“Dollar” credit markets are completely unconvinced by the Establishment Survey that economic growth is at hand. Not only has this bearish/tightening trend been in place for over a year, uninterrupted too, it has actually picked up in the wake of last week’s “unquestionable” payroll expansion. The bearishness continues on all fronts, in tandem with oil prices which is not a good sign.

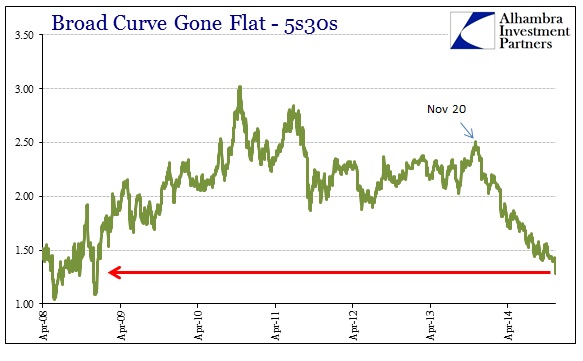

While the move since November 20, 2013, is remarkable in its own right, in the wider context of this “cycle” the treasury curve is as flat as it has been since the very dark days of the Great Recession. That is never a comparison you want to find of credit markets.

We are starting to get the same kind of comparisons in inflation trading as well. Breakevens all across the curve are now as low as they have been during crisis periods, especially the “dollar” disruption that kicked off the euro crisis in September 2011 (which nearly resulted, in early December 2011, in another bank panic).

The 5-year breakevens have shrunk to where they were in August 2010, the period between the “flash crash” and Ben Bernanke’s appearance at the Jackson Hole conclave announcing QE2 – a time so close to the Great Recession where it looked like there might not even be the slightest “recovery” at all. Even the Fed’s preferred (and unnecessarily convoluted) inflation measure, the 5-year/5-year forward expectations, is sinking to those levels.

But it is not just the descent that is revealing and significant, but the pace at which this has occurred. Again, the deceleration is both contrary to all expectations and exhortations and has come about with speed usually reserved for major economic and financial “events.”

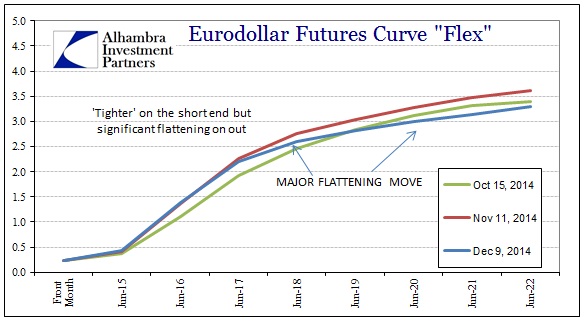

The trading in eurodollars and swaps show pretty much that kind of expectation. The swap curve has joined these other credit market indications in trading remarkable shifts and changes. The curve has essentially tightened since October 15 while flattening at a pace like nothing I have seen in years.

In short, the credit world of eurodollars and the global dollar short is showing tightening and negative expectations all at the same time. That means leverage and funding are relatively more scarce as bank balance sheets are clearly pulling back broadly from “risk.” The most obvious reason for doing so may be the end of ZIRP, but if it was just ZIRP that bank balance sheets were “correcting” for the eurodollar curve (as well as the UST curve) would be steepening further out as well as tightening in the shorter terms. The fact that we have both flattening and tightening is the worst case, as clearly credit and funding markets see the Fed as either heading toward something mostly like 1937 or at least being trapped by its own position.

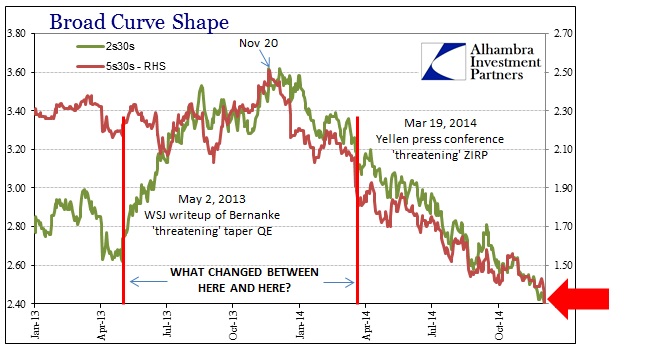

I continually go back to November 2013 as a frame of reference because I think that is still the dominant theme, especially given all that has happened in the past six months. The credit and funding markets viewed those events as confirming the idea that an “exit” was going to be utterly messy. The most charitable reading of that toward the dominant economic narrative is that credit recognizes and even acknowledges that the Establishment Survey is correct about job growth, but that in the end it won’t matter. The least charitable reading, which is where I think credit and dollar leverage are heading, is that there has been no real growth and that is why the November 2013 inflection is so concerning.

In one very important sense this matches what we have seen from China. Gone are the days where central banks will focus solely on economic growth and do whatever it takes. The lessons of QE, especially in the internal plumbing, is that there are too many negative impacts to ignore, especially when there isn’t all that much (or any) growth to balance it out. Central banks are shifting to asset bubbles from growth-at-all-costs and the extension (retrenchment) of leverage through bank balance sheet mechanics is betting they won’t be successful.

Echoes of Greenspan’s “conundrum” continue to reverberate, only now with QE-sized amplification.

Stay In Touch