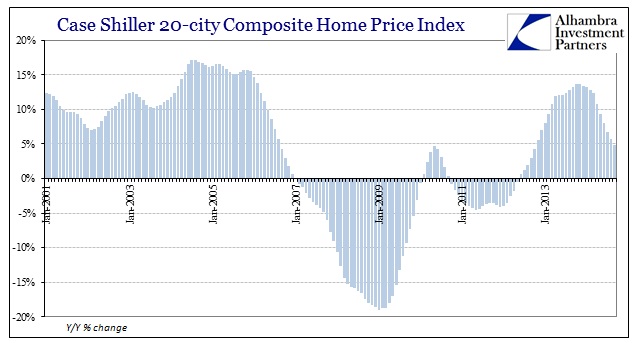

Price momentum is usually the key factor in any asset bubble, as it takes sustained ascent to draw in more and more participants. If price acceleration begins to falter, the discussion and bemusement (for some) about who might end up the Greater Fool becomes paramount. But that is not a straight-line process either, nor is it with price momentum.

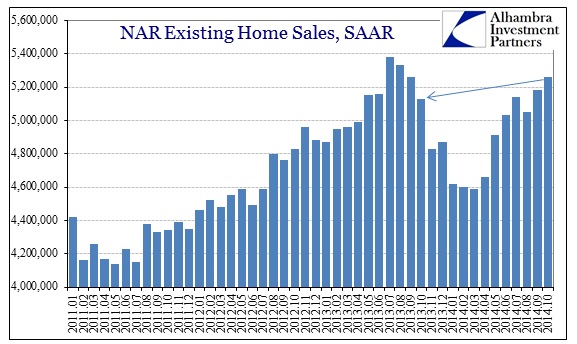

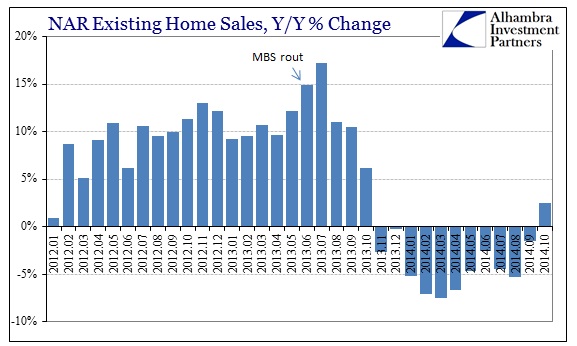

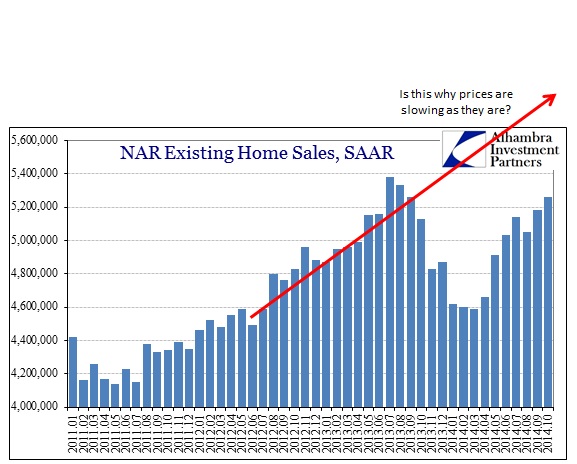

In any case, there are a number of contradictions in real estate at present that lead me to think that there is just such “discussion” under way. In existing home sales, or what they call resales, the National Association of Realtors (NAR) was pleasantly surprised in October by a positive number month over month. In terms of annual comps, now that the calendar has positioned sales with respect to 2013’s massive slowdown, year over year rates are going to be highly positive for some months to follow.

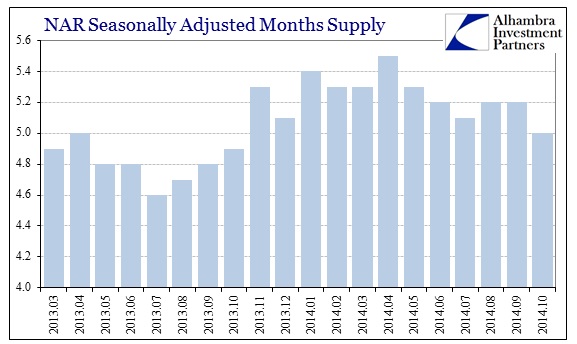

Despite the positive numbers in sales volume, inventory has not been following the assumed sales pace.

Overall inventory held for sale had been much higher in the middle of 2014 than the prior year in 2013, which seems to have contributed mightily to slowing overall price appreciation. The Cash-Shiller Home Price Indices are very clear on that account, as there is no doubt there exists at least a correlation between rising inventory and the sudden deceleration in home prices.

The peak growth rate in prices was reached in November 2013, just as the inventory-to-sales estimate jumped from 4.9 months to 5.3 months. So even with sales rising from the early part of 2014, is that actually keeping pace with expectations?

If inventory levels have indeed turned problematic at this level of sales volume, whatever Y/Y growth rates materialize, it will take a huge increase in demand to get prices rolling upward again. That certainly may happen, but unless there is a huge uptick in “wealth” in the US that doesn’t seem likely. While the NAR figures don’t provide breakdowns by price tier, other indications show that most activity, including inventory, is concentrated almost totally at the upper ends.

The inventory of for-sale homes in the bottom home-price tier rose year-over-year in 68.3% of the 353 total metro areas analyzed by Zillow, while inventory in the top home price tier rose in 82.2%, or 290 of the 353 markets analyzed. Inventory of all homes for sale nationwide increased by 15.8% year-over-year.

“Depending on their finances, it’s likely that individual buyers in the same market might be having completely different home buying experiences. Even as conditions improve for buyers overall, it remains a tough row to hoe for first-time buyers and lower-income buyers, especially compared to their more well-off contemporaries,” said Zillow Chief Economist Stan Humphries.

As per usual, the calling card of naked monetarism spelled out in gory inequality that somehow perplexes economists like Janet Yellen (who purports herself to be very, if not overly, concerned with such inequality). However, in the context of the real estate market as it exists in the last few months of 2014, this essential element of “demand” is likely to be a drag given this circumstance:

In Denver, there were almost four times as many homes available for sale in the upper price tier (priced at $357,900 or more) than there were homes priced in the lowest price tier (less than $219,000).

The same was true in many other markets. Dallas, Atlanta, Phoenix and Nashville had at least two times more homes for sale in the top tier than the bottom tier.

That disparity is simply staggering, especially since sales volume below $250k was, according to the NAR, 61% of all sales in October. Sales in the NAR’s upper tiers (which is different than what is quoted above) were only 11% proportionally. Such seeming imbalance is direct reference to bubble aspects. So again, will slowing prices and inventory be enough to disrupt these unstable mechanics?

At some point there may be a sort of reverse equalization whereby prospective buyers become far more patient and prospective sellers, especially when there are a lot more of them jammed into a single price tier, become the opposite. That point is made all the more by the continued absence of first-time buyers, leaving resales as more of price than fundamental supply and demand.

Stay In Touch