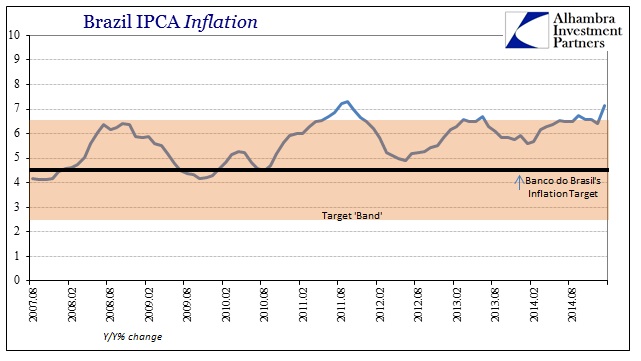

After having been subjected to the serious temper of the “dollar” for much of the past few years, with requisite calm periods interspersed, the Brazilian economy is finally reaching the epic inevitability of it all. “Inflation” in January broke out of the “band” set by Banco do Brasil’s policy target to the highest level, in the IPCA series, since 2011 (when, not coincidentally, most of this trouble all started).

To slow price increases, policy makers have raised the benchmark rate three straight times since Rousseff won re-election to 12.25 percent, the highest level in more than three years. Economists surveyed by the central bank Jan. 30 forecast the bank will raise the Selic another quarter-point by year-end as economic growth is set to slow to 0.03 percent. Some economists, including Itau Unibanco SA’s Ilan Goldfajn, are predicting recession.

Brazil has been in no-growth for most of 2014, and an outright recession is looking more and more likely. That is particularly true given the slowdown in China that is preceded, in time and in process, by the inability of the US economy, or Europe and Japan, to do much of anything like actually grow. The continued decline in economic fortunes throughout the world is inextricable from own condition.

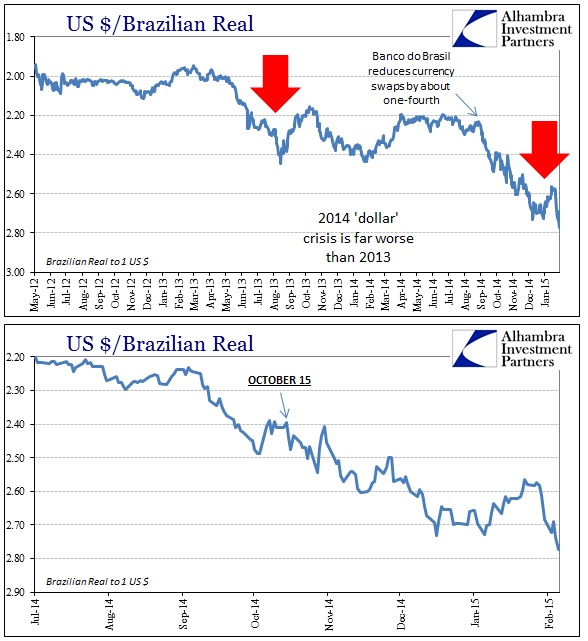

Unfortunately for Brazil, that means a cross-current of the worst of the worst – they get the trade end of the diminishment in global appetite for their resources at the very same time Brazilian banks are way, way over-exposed to the contrary (but related) tide of the tightening eurodollar world.

Brazil, though, is just one of many feeling the “dollar’s” great wrath of late, as all the BRICs (except India to a much lesser extent) are faced with almost existential economic downturns that turn into financial chaos via the “dollar.” That means not just “inflation” or the potential for “deflation” but asset markets and credit too.

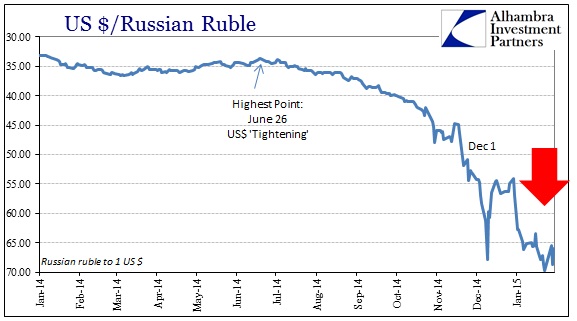

Despite a near-term bottom in oil prices, the Russian ruble remains at a dangerously low exchange. It isn’t just oil that is driving the Russian economy and its financial system, as the crisis there moves onward right alongside all the rest.

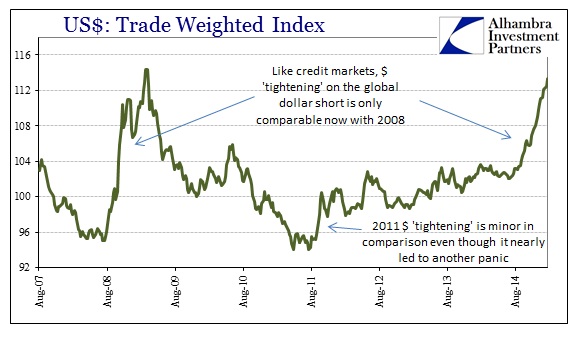

Essentially, there are no outlets for imbalances in the eurodollar world until they become far too large to ultimately sustain. And even then, any attempts at sustaining the financial imbalances them in financial terms only creates negative and reinforcing negative undercurrents in real economic terms. Any economy that requires “dollars” for trade is thus exposed to the eurodollar manner of balance sheet mechanics as “money supply.” But that is only the entry into the imbalance, as once those “dollar” systems are activated all manner of “dollar” flow, especially for speculation, is then possible – in both directions.

In many respects, what we are witnessing here is the same thing that happened in the US during the panic. The US gained speculative entry of eurodollars, though starting way back in 1995. The borrowed nature of these “dollars” tied to foreign balance sheet exercises meant exactly this kind of weakness in imbalance, US asset bubbles, as the destructive nature of the retrenchment in 2007 starting in financial form reinforced eventually the massive decline in economic standing by the latter half of 2008 (if you recall, it was the exact same pattern of “inflation” first, then “deflation” and economic collapse).

What is ironic about this, tragic really, is that modern orthodox thinking about floating currencies was that the break from the restrictive nature of gold would prevent exactly this kind of transmitted chaos. Some of the deficiencies toward that end are due to the fact that floating currencies and internal monetary frameworks have not developed as they were “supposed” to when the fathers of floating currencies first antagonized for them. This is not to absolve them, especially Milton Friedman, via good intentions, as they should have known that turning tremendous monetary power over to ostensibly political hands was an invitation for disaster – especially since floating currencies removed the very means by which self-correction took place.

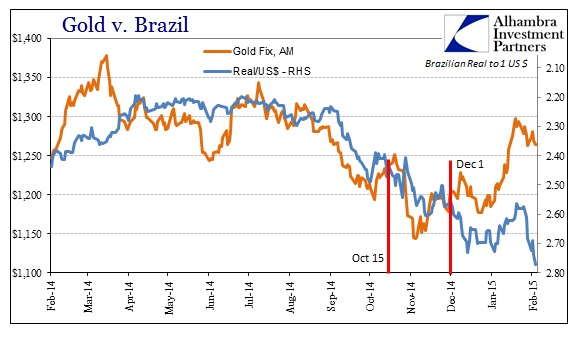

The irony, then, is that gold is the salvation under these modern terms. The great hedge against “tail risk” is gold, and it is acting like it at least since December 1 despite continued “dollar” stress. That may not remain moving forward, as the potential for “dollar” collateral problems is still quite high (and negative for gold prices), but given the circumstances here the turnaround from intended evolutionary direction is a lot to appreciate, on many levels.

Stay In Touch