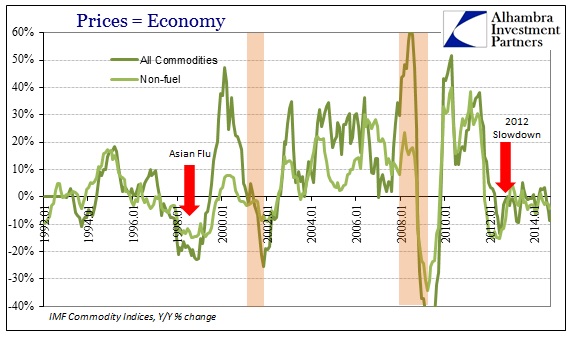

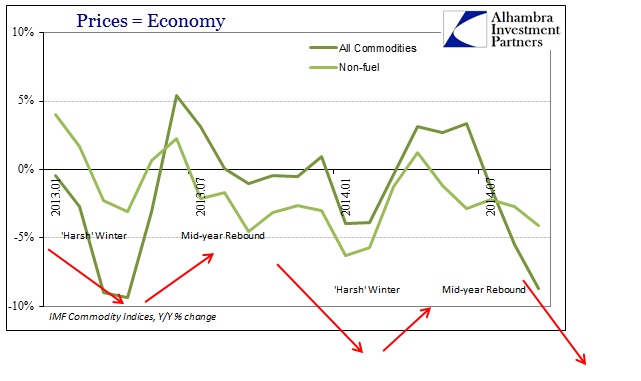

Further, those inflections in recent prices of industrial commodities and metals, as well as WTI, match up with the “weather” effects on the economy spanning, as much as the media has forgetten, both 2013 and 2014. With a wider perspective, that becomes clear as “deflation” in prices is typically correlated with deficient global economic function (thus it is not “weather” driving these mini-cycles, but likely consumption patterns, set against weak income growth, around Christmas).

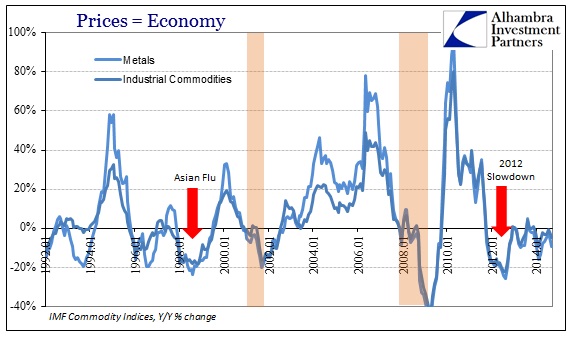

That would suggest that while supply is certainly a factor, demand is the key driver as is, unfortunately, the “dollar.” As is clear in the chart above, prices never rebounded from the 2012 slowdown which conforms to the idea of the elongated cycle; thus the minor variations, or mini-cycles, are nothing more than mistaken perceptions about intermittent “stability” (an oxymoron, I know, but this relates to narratives and economists) in demand and economy.

It is not just industrial commodities and metals, as overall commodity prices globally follow much the same pattern (except food in 2014, particularly coffee and beef) – both longer and shorter terms.

It seems quite easy to dismiss the oil supply narrative as responsible for oil prices lately when oil prices correlate so highly with all these other economically-sensitive prices (and “dollar” sensitive).

Again, the amplitudes may be different but the general behavior of prices, especially in the “recovery” from the Great Recession, argues for far more uniform causation, thus excluding the idea of supply in each specific commodity.

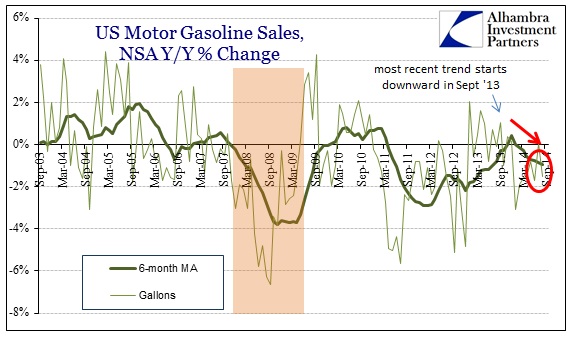

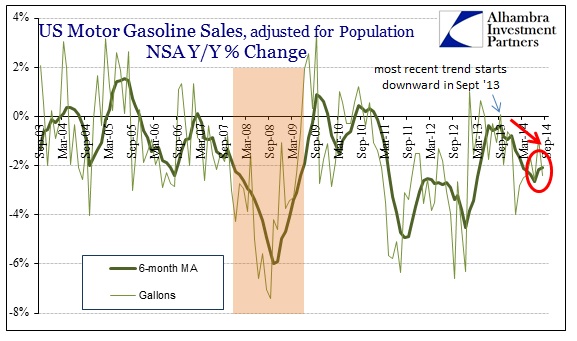

At the very least, gasoline sales corroborate weak demand in the largest usage of crude oil inside the US.

When you simply assume that monetary policies simply “work”, then the idea of economic retrenchment after years and years of the heaviest doses is too much to bear. It is easier in that case to reach for convolutions as comforting, but that only gives away the original bias. The global economy is not responding to monetarism, as much as it may have at all prior, to the point that “global growth” is very much in doubt. Commodity prices, especially oil, are trailing the “dollar” and bond markets as at least some investors are recognizing very real risks.

Stay In Touch