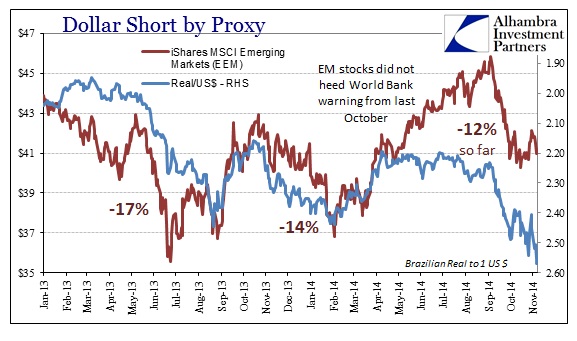

The re-emergence of “tight” dollar “supply” has created much the same problems as had been seen prior to October. That means the usual places exhibit duress to varying degrees. What I don’t think is really appreciated is how this year’s episode is transformative toward a different set “ruling” the global dollar short.

In one sense, it is not surprising to see gold (with GOFO again down to -18 bps today) drop in much the same fashion as the Brazilian real.

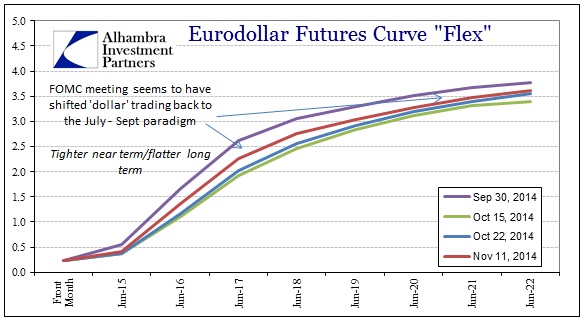

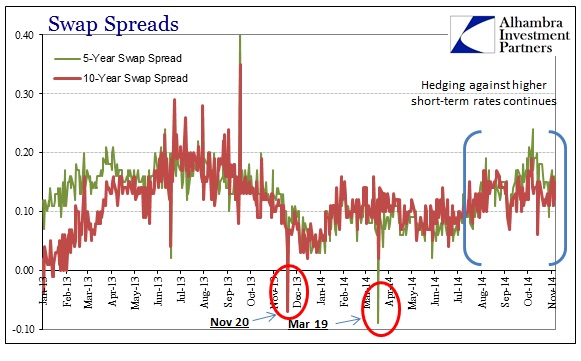

Tight dollar supply is tight dollar supply after all, meaning that “someone” somewhere is going to be in relatively dire shape to acquire them at increasing cost and difficulty. Thus, as in gold, alternative pathways are sought. But that is increasingly an astounding circumstance given the superior feature of this remains how little outward appearance there is to the “tightening” condition. In eurodollars, the curve has barely shown any significant movement, and without much of any gyration in interest rate swaps (especially in comparison to 2013).

The eurodollar curve is not much “tighter” than its latest nadir on October 15, yet the results in almost every global “market” touched by wholesale funding is reacting as if it were something far less risible.

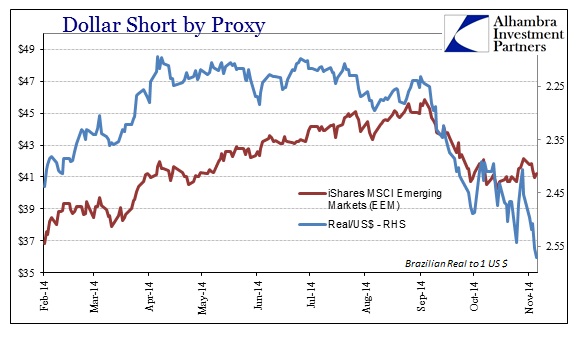

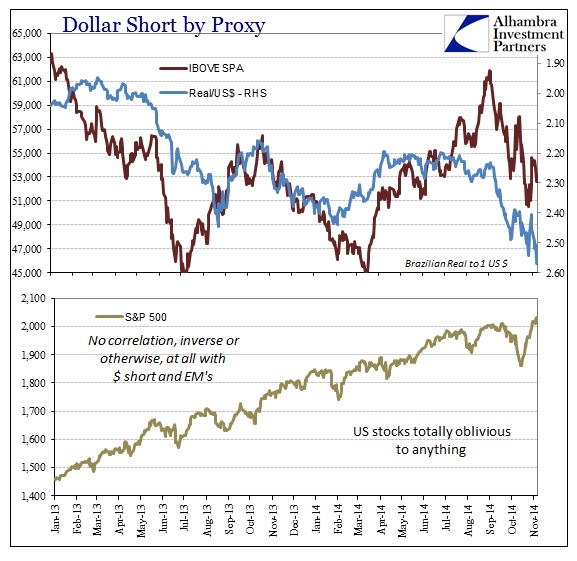

Emerging market stocks have been unable to gain traction after a huge runup during the middle months of 2014 where the “dollar” was almost totally benign. Since Brazil’s central bank failed to renew its dollar swap workaround, all bets have been re-adjusted especially contained within the “rising” dollar period. Dollar issues have been revisited in so many locations, including Russia and South Africa.

I think we are beginning to see the disparity between what dollar finance shows via these admittedly lacking rates and derivative prices and changes in the global dollar short due to more basic shifts. In that respect, Brazil as a proxy is once again very helpful. The difference starts with the dollar/real cross and runs into the Brazilian stock and bond markets, but there are deeper considerations that might be hidden behind this overdone financialization.

The Bovespa was down 18% from its high to the end of October after a huge run again in the middle of the year. At the same time Brazilian and emerging market stocks were enjoying themselves royally, and the dollar was not at all disruptive, the Brazilian economy has headed right toward recession.

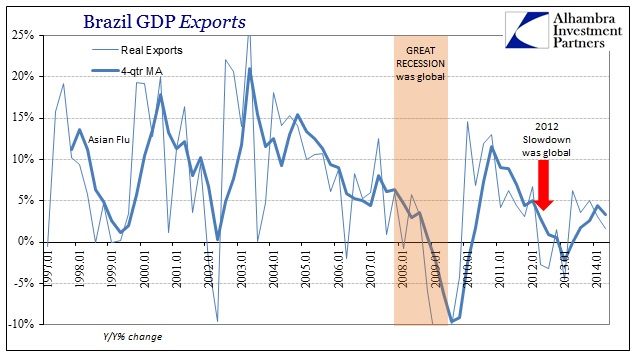

Even though the negative number on GDP was “unexpected” the Bovespa had no trouble in largely ignoring it. Part of that might be attributed to the same sentiment that has re-assured orthodox economists quite steadily all over the world, “global growth.” So whatever trouble Brazil was experiencing was published as a temporary factor in an otherwise global renaissance. With Brazil as an export-oriented economy (though less so since 2007) you might forgive some exuberance in stocks taking the word of economists.

As in almost everything in 2013 and 2014, there was a rebound from a disastrous 2012 but only to a scale that represented past recessions in practice. So exports were going from really bad to only bad before “unexpectedly” falling backward in Q2 (with Q3 results coming shortly). So where economists may have been extrapolating in a straight line from the depths of Q1 2013, it was never that good to begin with.

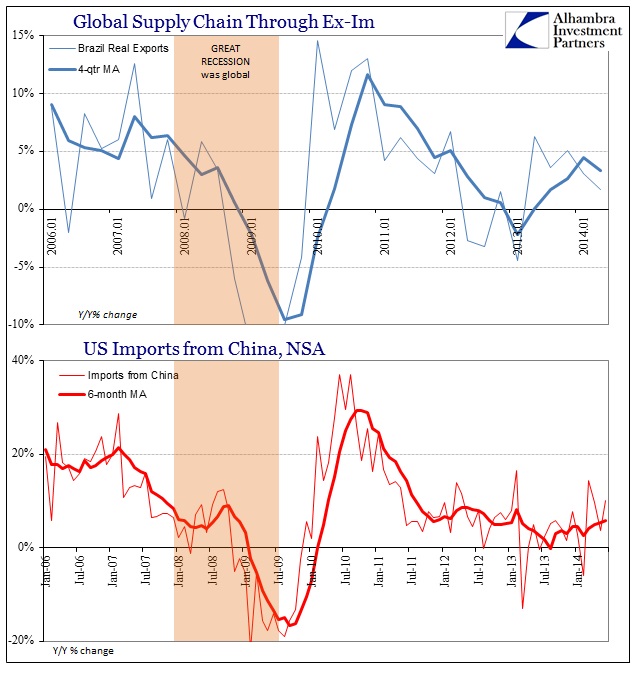

I doubt Brazilian stock investors were so enamored with “global growth” as an engine for some level of prosperity that would justify the movement of Brazilian stocks. Instead, there is a conspicuous replication of trend and pattern that joins “global growth” disappointment across continents and hemispheres. Brazil’s lack of export-driven fortunes have always been closely tied to the global supply chain, and thus to China and eventually the US and Europe.

Outside of orthodox economics (still pining for closed systems) there is no surprise when comparing Brazilian exports and US imports from China. In fact, that the two are seriously correlated in almost exact timing and degrees (if not fully on the same scale, which is expected) is a given. It may shock the mainstream media, but (lack of) US demand is the reason for slowing economies all over the world, especially Brazil.

That raises the issue about what we have seen in various asset markets in all these far-flung locations. If global growth is essentially one big homogenized disappointment, then why are stocks so jubilant if not overall in very intense and discrete bursts?

The answer is again the dollar as it pertains to various central bank activities in each place. So where actual economic growth has been in a downward spiral since 2012, each central bank (from the PBOC to ECB to Banco do Brasil) has responded on its own terms (or so they believed). In 2012, Banco was busy rapidly reducing interest rates to try to “stimulate” its economy in the face of that growing negative economic wave. Of course, that affected so called “hot money” (that really isn’t hot money) bringing about gyrations there.

At the same time, the PBOC was unleashing its second massive credit expansion for the very same reason – the 2012 slowdown. Thus, various global locations were to differing degrees re-assuring and “loose” toward financialisms while economic reality deteriorated. Over time, the two simply grew further divorced, where financial factors dominated to the exclusion of recognizing the real situation for “global growth.” In Brazil, markets there rose and fell (and rose again) on the financialism in eurodollars related to US taper. China earlier this year saw something similar as it attempted to enforce some measure of “reform” and allow risky defaults (leading to a comparable and intense burst of “devaluation” on dollar tightening).

So central banks have dominated these places for years with essentially the same economic backdrop, in fact trying to combat it in their own expressions. However, the relatively paltry levels of financial movements in “dollars” this year more than suggest that the global dollar may be far less effectively financial. In other words, where central bank activities may have been foremost in setting wholesale funding conditions previously (including the believability of the “recovery narrative”) it does not appear as if that is the case now.

That would seem to further suggest that “dollar supply” and positioning is more and more based on the continued discrepancies between what was supposed to happen via central bank matters and what has actually happened. Like Europe, there is more than a hint of growing discomfort about “the narrative” and that financialism all its own may not be enough to govern marginal changes in each of these “markets.”

If the wholesale “dollar” market were acting on the Fed’s supposed intent to actually raise interest rates, because, of course, they judge the economy to be so robust, the eurodollar curve would be moving in that direction not at all unlike what happened in the middle of 2013. It’s not doing that, indicating that “dollar” tightening is not likely related to policy, again meaning financial factors are not be the driving influence.

Global recession is one possibility that can change willingness toward risk in spite of financial comfort and encouragement from central banks or whomever else might project increasingly doubtful promises. That would certainly comport with yield curves all over the world taking on a bearish flattening program in outright “defiance” of projected financial properties.

Stay In Touch