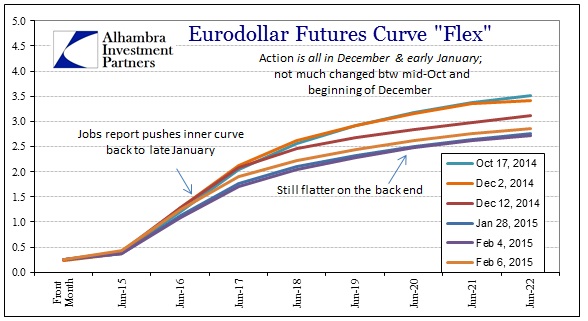

When the FOMC came out and said the economy was good enough for them to begin raising interest rates, the eurodollar funding market did the opposite of what would be expected of that situation. Not only did the market move in the “wrong” direction, it did so with a great deal of conviction.

Today’s jobs report moved the eurodollar market also with conviction, though now back in the other direction from the FOMC. As a result, we have returned to January levels of rate “interpretations”, though still with the requisite flattening in the outer years.

Ultimately, I don’t believe these markets, including treasury rates, are factoring anything different than what they had been doing almost uninterrupted since November 20, 2013. Rather, I think given all the dramatic bearishness imbedded within these levels, especially since December 1, a retracement was long overdue. The 10-year CMT rate fell from 2.27% back on Christmas Eve all the way to 1.68% a few days ago almost without pause; the 30-year went from 2.85% to 2.29%.

These huge moves were bound to be undercut by a countertrend at some point, so in that sense this jobs report fits as one catalyst (rates have been rising before just today). I think funding markets are just reacting to the same, though the flattening suggests that not much has changed about interpretations of future conditions.

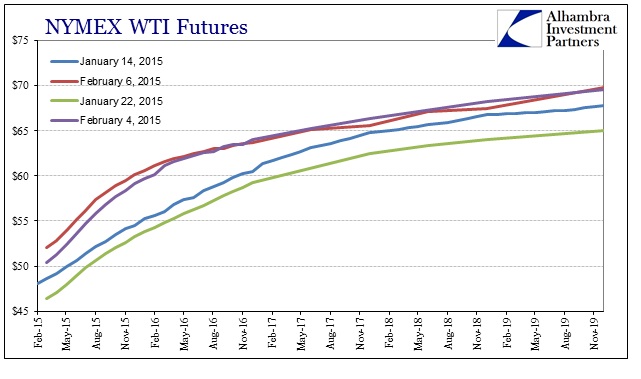

That seems to be similar in construction to that of the futures curve for crude oil, or at least the WTI version of the stuff. The outer years seem to be settling into somewhere around the low $60’s despite the daily gyrations since the massive selloff ended (this leg anyway). That is a far cry from the $110+ that was consistently traded during the summer – before the “dollar.” Some will persist in blaming supply, but forecasts for supply have not changed much these past six or seven months; and if anything are starting to drop which would account for the appearance in February of a “bulge” in the curve above around late 2015/early 2016.

In other words, there isn’t much to suggest in these markets that the world looks appreciably better than it did before the jobs report, only that there is less visibility about what it may mean in the near-term. Further, given that things were already in motion in that direction anyway, I’m not at all convinced Payroll Friday had much to do with it aside from adding so amplification to the volatility. It will be interesting to see how far this goes before the next catalyst forces re-evaluation even near-term yet again.

Stay In Touch