In commentary about Shinzo Abe’s overwhelming re-election last week, there was a growing sense of divergence between rhetoric and support. Clearly, Abe’s administration had the nearly full support of the Japanese people, a fact due more than anything to the manner in which “economics” is not just reported but understood. In describing the looming track of a worse recession from the standpoint of business investment, Reuters published the following paragraph:

The poll showed that companies are becoming less positive on business investment, not a good sign for Prime Minister Shinzo Abe’s pro-growth policies.

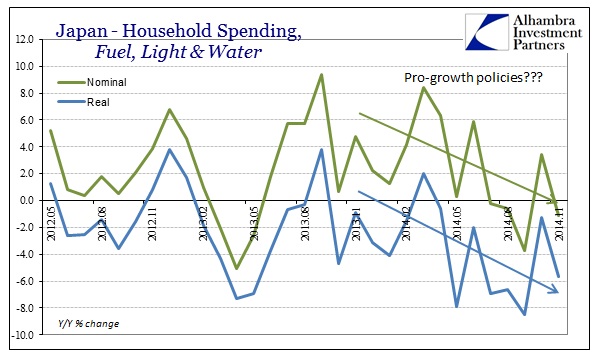

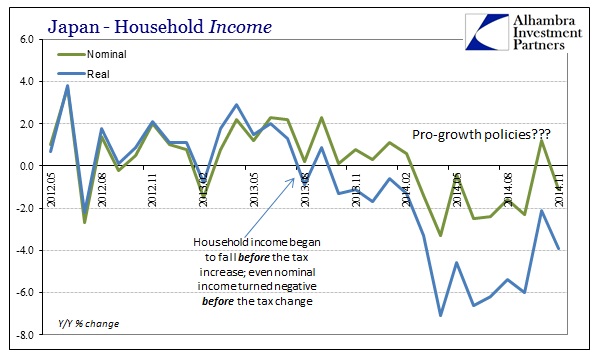

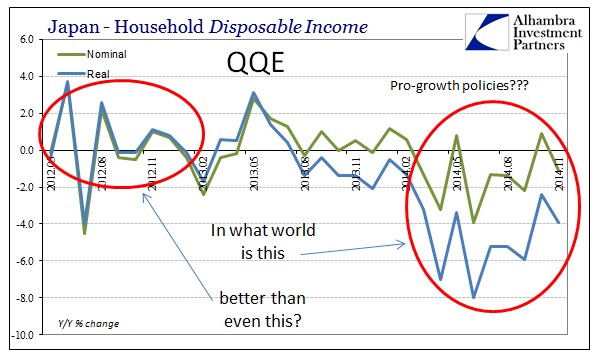

Pro-growth policies?

The entire article was devoted to how Japanese businesses are “souring” on Abenomics, which directly contradicts the qualification “pro-growth” since it is business activity that was to form the foundation of all of it (including the export sector). But to the orthodoxy, this recession is divorced from Abenomics and QQE, as if the economy itself is struggling in a manner nothing to do with the heavy attempts at redistribution. That seems to be the settling theme for 2015 as global recession looms; that secular stagnation as a practical rather than academic concept now applies to the entire world. There is, we are told, something wrong with the global economy, and so “pro-growth” policies can remain as such because the economy is wholly at fault (meaning you and me – we really are right back to the 1930’s in some aspects).

With the last bits of data released for Japan last week, the only way to continue to refer to QQE as “pro-growth” is to ignore everything. It absolutely clear that the Japanese economy is a mess, and one breaking apart still further, because of QQE and Abenomics not in spite of their valiant “aid.”

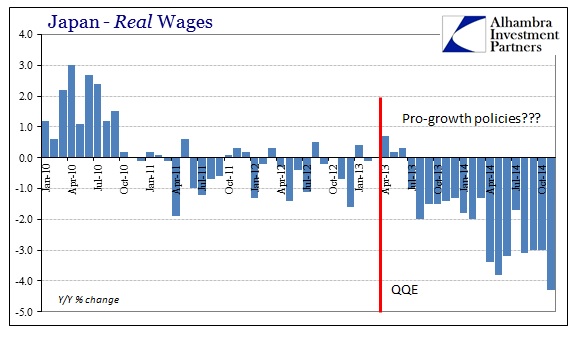

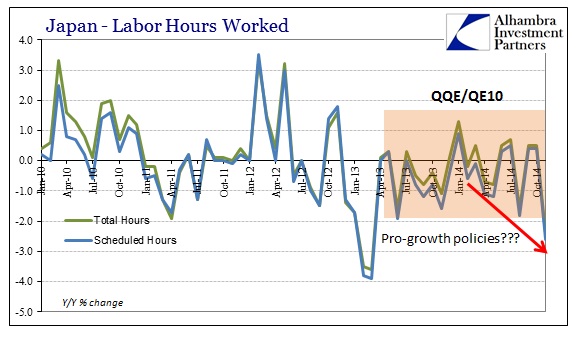

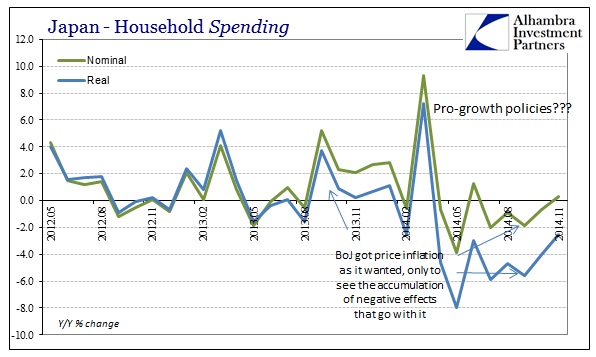

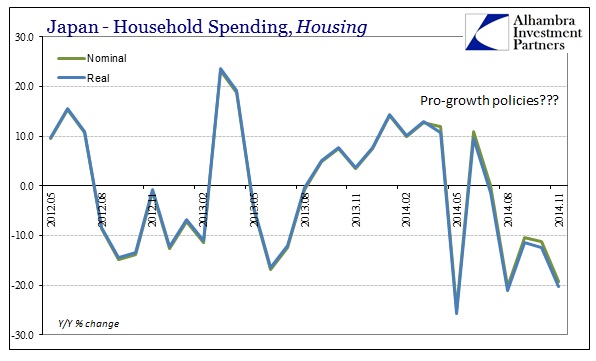

The catalogue of “pro-growth”:

Certainly the decline in real wages was bad, but it was at least consistent with pretty much all of the QQE period. However, the drop in total hours worked in November is the opposite of “shallow recovery” as the next phase is already being called. Redistribution does not lead to actual production, only the transference of nothing more than nominal numbers – a fact made perfectly plain by the continual decline in total hours worked. That total hours are now falling at a greater second derivative is, again, not quite “pro-growth.”

Consistent with rational expectations theory, the elevation in inflation expectations due to QQE and yen devaluation at most pulled forward “demand” in an artificial burst. As I said at the time, the fact that the “burst” was outsized was indeed a very bad sign for future levels of activity. Economists expected that such an artificial surge would lead to more spending by businesses and then more hiring, but as shown above in total hours worked it did the opposite.

That was also true of the export segment, as yen devaluation was intended to boost activity in the export economy. Again, the exact opposite occurred, which more than suggests that there is nothing wrong with the Japanese economy apart from the continued infusion of economic and monetary theory that has everything backward.

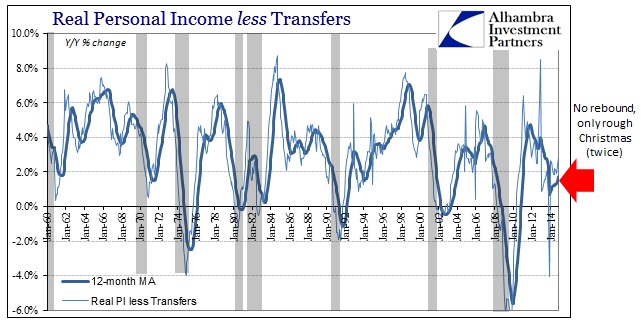

What the tax increase brought was not a small measure of fiscal discipline, one of Abe’s arrows anyway, but rather plausible deniability about economic collapse. That is the hold orthodox economics has on not just Japan but economies all over the world. Somewhere along the way, monetarists gained credibility by separating actual economic progress from their work. Now it is convention that an economy can “recover” without any actual increase in wages, earned income and productive activity. That, too, is shared way beyond just Japan, including the US:

Stay In Touch