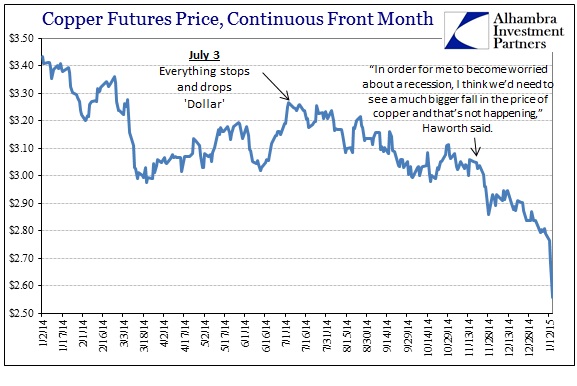

There wasn’t anything out of China that would explain, even partially, the big hit to copper today. Every commentator tasked with offering an opinion has linked copper to China and only China, yet the only economic news of note today was retail sales in the US. The World Bank did its part by cutting growth expectations largely on Asia and emerging markets, but that wasn’t a surprise and had been apparent for months.

And it’s not as if this is a one-day event, though the price action of just this week is quite severe, as copper has gained a lot of nervous attention maybe even more so than crude prices in January.

“People are starting to get very nervous as commodity prices are faltering and we know it’s because the global growth rate has been brought down,” Tom Stringfellow, president and chief investment officer of San Antonio-based Frost Investment Advisors LLC, which manages about $10 billion, said in a phone interview. “The U.S. alone can’t support the world and the retail sales are a warning shot across the bow. One month isn’t a trend but it does put people on alert.”

I think that statement is past due, as “people” certainly in credit markets have been alerted for many, many months now. Instead, the plunge in copper and crude are more about confirmations of prior concerns than the sudden appearance of them. The implication by proxy of retail sales is as I described in highlighting the massive chasm between the mainstream narrative about the economy and actual spending.

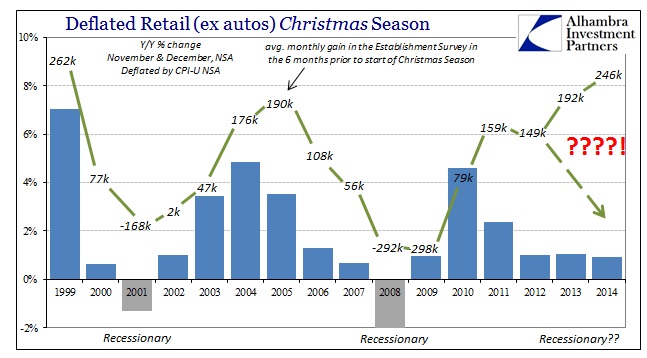

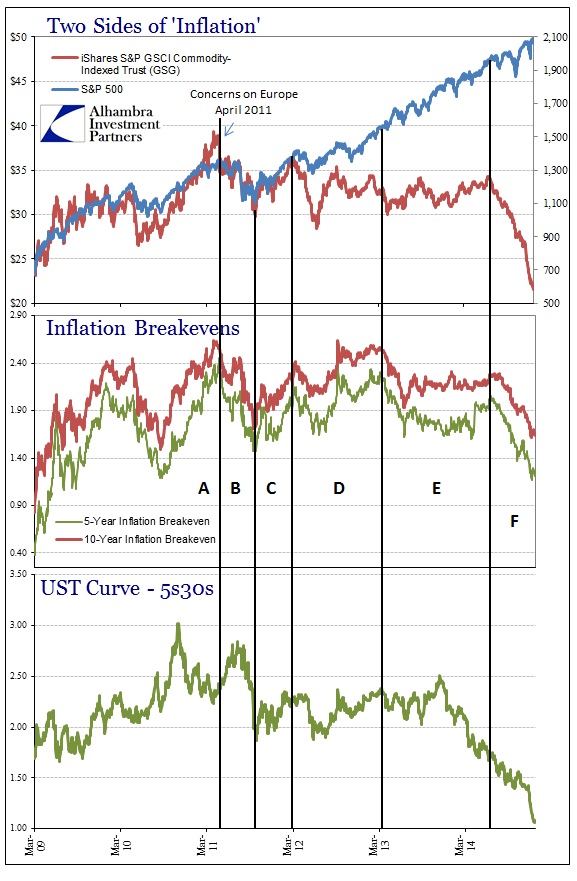

The whole of the “bull” case rests upon the US, as the purported “lone engine” of economic expansion, which itself rests upon nothing but the unemployment rate. If the unemployment rate were at all indicative of “demand”, the dollar volume of retail sales shown above would be following at least somewhat the trend of the Establishment Survey. Instead, they have diverged starting in 2012 or 2013, which is right around the time that commodity prices split off from stocks and bonds (with bonds picking up this theme in late 2013 and moving against stocks).

In other words, again, commodity prices and demand are very well acquainted as it is mainstream commentary just now coming to terms with imagined growth prospects.

“Macro challenges including lack of wage growth, persistent low labor force participation and rising housing and health insurance costs may continue to adversely impact low- and middle-income customers,” Family Dollar Stores Chief Executive Officer Howard Levine said on a Jan. 8 earnings call. “When we look at the Family Dollar shopper, it is clear that she has continued to face economic headwinds even as the broader market has experienced a recovery.”

This is the exact methodology of the breakdown, in the United States not China or emerging markets, that pinpoints the exact moment of these disparities between economic models and actual prices determined by physically clearing supply and demand. It has been simply assumed that redistribution targeting any part of “aggregate demand”, or spending for the sake of spending, would lead to follow-on activity and so on. Instead, we see only small and isolated pockets of “robust” activity that some of these economic accounts are taking both literally and universally. Luxury auto sales are at record highs but shoppers at Family Dollar, who are far, far more numerous, can’t even enjoy all this energy “tax cutting” going on.

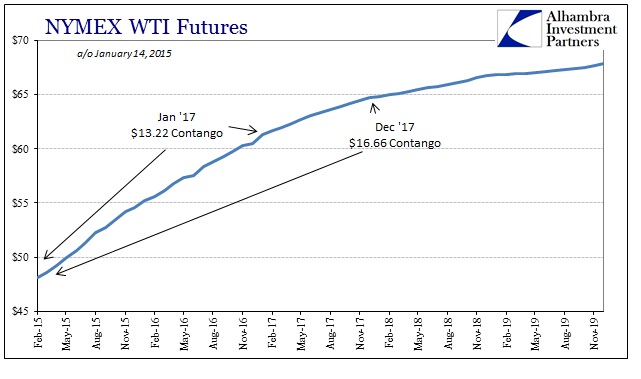

As if to emphasize that point even further, the futures curve for WTI light sweet crude is in what may only be a record contango. In other words, it would be very, very profitable for you to buy as much physical oil in the spot market as you could possibly obtain and simultaneously selling all that oil in the futures market out many months, simply storing it all until the futures come due in delivery. As you can plainly see above, the vast majority of contango is evident in the next two years.

Outside the United States, some of the world’s biggest oil traders have booked supertankers to store at least 25 million barrels at sea.

“OPEC is not going to come to the rescue of the market,” said Harry Tchilinguirian, global head of commodity markets strategy at BNP Paribas. “The onus is on floating storage.”

Yet for all that increasingly “non-market” crude taking up tanker space (and storage capacity, which is immense, within the US) the massive contango remains, and remains the trading focus for many. However, perhaps the larger point is where the outer years have actually settled – January 2017 is trading just above $60, a huge decline in prices on its own! Even if you believe that crude is trading right now on almost all supply concerns the fact of the rest of the futures curve says that is simply not the case. So where a high degree of contango may argue in favor of a larger imbalance in petroleum supply, the overall settle of the futures market is decidedly bearish on demand going out many years (if most investors traded on the belief that global growth was going to return with a vengeance in 2016 or even 2017 as predicted, the futures prices in those months would be much, much higher and would eventually drag the near-term maturities up with them – instead the whole curve is going in the other direction with short-term weakness dragging down all delivery prices despite contango in any condition).

The U.S. Energy Information Administration (EIA) released its weekly petroleum status report Wednesday morning. U.S. commercial crude inventories increased by 5.4 million barrels last week, maintaining a total U.S. commercial crude inventory of 387.8 million barrels. Crude inventories are at their highest level for this time of year in at least the past 80 years.

Undoubtedly there is a great deal of additional supply, as US crude production is at an all-time high. Yet, given prices in commodities there should be, if the economy was so full of “demand”, a greater degree of contango-type financing and arrangements to alleviate such huge drops in prices. Financial markets are uncertain, if not completely doubtful, about the US economy and its outlook to absorb physical supplies of basic materials used in the fundamental processes of economic function. The concerns about China and emerging markets are well-founded because of continued faltering in the US. Aggregate demand isn’t a real concept, and only those that believe in it (which includes, unfortunately, the whole of the media and economics profession) are just now moved to worry, even if they still ultimately dismiss it in favor of that alluring and addictive Establishment Survey.

Stay In Touch