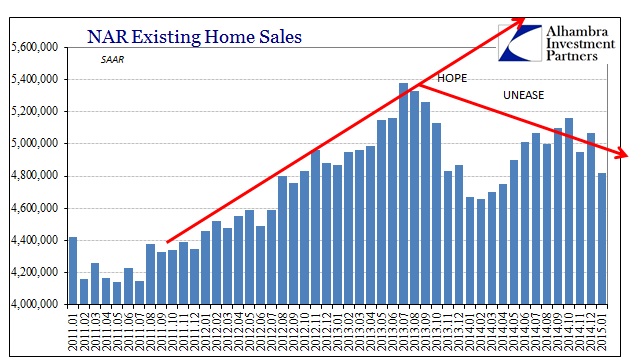

For almost a year now, even before 2014’s version of winter, the constant theme has been one of growing and robust jobs. It had become so ubiquitous as to infiltrate every economic data point, including the housing market. There was some correlation last year between the sentiment about payroll expansion and at least a tepid rebound in home sales, but that both waned at the end of the year (just when the Establishment Survey indicated businesses were hiring at historically fast rates) and never really established a consistent match with the prior trend.

More and more, that rebound appears to be past tense as true fundamental supply and demand were held artificially apart by attempted monetary redistribution. Even the NAR itself has stopped referring to the assumed wage gains and acknowledged that there is an “affordability” problem.

“January housing data can be volatile because of seasonal influences, but low housing supply and the ongoing rise in home prices above the pace of inflation appeared to slow sales despite interest rates remaining near historic lows,” he said. “Realtors® are reporting that low rates are attracting potential buyers, but the lack of new and affordable listings is leading some to delay decisions.” [emphasis added]

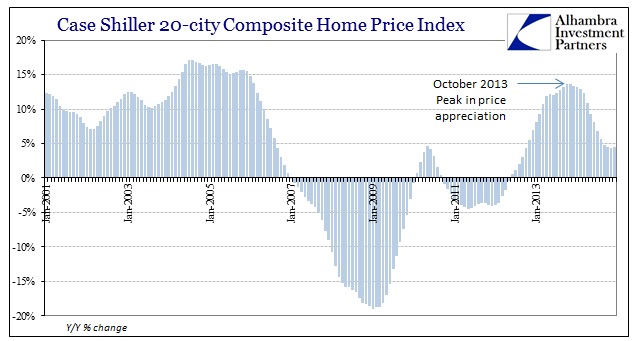

One of the basic tenets of intentional redistribution by monetary means is that not only does spending for the sake of spending produce further spending (and thus jobs and wages) but also that “pushing” rising asset prices is necessary to return to normalcy. The psychology of rising prices is supposed to combine with rising wages to produce a healthy and sustained real estate market which more than contributes to the broader economy’s recovery and health. The FOMC’s intentions with QE2 and QE3 clearly moved real estate, but only producing a growing dichotomy where “affordability” becomes a primary factor. Prices have badly outpaced wages (not much growth at all) and it is starting to get serious.

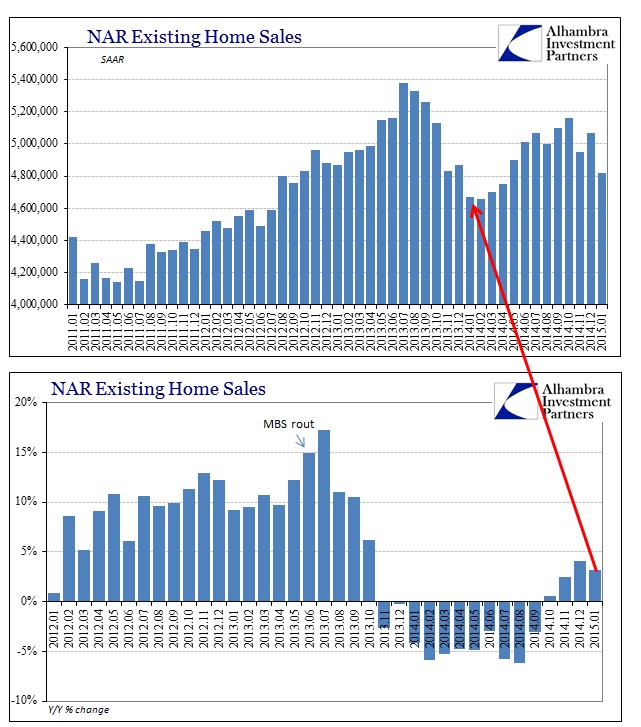

There was a rebound from last year, even though the pace of sales in the winter months were depressed not by snowfall but irregularity in finance (the massive MBS rout of June 2013, another huge and intended imbalance that didn’t quite live up to the QE-hype). If you thought that the depression was weather-related, it was easy to be captured by that the jump in sales through July 2014 as a return toward the prior trend. However, with deeper imbalances here, both finance and, again, economic, such a rebound was likely just the normal ebb and flow of imbalance seeking stability in whichever direction.

What that means is greater instability in this “market”, owing to so much introduced distortion, pushing once more in the “wrong” direction which I think is starting to be absorbed by even otherwise unaffected home sellers.

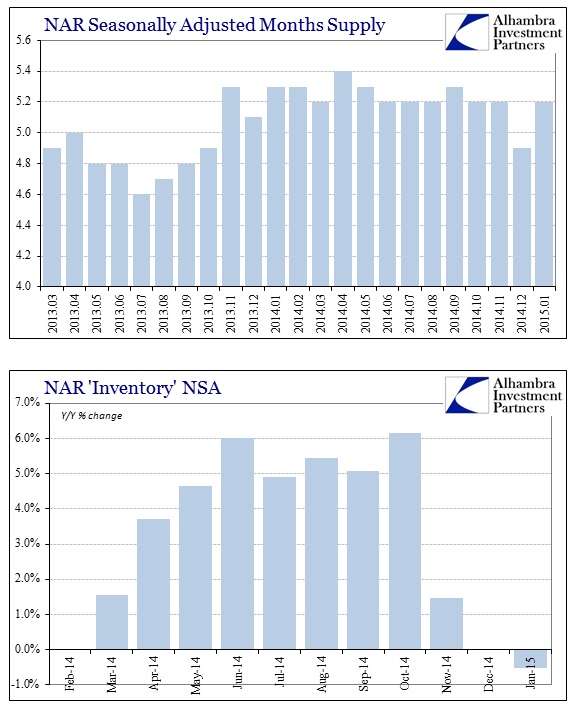

January 2015 was only 3.2% above January 2014, which is quite amazing since January 2014 was the second worst month of the past thirty. Such a paltry sales pace, of late, has seen a decline in the amount of inventory for sale. That would seem to suggest even home sellers are starting to be become pessimistic.

Ideally, that would bring home prices down to match paltry and non-existent wage growth, but the actual imbalance between them is probably far larger than can be made with an “easy” and relatively quick adjustment. In other words, the housing market by actual fundamentals is likely so highly imbalanced that if “allowed” to correct for prior redistribution might not lead to a gentle re-establishment of a clearing “equilibrium.”

For example, the S&P Cash-Shiller Home Price index actually ticked up in December 2014, which shows that prices are not so easily tamed by even growing seller pessimism. That might suggest that any price adjustment toward “affordability” would be larger and likely more uncontrollable than the NAR or FOMC would like to admit. Either wages will have to actually rise, and do so quickly and sharply, or home prices will have to stabilize far down to wage reality. The latter form of transition, given this subverted state, will have much wider and negative effects on the economy.

Stay In Touch