The “other” part to the GDP euphoria of the tax-like increase in non-discretionary spending was the apparent increase in business optimism. The latest durable goods figures, which includes capital goods, show that like the PCE revisions for health insurance spending there were relative changes that may account for better “investment” results in Q3. However, October and November more than suggest another temporary mid-year expansion seriously waning.

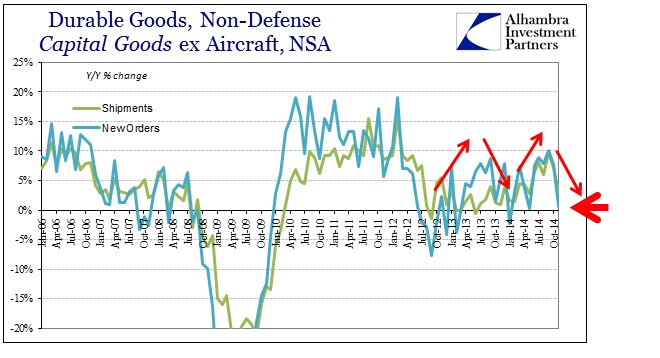

There is an almost identical mini-cycle playing out in 2014 in reflection of 2013. While shipments had been better this year (until October), the mid-year peaks are prominent in relation to likely inventory builds that are not satisfied as expected. In other words, production and productive investment rise (recall that winter weather was blamed for Q1 2013 as Q1 2014) in anticipation of that elusive “second half” economic takeoff only to be disappointed yet again. Capital goods orders fell essentially to zero in November after hitting 10% in September.

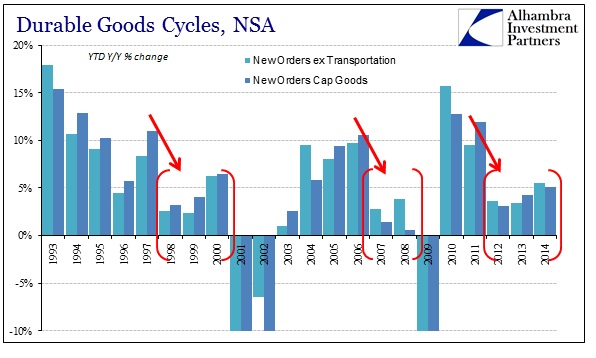

That is the big problem as it relates to interpretations of robust business investment. None of this “expansion” is stable, instead gyrating between tepid euphoria (like Q3) and utter despair (like Q1 2014 & Q1 2013, and looking like that yet again for Q1 2015). This variability resembles more of past periods of recession or near-recession than anything like high growth. In historical context, there is nothing of the past two years to suggest anything other than post-slowdown mini-cycles.

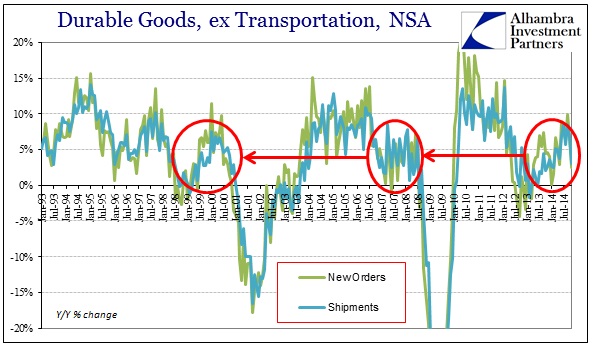

That is true of not just capital goods but overall in durable goods. Just like the unsatisfactory state of personal spending in a wider historical context, durable goods here remain in a patter too reminiscent of past “cycle” peaks.

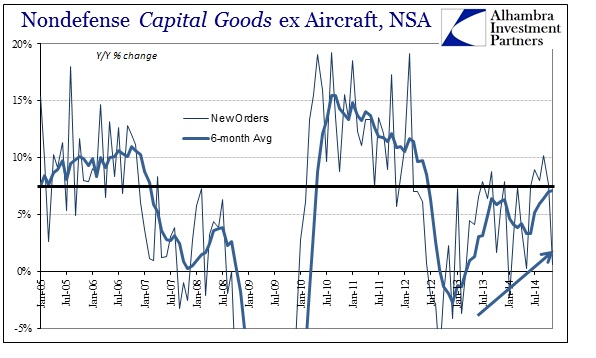

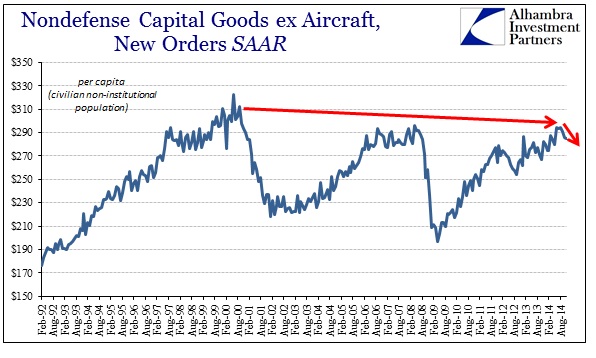

So where relative changes are better recently when compared to earlier this year (contributing to that 5% GDP growth rate), historically there is very little growth in capital goods. When the nominal rate of this important economic sector doesn’t even keep up with population expansion you know there is something seriously amiss despite any so far temporary increases.

Productive investment continues to fall behind, which is a major factor as to why incomes remain so lackluster and dangerously short of demands on consumer spending. What statistics like GDP pick up are the mini-cycles inherent in this unstable arrangement, ignoring the wider context that offers a more compelling view on economic progress (or lack thereof). Watch out for Q4 though.

Stay In Touch