The rash of “unexpected” declines in PMI’s this morning in the US, of all places, seems to have abraded at least somewhat the pervasive belief in the American “decoupling.” As I have said before, I afford little validity to PMI’s as anything other than potentially a relative measure of changes, not magnitudes, in shorter-term circumstances. That is why the most recent results in almost all of them, to which their numbers seem to have proliferated geometrically, are at least curious in how they match the past two years of mini-cycles.

If that is the case, then the current downswing in 2014’s mini-cycle, that began in April or so and peaked around June or July, is markedly worse than 2013’s. That isn’t surprising to anyone paying attention to US credit markets. While on the surface, there may be enough economic gloss to ensure that optimistic doubts continue to underpin glowing expectations, the “truth” as told by credit is a fundamental and massive erosion in expectations for what might happen in 2015.

As I wrote just before the end of the year:

That seems, to me, to be the message of crude prices, the yield curve and even “dollar” funding. The worries are that there is much more than a non-trivial chance that as the economy falls off again at the end of this year it may not get back up for next year.

To which most commentary has attributed that bearishness to the happenings far, far away. Global travails are certainly a factor in consideration, particularly of “dollar” markets that connect the global economy, but the heightened depression in this downswing of the mini-cycle is beginning to look far more serious than remote concerns of only slightly more than trivial potential.

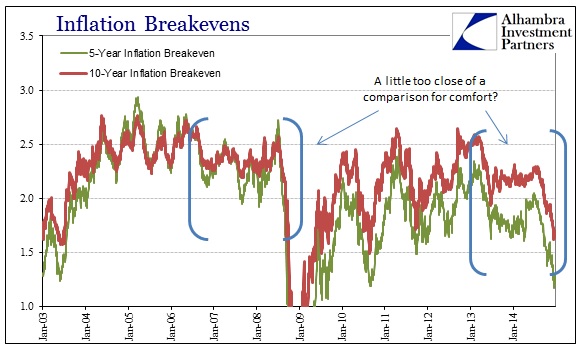

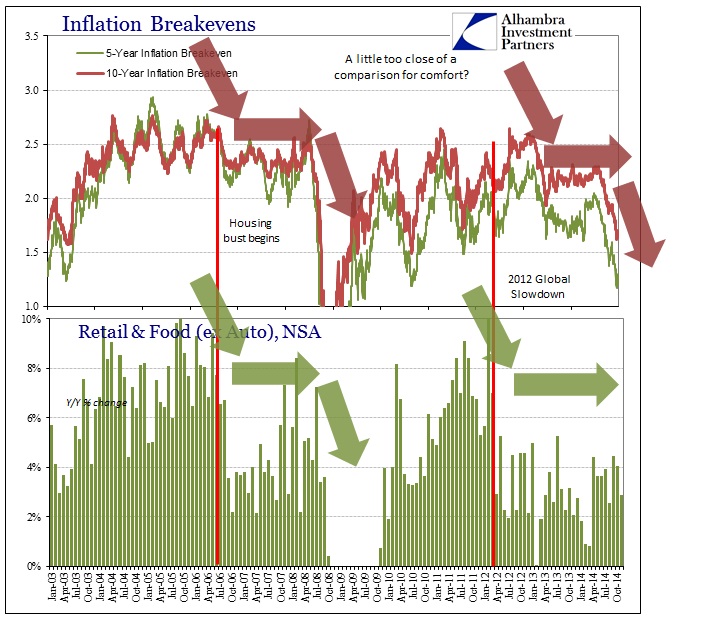

Janet Yellen and the rest of the FOMC continues to publicly proclaim their total faith in “inflation” despite the massive drop in crude oil and other commodities. They keep saying that meeting their target with be but a “transitory” period away when they have been so far off on their expectations for “inflation” for several years now. That “transitory” period of missing the target has coincided with exactly this slowdown period and descendant mini-cycles in the economy – a pattern that is replicating almost exactly the period right before (and into) the Great Recession.

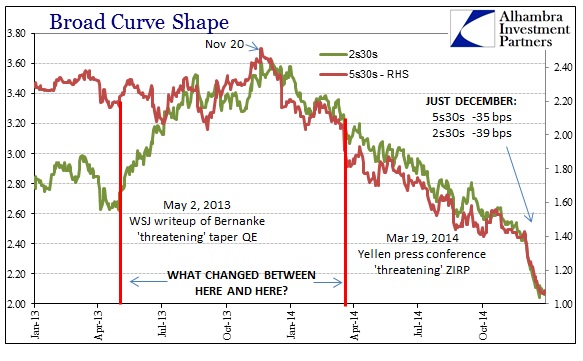

The months just prior to these changes in inflation regimes (2006 & 2013) were marked by monetary “tightening” due to the FOMC’s misplaced confidence in the validity of their economic views. In both cases, policymakers mistook artificial intrusions for true economic advance (a mistake also made in 1936) only to see the difference revealed in a downward economic spiral. However, that wasn’t a straight line in 2006-08 nor does it appear to be one in 2013-14. The months and years in between the 2006 slowdown and ultimate severe recession instead produced what looked like slow but stable growth, hiding the true negative forces that were only eroding economic progress at an unusually deliberate pace – the elongation of the economic cycle at the peak.

In one sense, the most important aspect of both “cycles” is how the FOMC was mistaken in its view of the economy at each stage, a fact that credit markets were conspicuously disputing then as now.

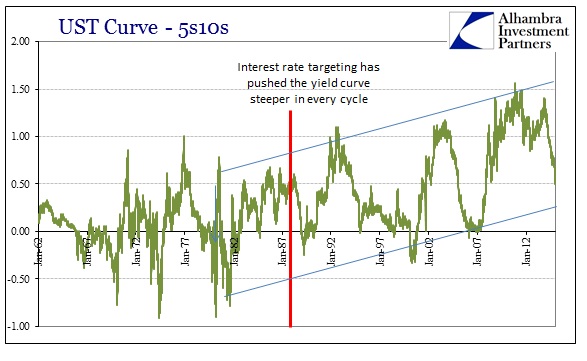

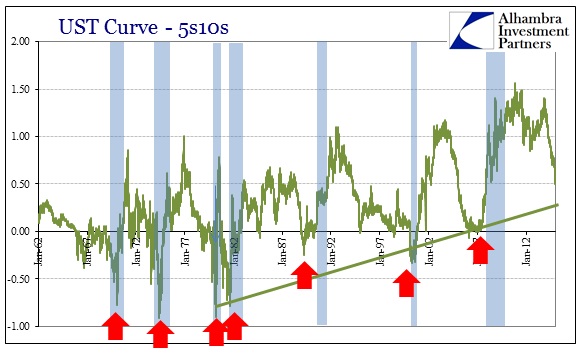

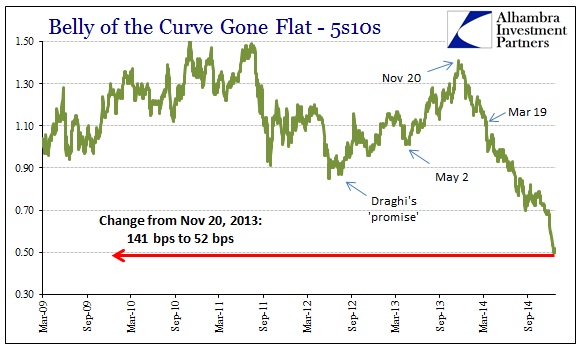

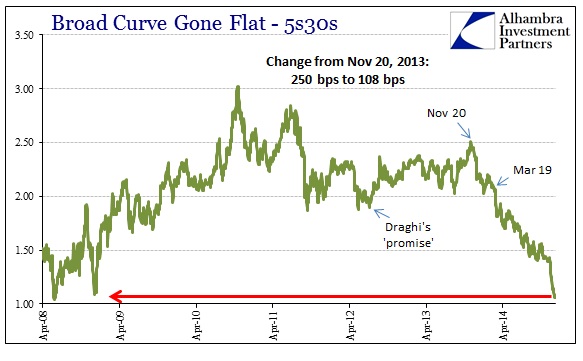

Taking account of how monetarism under the interest rate targeting regime (which essentially boils down to an artificial steepening of the yield curve, thus a disabling of price discovery in pricing risk as well as a false sense of where the economy is actually providing opportunity) has shifted the yield curve, especially in the all-important 5-10 year segment, the treasury curve is expressing an almost extreme pessimism about not just the global economy but the American place within it.

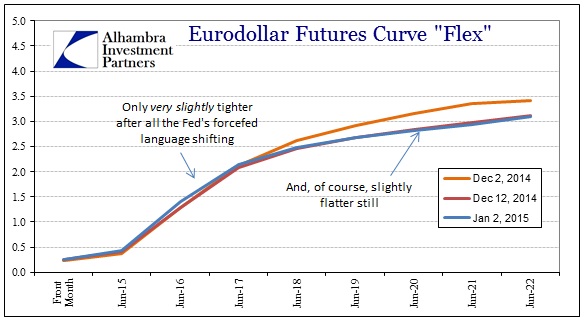

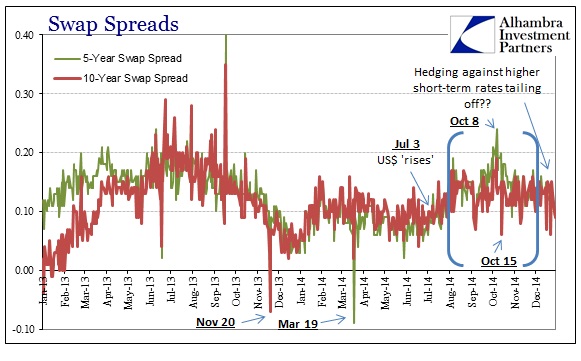

That view seems to apply to funding markets as well. The eurodollar curve is still only slightly “tighter” upfront despite the change to “patience” from “considerable time.” In other words, funding markets aren’t so sure that anything has changed from a fundamental perspective that would “allow” the FOMC to actually get to ending ZIRP. Swap spreads indicate as much if not even more uncertainty about that in December.

In the past few weeks there has been a noticeable compression bias, though by no means conclusive in proportion. That may indicate corrosion in the desire to hedge against a Fed move, suggesting at the very least doubts about policy expectations being derived from actual, as opposed to imagined, conditions.

The FOMC sees 5% GDP and a serious workdown in the unemployment rate; credit markets are worried about how continued mistreatment of economic fundamentals may mean another disastrous trip like the one from the housing bust to the Great Recession. Worse than that, the treasury curve, in particular, may be going a step further by envisioning that we may already have replicated that period and are now very deep within it.

I suppose, to the orthodox economist, this is all just one huge coincidence (or several large “random” errors):

Stay In Touch