After months of hearing about how the fracking “miracle” is totally, fully and comprehensively responsible for the drop in oil prices there is finally penetrating reality. After the continued disruption in the Chinese economy as well as the close onset of recession in Europe, plus full-blown recession in Japan and Brazil, all that is left is really the diminutive hope of “decoupling.” Throw in some currency crises and even that falls out of the realm of possibilities as the drawing unease relates to impending global dysfunction without any real place to hide.

And so risk margins are reduced, bank balance sheets adjust and the “dollar” supply for leverage and “growth” finance (mostly waste) shrinks. Sure, oil prices are due to oversupply but only in the context of significantly reduced usage.

Oil fell below $59 a barrel for the first time since May 2009 on Tuesday, extending a six-month selloff as slowing Chinese factory activity and weakening emerging-market currencies added to concerns about demand…

A report showing Chinese industrial activity shrank for the first time in seven months in December added to concern about oil demand. China is the second-largest oil consumer after the United States.

Hopefully as this new reality, falling away from the “narrative” of central banking genius, breaches further it will start to pull the curtain away from the central aspect of reduced growth globally – end market demand is simply not there. The recovery isn’t.

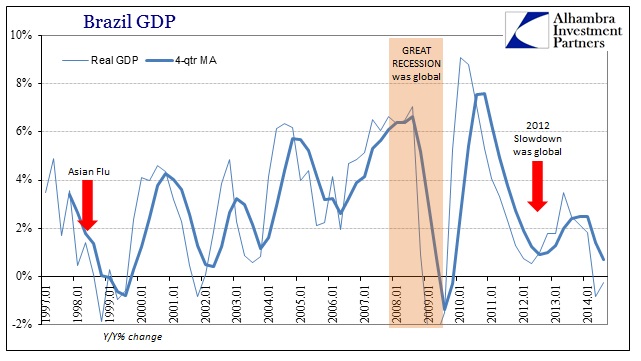

China’s contraction in activity is Brazil’s reduced baseline. Exports from Brazil conspicuously follow the pattern of US imports from China because that is how, marginally, the global flow of resources to goods to end user works. As a resource economy, Brazil is captured by exterior demand, but also bears the brunt of the global eurodollar system. Most commentary calls this “hot money” but that misses the important connotations and connections.

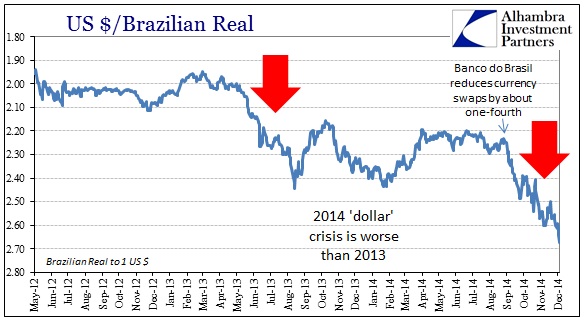

That economic reality of impending global distress hits Brazil twice, not only in a slower reference point of demand for its resource exports but also in finance as “dollar” funding of all of it becomes problematic. In that way, this becomes self-reinforcing as economic distress only furthers financial difficulties. The expression of that is a serious devaluation in the real, otherwise known as true inflation.

So Brazil is stuck in orthodox hell, whereby growth is essentially impossible but financial imbalances demand “contractionary” monetary policy in the (vain) hopes that the central bank can at least assert some control over the real (it can’t as the “dollar” problem is far beyond its grasp).

This is the theme of the past two years or so playing out its inevitable end. The elongated business cycle in the US (and globally) reduced “demand” in 2012 which triggered all sorts of economic and financial responses. Where US growth came close to recession, Europe fell into one and China came close. The response was textbook monetary “economics” as central banks all over the world went into overdrive to “forestall” such close retrenchment (coming not long after the Great Recession).

All that “stimulus” all over the world accomplished was even greater financial imbalances, meaning that while mainstream commentary took it as recovery it was nothing but artificial redistribution masking this lack of true economic progress. Unfortunately, this is a global system tying everything together as a single source of deepening malaise – financial imbalances and sharply reduced (and reducing) economic baselines.

As I said yesterday, there are three major indications of this as reality: oil, credit and “dollar.” Warnings persist in each (ask Russia) to the point that it is becoming harder to ignore them. Central bank redistribution policies can only buy time (at great cost in bubbles), but they have no directive for when the clock strikes zero. Oil supply indeed.

Stay In Touch