The confusing nature of the PBOC’s actions in the past year or so has led now to publications of theories over a potential power struggle at the central bank. While finally acknowledging that last year was all about “targeted” approaches to monetary “guiding” economic reality, this year is about to explode in personnel changes and therefore, supposedly, a reactionary course to more familiar “flooding” of broad-based approaches. Curiously, unlike last year, there is no contention about the state of China’s economy as it is now-universally accepted as foundering badly.

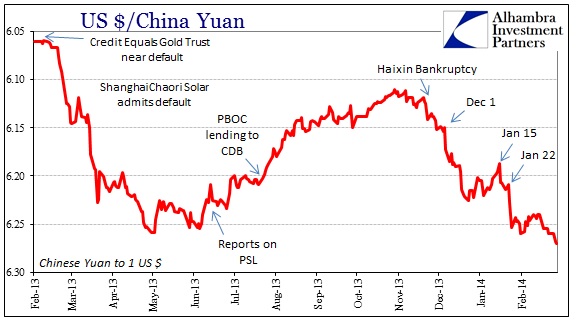

The last two “rate cuts”, including the one just conducted this weekend, are being listed under that paradigm, though I don’t know how there is any way to reconcile them without including currency moves. The PBOC may have reduced its benchmark rates, but has simultaneously also moved to a higher fix on the currency. The latter is far more important and is perfectly within the “reform” paradigm as such a move is most likely (nobody will ever know for sure) aimed at speculative “dollar” financing of all China’s problems – bubbles.

Friday’s fix was 6.1475, the lowest since November 2014. Meanwhile, the yuan traded close to the 2% official band, at 6.2699 – the lower bound at that fix would be only a few pips further at 6.27045. That was the weakest yuan/”dollar” cross since October 2012, below even last year’s sudden and “reform”-triggered depreciation.

To my mind, that suggests nothing much has changed in terms of “reform.” The rate “cut” itself is, as the PBOC even acknowledges, a neutral measure aimed at harmonizing money rates with “inflation.” China’s central bank wants to make sure that it doesn’t get “too tight” by keeping rates steady while “inflation” falls. The latest official “inflation” figures were at a five-year low, matching the 2009 trough.

That would mean “real” rates have not been cut at all, which is in opposition to the idea of a broadening monetary stimulus movement afoot. The tightening up of the “dollar” problem along with what is clearly a neutral stance in money rates amounts to more of the same as we have seen.

However, the Wall Street Journal is more than suggestive in this idea of a policy shift. Given the Journal’s status, it is difficult to discern if this is reporting or outright cheerleading:

For much of last year while the economy skittered, the central bank, under its longtime governor, Zhou Xiaochuan , insisted on targeted efforts rather than broader moves like rate cuts out of concern that broadly easing credit would worsen debt problems. But increasingly, as a personnel shuffling is sweeping through the central bank’s senior ranks, the central bank is acceding to demands from the Chinese leadership to reduce financing costs for businesses, according to officials and advisers to the bank.

Hu Xiaolian, a deputy governor and a protégé of Mr. Zhou, recently left the central bank to head the Export-Import Bank of China. Jin Qi, a senior assistant to Mr. Zhou, meanwhile, has also left to manage a newly formed $40 billion government-run infrastructure fund, called the Silk Road Fund.

Mr. Zhou himself is also expected to step down soon, according to officials at the central bank. At 67, he’s already passed the retirement age of 65 for senior Chinese officials. The Wall Street Journal reported in late September that Chinese leaders were discussing replacing Mr. Zhou amid disagreements over the direction of financial policy.

On one hand, it is good to see that even the Journal has come to terms with “reform” and is recognizing it for what it is – the PBOC’s recognition of asset bubbles and a means by which to manage their intended decline. On the other hand, the article is almost pleading in its insistence that such a course violates the mainstream form of economic “good sense.” Judging by the same article’s view on the Chinese housing market, there is more than a hint of orthodox flavor (which should admittedly be expected given the source).

Prices of new homes fell in February compared with the month before, reversing gains recorded in January as demand for homes decline during the Lunar New Year holiday. On an annual basis, average new-home prices fell 3.8% in February, a steeper decline compared with the 3.1% fall in January and the 2.7% drop in December, according to data provider China Real Estate Index System.

The property-market’s troubles are in part due to a housing glut fed by developers taking on too much debt, and many developers are finding it hard to raise funds to complete projects.

All that simply means that the purported broad-based rate “cut” in November had no real, discernable impact on housing. You can see that as accidental ineffectiveness, as the Journal hopes by implication, or as a matter of intent. Developers “finding it hard to raise funds” can either be an acknowledgement that the PBOC no longer wishes to be complicit in the gargantuan waste, or that they have gone too far in allowing true market balance. In either case, any shake-up in policymakers at the PBOC bears close attention as maybe government structure isn’t as comfortable with the downside of “reform” as maybe they were in theory last year. To this point, however, I don’t see anything that would convince me of a shift away from it.

Even if Zhou “retires” that does not necessarily invite a full course correction. He was not the sole architect of this shift in monetary policy, and when it occurred it appeared he had wide backing within the PBOC apparatus as well as higher government approval. As we have seen with Greece, however, political risks are nearly impossible to forecast. It is entirely possible that the internal economics in China have grown precipitously worse than even thought a few months ago, enough to force even “reformists” to reconsider their current disdain for asset bubbles. In other words, for them to shift back to embracing bubbles would seem to suggest dire conditions.

At this point, I am more inclined to believe that the Journal is engaging in wishful thinking, but it cannot be discounted entirely; thus, this bears close, continued observation.

Stay In Touch