Indonesia has been here before, playing a key role in fomenting the Asian “flu” in 1997 and 1998. As it turned out, the slide in the rupiah last year, caught up in the taper drama of US “dollar” tightening, was just the initial phase of what looks to be shaping up as a protracted “dollar” problem. It never gets treated that way, as most commentary focuses locally ignoring the wider disruption. That was why in 1997 most people were shocked and surprised by the “unexpected” appearance of a currency crisis that spread far and wide – because it wasn’t a crisis of currencies so much as a “dollar” event under the nascent eurodollar surge.

That has become the dominant theme yet again as the latest problems in global currencies are being blamed on local issues. Russia is the epicenter at the moment, providing everyone else with cover to blame the Russians.

Indonesia’s rupiah halted a slide that pushed it to the weakest level since the Asian financial crisis after the central bank intervened to stem losses.

The rupiah closed up 0.1 percent at 12,680 per dollar after dropping as much as 1.9 percent earlier, prices from local banks compiled by Bloomberg show. It fell 1.9 percent yesterday, recording its lowest finish since August 1998. In the offshore market, one-month non-deliverable forwards rose 0.8 percent to 12,980 after declining 5 percent in the last two trading days…

“That’s a regular thing they do,” he [Wiling Bolung, head of balance-sheet trading at PT Bank ANZ Indonesia] said in Jakarta. “The Russian ruble was the main trigger” for the rupiah’s losses, Bolung said, adding that it was an “over-reaction by some people.”

That was a sentiment echoed, as you would expect, from official channels once the government rushed to reassure.

Finance Minister Bambang Brodjonegoro said today that, while it’s concerning, the current situation with the rupiah is temporary.

It’s easy to lose track of the rupiah as it is not one of the majors, but “temporary” is not a description that fits; at all.

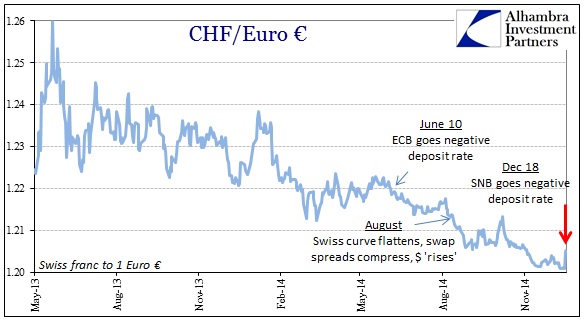

The rupiah has been sliding since the SNB first pegged the franc to the euro. I realize that connections here seem desperately remote, but the euro crisis that erupted in August and September 2011 was as much about “dollar” financing (and balance sheet contraction) as it was the euro’s potential disintegration. That is the primary observation to be made here, that the eurodollar system connects these far-flung financial systems together in a financial entanglement that can be at times (the worst times) inextricable.

Even Russian’s current mess is as much about the “dollar” as it is Russian factors. Yes, there are sanctions to consider and Russia’s economy has been downshifting for more than just 2014, but in terms of the eurodollar system that just meant the ruble was the weakest link and therefore first in line to be deprived of “liquidity” when balance sheet contraction occurred.

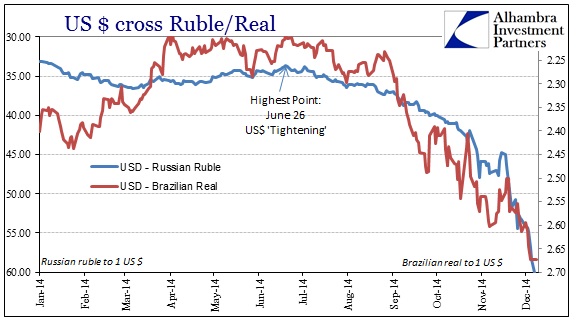

We see yet again another currency (or asset price/index value) where the highest point is met in the last week in June or the first week in July. That period was extraordinary for the turn in the “dollar” coming out of desperate repo illiquidity (as a symptom of bank balance sheets resetting).

What was largely stable and even appreciating slightly turned into rapid devaluation just as “dollar” funding grew problematic. And while the scale of the ruble’s collapse is much bigger, it still aligns too well with its BRIC cousin the Brazilian real. The common theme is economic weakness exposed by “dollar” tightening. That this didn’t occur to this dangerous degree in 2013’s “tightening” is another indication of how 2014 is far, far worse – with no end yet in sight.

All of this leads back to, of course, Switzerland. The Swiss National Bank this morning announced that it would start charging for sight deposits (with some limitations) as the Swiss franc threatens to unwind at the peg. SNB officials are also using the Russian problem as an excuse, but as I have endeavored to show here there is no “Russian problem” but rather an entangled “dollar” mess striking pretty much everywhere and anywhere.

Swiss National Bank President Thomas Jordan cited the Russian turmoil as a “major contributory factor” for the surprise decision to introduce a charge of 0.25 percent on sight deposits, the cash-like holdings of commercial banks at the central bank. The SNB also lowered its target range for the three-month Libor in an attempt to push the rate below zero. It fell to minus 0.046 percent today.

In that respect, the SNB is now in the same kind of conundrum (in opposite directions) as the Banco do Brasil in trying to ward off a currency problem that is not its own. The “dollar” missteps in the past six months are too immense for any one central bank to address. That is the problem here as this is not just a run of “dollar” disorder, though that is the primary symptom and means of “contagion”, but rather the global financial system is in a state of high pessimism and contraction. With currency crises raging all across the planet, it is a desperate warning that too much financial imbalance is unsustainable for the given economic reality as measured against prior economic expectations.

The end of the gold standard was supposed to alleviate these kinds of globalized contractions in finance and supply of “reserves.” It is very ironic, then, that the eurodollar standard is acting almost like a gold standard in enforcing monetary “shortages” against the determined counteractions of central banks. That leaves the eurodollar standard as wholly inferior since the gold standard, properly left alone, would have enforced tightening before global-sized financial bubbles, not after.

Stay In Touch