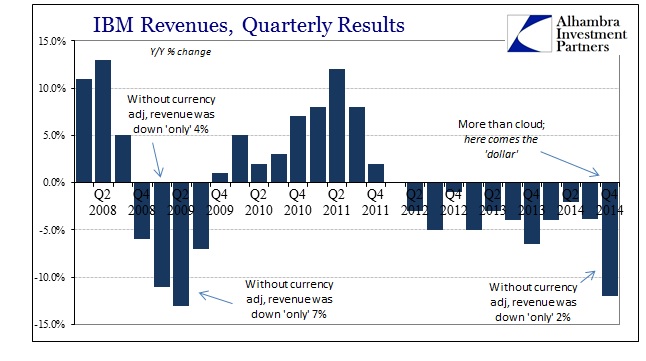

I am not fully sure as to why IBM’s reported figures haven’t been more widely digested for what they portend; likely it is just the still-hanging cloud of rationalizations about bubble behavior. Revenue at “Big Blue” dropped 12% in the fourth quarter, an alarming rate for any company let alone one that still serves as a proxy for business investment. More recently, analysts have downgraded not the economy but rather IBM’s place within it, as they seem to believe that cloud computing and SaaS are taking away the company’s core business.

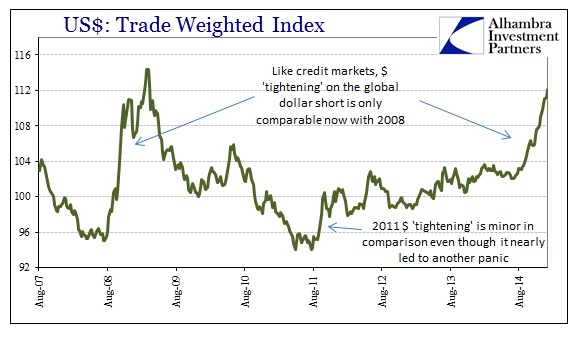

However, IBM has answered those problems and is actively partaking and even leading many segments of the next general “solutions.” In any case, that is not even the primary cause of the revenue slump in Q4; that would belong to the “dollar.”

In constant currency terms, according to IBM’s non-GAAP presentations, revenue in Q4 was down “only” 2%. That means the “dollar’s” rise was responsible for a 10% equivalent decline in the corporate top-line, providing what seems to be an impetus to ignore the 12% figure as somehow illegitimate or at the very least irrelevant. But this is not going to go away (unless somehow ECB QE “works” where no QE has before) and is indicative of globalized economic distress.

The 12% decline in revenue (which already is adjusted for a small divestiture) is on par with only 2009. That includes both actual results and those in constant currency (CC) terms. Revenue in Q1 2009 was down by 11%, but the “dollar” was again the major culprit, as in constant currency revenue was “only” off 4%. Same with the next quarter, the absolute nadir of the Great Recession, as Q2 2009 growth was -13%, but “only” -7% in constant currency.

As with so many financial indications, the “rising dollar” is a harbinger of not just future distress but something far more current and immediate. In other words, there are transmission mechanisms between the financial plumbing in bank balance mechanics into the very real world results of primary businesses.

This is not just some Asian or European problem, as even “the Americas” segment declined 9% (but “only” 4% in CC), to which the sales in the United States provide the vast majority (thus the -4% in CC is far greater than the -2% for the company as a whole).

Companies have already tried to switch reporting mechanisms into non-GAAP or pro-forma “adjusted for one-time expenses” which is nothing more than catering to the bubble mentality. I have little doubt that non-GAAP will be supplemented by CC in a highly growing proportion of not just Q4 2014 earnings but perhaps universally (among multi-nationals) by Q1 2015. There is a reason this kind of behavior correlates solely with former times of economic distress, and why companies will be only too eager to embrace any means by which to discount it.

The “dollar” is the financialized epitome of modern economic landscape, so it makes far more sense to include it then to ignore all the very negative implications as a matter of bullish convenience.

Stay In Touch