I mentioned yesterday in looking at the behavior of gold that it seems as if the “dollar” has entered a bit of a pause in its wider destructive reality of late. Maybe that coincidence with the SNB’s dramatic alteration offers an explanation for it, with renewed focus on the European end of eurdollars, or that these are merely complimentary of each other, none of it is altogether evident. However, given that the “dollar” has seemingly run out of disorderly momentum for more than a week now, you would expect at least some retracement in those places most effected.

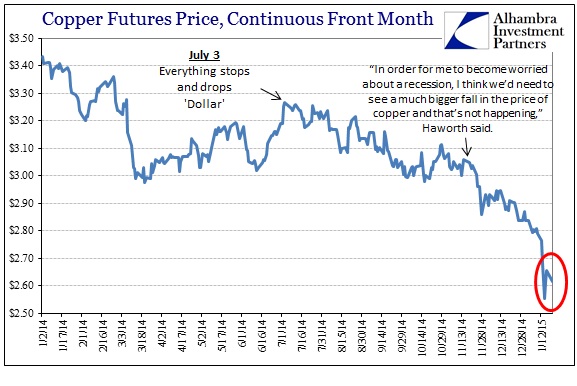

That would mean, at first glance, the commodity space where economic and financial concerns intersect so vividly. Crude prices without renewed dollar pressure have seemingly stabilized, as have copper, but that isn’t quite a renewal of confidence in the “oversold” nature of growing pessimism. As most markets do, a large selloff typically sees a rapid and undeniable retracement even if it is at most temporary.

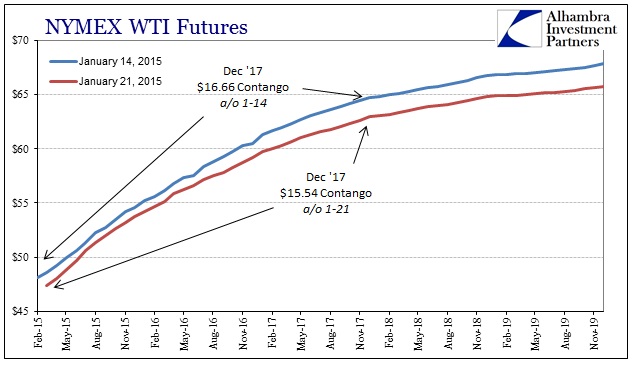

Over the past week, WTI futures have actually settled lower all across the curve. But what is more interesting is that this downward movement has been more apparent in the later years than those maturities nearer. The entire idea of contango is a financial process whereby the current flow of a commodity to “market” is instead redirected off-market to storage. Thus the spot or near-term futures prices should rise in relation to the prices of the outer year futures.

Instead, we have the opposite condition where the current price of crude continues to drag the futures prices disproportionately lower – to the point that the contango is shrinking not by the “correct” posture but rather in diminishing expectations for the ability to return crude to market in the outer years after all this “temporary” disorder is well behind. In other words, in this “dollar” “pause”, the direction of pessimism is still apparent where perhaps a rebound “should” materialize, especially with “non-market” crude gaining position.

The echo of the same process in copper makes this quite interesting as a statement, potentially, about still eroding expectations away from the financialism of the “dollar.” And that is the worst case, at least according to the dominant monetary theory. The Fed will “tolerate” low inflation as long as it believes expectations for the future remain “anchored” suitably (according to their policy targets). Once expectations “unanchor” from what the Fed deems as benign (which is really redistributionary theft, but only “a little”) monetary policy is in danger of being badly calibrated and thus unsuited to its major tasks.

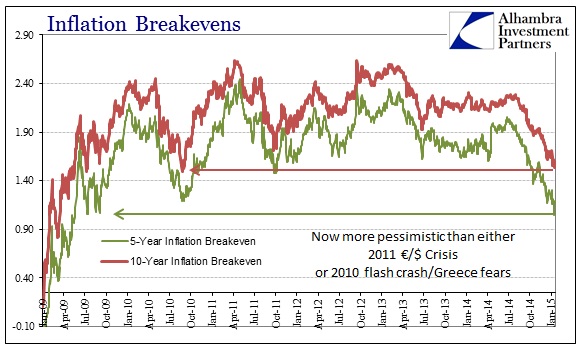

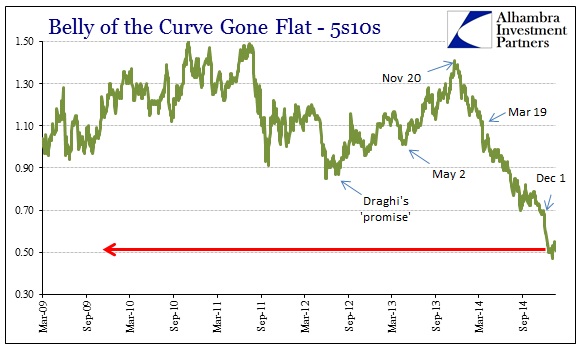

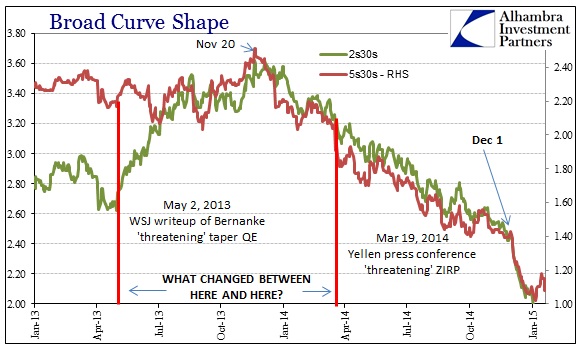

At some point, and there is no bright warning signal, credit market pessimism and commodity selling start to converge upon previously anchored expectations. Once they become largely self-referential and correlate very strongly, monetary policy is at that point, even in the estimation of its own practitioners, decidedly weak (thus offering an alternate explanation as to why the FOMC was in such a hurry to appear “tight”).

That is the other remarkable aspect of recent trading days as tomorrow marks the official unleashing of European QE. On the surface it may not seem like a big deal to US-dominated credit and commodity prices, or even the “dollar”, but there are numerous feedbacks and coincident financial channels that it should, if it actually worked, influence expectations decidedly in the “right” direction. That neither commodities nor credit have responded in the buildup is more than curious, and may suggest exactly that point about unanchoring expectations.

The greatest disaster for monetary policy is “deflation”, especially with any financial component. The FOMC in its versions of QE was actually intending on unanchoring inflation expectations and forcing them upward, into what they believed was consistent with an actual recovery. Instead, expectations appear to be heading toward at least disinflation once more, meaning that in the reckoning of orthodox monetarism the danger zone is just ahead if not already here.

The collected signals of these market indications is now beyond just doubts about the recovery story as it plods, supposedly, toward the righteous outcome; instead the cumulative outlook is now one of not just pessimism about the here and now but to the point where there is an ever greater amount of uncertainty far down the road. For central bankers, their job, or at least how they see it, just got exponentially more difficult as anchoring in “deflation” would be the same as self-fulfilling in global recession.

And the best “they” can come up with is yet another QE? There isn’t much mystery here as to why markets are so desperately lacking in so much confidence, especially now that monetarism has been almost fully revealed; if only economists were to make these trades!

Stay In Touch