From strategic research partner MRB…with Alhambra’s added commentary.

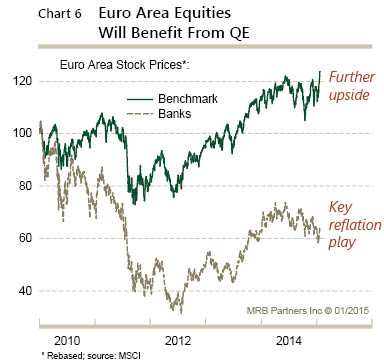

- QE is primarily a signaling device to demonstrate policymakers’ commitment to fostering the recovery and sustaining a cohesive monetary union.

- The policy is implicitly designed to reduce the equity risk premium.

- We expect a gradual re-rating of euro area equities.

- A cheaper euro, itself associated with QE, will also boost globally-oriented equity sectors such as industrials, technology, consumer discretionary and staples.

- Banks should also be beneficiaries in our base case, where the ECB’s reflationary push bears fruit.

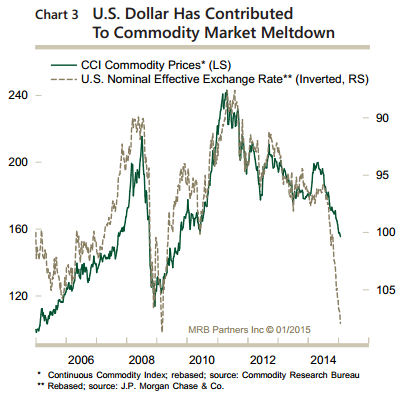

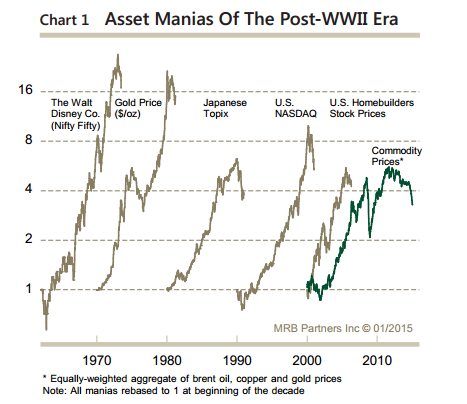

Some charts to help quantify and give a historic context to oil/commodity prices over the past 7 months:

The commodity bear has been about a strong US Dollar. Credit expansion from the last decade pulls demand forward. The current state of below average demand inevitably results. This is accompanied by de-leveraging, a preference for currency (today’s dollars) to extinguish future dollar liabilities (pay down debt).

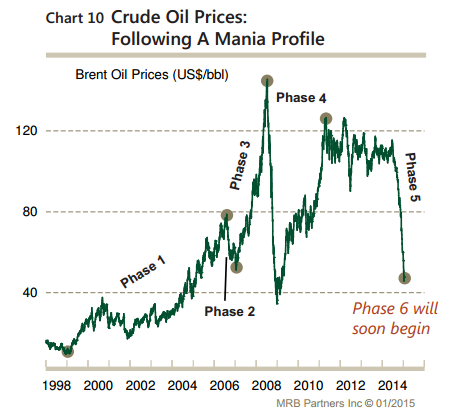

Past Manias:

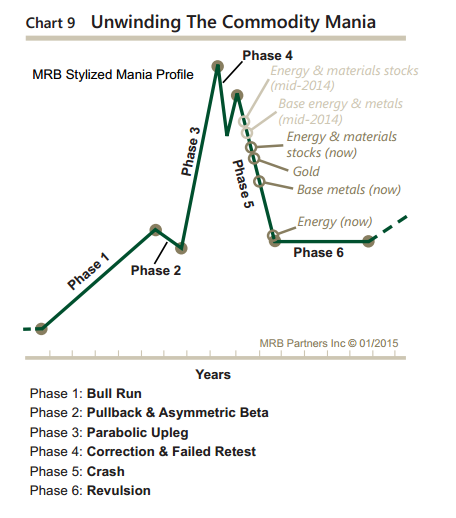

The Anatomy of a mania:

The Manic Cycle of Crude Oil:

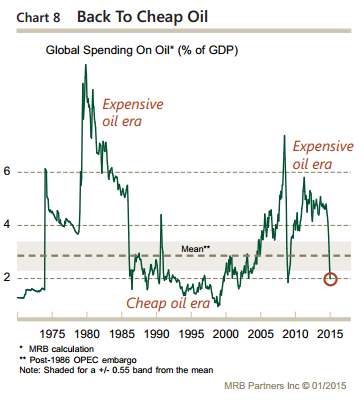

The good: Spending on oil as a % of global GDP has returned to an area labeled “Cheap Oil Era.” The last time we were in this area for any significant time was in the 90’s and coincided with a major stock boom.

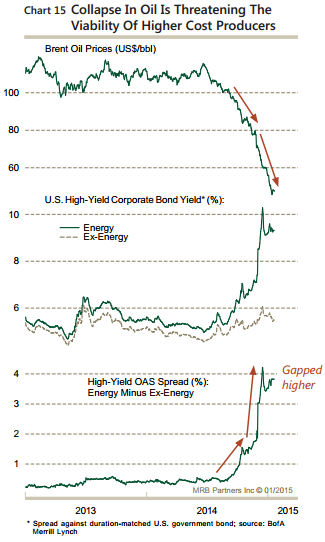

The Bad and the Ugly: There has been a big jump in credit spreads for high-yield corporate bonds in the energy sector. This combined with significantly lower top-line revenue creates the ultimate fear of bankruptcies and contagion in the financial sector. At the very least, the shutting down of unprofitable exploration will have an effect on capital spending and employment in the sector. This would be expected to extend, on some scale, to the broader economy.

As always, please feel free to contact me with any questions or concerns.

Click here to sign up for our free weekly e-newsletter.

For information on Alhambra Investment Partners’ money management services and global portfolio approach, Douglas R. Terry, CFA is reachable at: dterry@4kb.d43.myftpupload.com

This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product.

Stay In Touch